India Kotak Request for Major Revival of Policy 2018-2025 free printable template

Show details

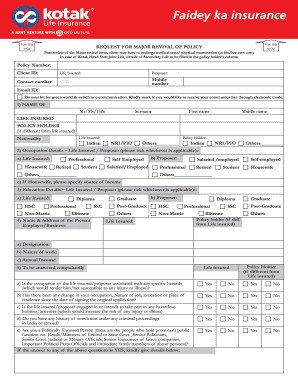

REQUEST FOR MAJOR REVIVAL OF POLICY Details of Primary Life to be filled in Life Insured and Secondary Life to be filled in the Policyholders' column where Primary Life & Secondary Life are 2 different

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kotak insurance request revival policy mrf create form

Edit your kotak insurance request revival policy pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kotak life insurance major revival fillable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing kotak insurance request major revival mrf get online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit kotak insurance request policy mrf get form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

India Kotak Request for Major Revival of Policy Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out kotak insurance request revival download form

How to fill out India Kotak Request for Major Revival of Policy

01

Obtain the India Kotak Request for Major Revival of Policy form from the Kotak Life Insurance website or your nearest branch.

02

Fill in the policyholder's personal details including name, address, and contact information.

03

Provide policy details such as the policy number and type of policy.

04

State the reason for the revival request in the designated section of the form.

05

Attach any required documents, such as identity proof, policy documents, or medical reports if needed.

06

Review the completed form for accuracy and completeness.

07

Submit the form either online or at a Kotak Life Insurance branch, along with any necessary fees.

Who needs India Kotak Request for Major Revival of Policy?

01

Policyholders who have lapsed their insurance policies and wish to revive them.

02

Individuals seeking to reinstate their insurance benefits and coverage.

03

Those who want to continue their investment in the insurance policy after missing premium payments.

Fill

kotak insurance major revival policy

: Try Risk Free

People Also Ask about kotak insurance request revival blank

How can I surrender my Kotak Smart Life plan?

Surrender Policy: The surrender form and reason(s) for policy surrender needs to be submitted at the nearest Kotak Life Insurance Branch, along with the following documents: Original policy documents. Canceled cheque with the policyholder's name on it.

What is the full form of PHF in Kotak insurance?

PHF means Principal Healthcare Finance Pty Limited or any other trustee for the time being of the Trust.

Who is the new MD of Kotak life?

Uday KotakNon-Executive Director - Chairperson.

How to cancel Kotak Life Insurance?

You can do this by logging on to the website and then going to the 'Cancel Policy' section. Or you have to contact the Kotak Mahindra life insurance company and convey your wish to cancel the policy. Make sure that you have given a free look period of 10 to 30 days for cancellation of your policy.

What is the surrender value of Kotak Smart life Plan?

The surrender value of Kotak Mahindra Life insurance policy is calculated as a Single premium multiplied by 75% of the outstanding term to maturity/ total term.

Can I surrender Kotak life insurance policy?

However, Kotak Life limited-pay and single-pay e-term plans accrue term insurance surrender value after you pay the premium for a specified period. The amounts you get on surrendering such policies depend upon the premium paid and the remaining policy term. Surrender charges apply.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit kotak life insurance request revival mrf fillable in Chrome?

kotak life insurance request mrf blank can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I edit india kotak life insurance request mrf get on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing kotak life insurance revival mrf fillable right away.

How can I fill out india kotak life insurance request major get on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your kotak life request policy form mrf print. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is India Kotak Request for Major Revival of Policy?

The India Kotak Request for Major Revival of Policy is a formal application process that allows policyholders of Kotak Life Insurance to request the reactivation or revival of their lapsed insurance policies.

Who is required to file India Kotak Request for Major Revival of Policy?

Policyholders whose insurance policies have lapsed due to non-payment of premiums are required to file the India Kotak Request for Major Revival of Policy.

How to fill out India Kotak Request for Major Revival of Policy?

To fill out the India Kotak Request for Major Revival of Policy, policyholders must provide relevant information including policy details, personal identification, and may also need to submit additional documents as required by the insurance provider.

What is the purpose of India Kotak Request for Major Revival of Policy?

The purpose of the India Kotak Request for Major Revival of Policy is to enable policyholders to reinstate their lapsed insurance policies so they can continue to enjoy the coverage and benefits originally agreed upon.

What information must be reported on India Kotak Request for Major Revival of Policy?

The information that must be reported includes the policy number, personal details of the policyholder, reasons for the lapse, and any outstanding premium amounts that need to be paid for revival.

Fill out your kotak insurance request major online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kotak Life Insurance Major Revival Policy Printable is not the form you're looking for?Search for another form here.

Keywords relevant to india life insurance major form mrf blank

Related to life policy mrf make

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.