Get the free DIRECT CONNECT MORTGAGE REFI

Show details

DIRECT CONNECT MORTGAGE REF

Mortgage, FinancePostal, Telephone, Emailing DESCRIPTION

These individuals placed a phone call to learn more about qualifying for a mortgage or refinancing their

home.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign direct connect mortgage refi

Edit your direct connect mortgage refi form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your direct connect mortgage refi form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit direct connect mortgage refi online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit direct connect mortgage refi. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out direct connect mortgage refi

How to fill out direct connect mortgage refi

01

Start by gathering all the necessary documents, including income statements, bank statements, and tax returns.

02

Contact your mortgage lender and inquire about their direct connect mortgage refinance program.

03

Fill out the application form provided by the lender, providing accurate and detailed information about your financial situation.

04

Submit the completed application along with the required documents to the lender.

05

Wait for the lender to review your application and conduct a credit check.

06

If approved, review the terms and conditions of the refinance offer and decide whether to accept it.

07

If you accept the offer, sign the necessary paperwork and provide any additional documentation requested by the lender.

08

The lender will then proceed with the underwriting process, which includes verifying the information provided and determining the new terms of the refinance.

09

Once the underwriting process is complete, the lender will schedule a closing date for the refinance.

10

Attend the closing meeting, sign the final documents, and pay any closing costs or fees required.

11

After closing, the lender will disburse the funds to pay off your existing mortgage and establish a new loan agreement.

12

Make sure to review your new loan terms and payment schedule, and continue making timely mortgage payments as required.

Who needs direct connect mortgage refi?

01

Direct connect mortgage refi is beneficial for individuals who:

02

- Want to refinance their existing mortgage to take advantage of lower interest rates.

03

- Need to cash out some of their home equity for various purposes such as home improvements or debt consolidation.

04

- Are looking to change the terms of their current mortgage, such as switching from an adjustable rate to a fixed rate.

05

- Wish to reduce their monthly mortgage payments by extending the loan term or securing a lower interest rate.

06

- Are seeking to consolidate multiple mortgages or debts into a single loan for simplicity and convenience.

07

- Want to shorten the duration of their mortgage by opting for a shorter loan term and paying off their debt faster.

08

- Have improved their credit score or financial situation since obtaining their original mortgage and now qualify for better loan terms.

09

- Are looking to switch to a different lender for better customer service or more favorable terms.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify direct connect mortgage refi without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your direct connect mortgage refi into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit direct connect mortgage refi straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing direct connect mortgage refi.

How do I complete direct connect mortgage refi on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your direct connect mortgage refi from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

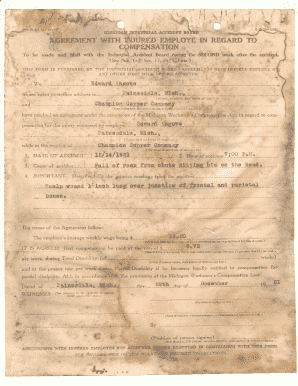

What is direct connect mortgage refi?

Direct connect mortgage refi is a process where a borrower refinances their mortgage loan directly through a lender, without the need for a mortgage broker or intermediary.

Who is required to file direct connect mortgage refi?

Borrowers who are looking to refinance their mortgage loan through a direct lender are required to file direct connect mortgage refi.

How to fill out direct connect mortgage refi?

To fill out direct connect mortgage refi, borrowers need to provide information about their current mortgage loan, financial situation, and desired terms for the refinanced loan.

What is the purpose of direct connect mortgage refi?

The purpose of direct connect mortgage refi is to help borrowers secure more favorable terms on their mortgage loan, such as a lower interest rate or monthly payment.

What information must be reported on direct connect mortgage refi?

Information such as current mortgage balance, interest rate, term remaining, credit score, income, and employment status must be reported on direct connect mortgage refi.

Fill out your direct connect mortgage refi online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Direct Connect Mortgage Refi is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.