NY DFS RPAPL 1304 2018-2025 free printable template

Show details

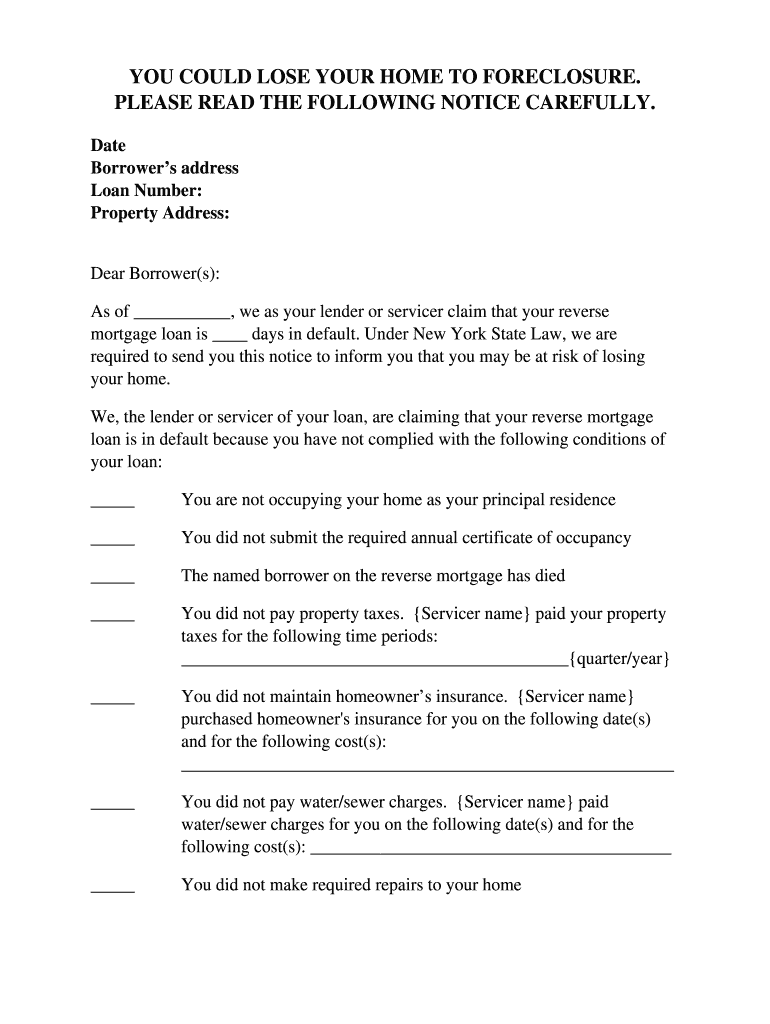

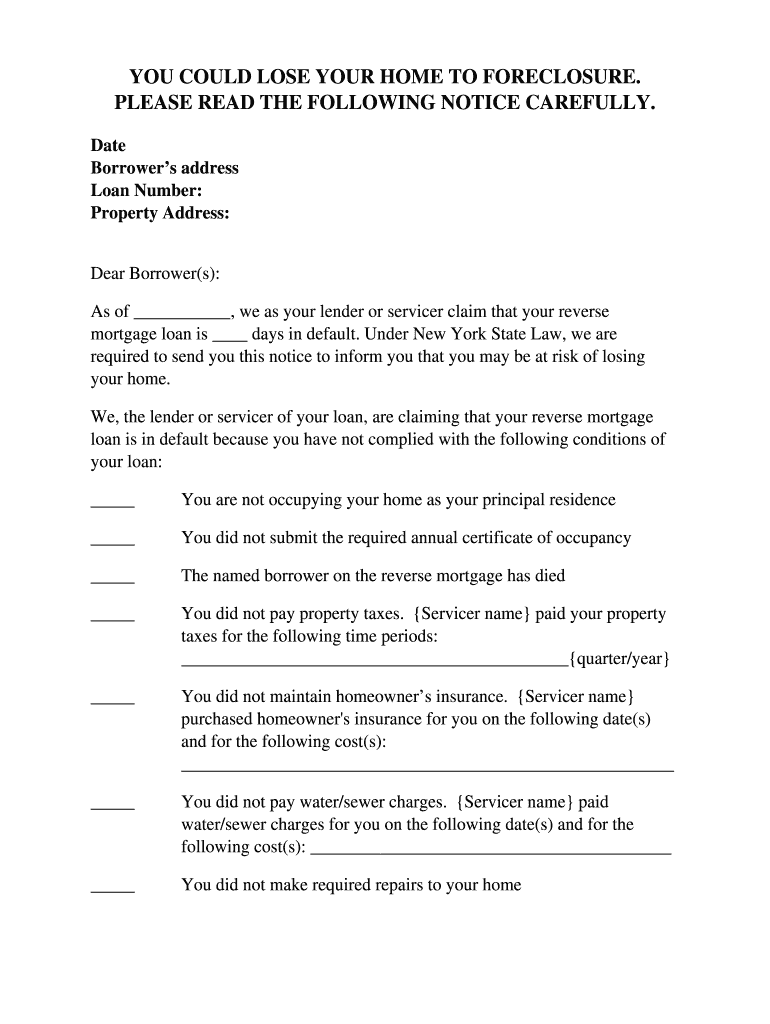

YOU COULD LOSE YOUR HOME TO FORECLOSURE. PLEASE READ THE FOLLOWING NOTICE CAREFULLY. Date Borrowers address Loan Number: Property Address: Dear Borrower(s): As of, we as your lender or service claim

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign reverse mortgage pre foreclosure

Edit your reverse mortgage pre foreclosure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reverse mortgage pre foreclosure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit reverse mortgage pre foreclosure online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit reverse mortgage pre foreclosure. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reverse mortgage pre foreclosure

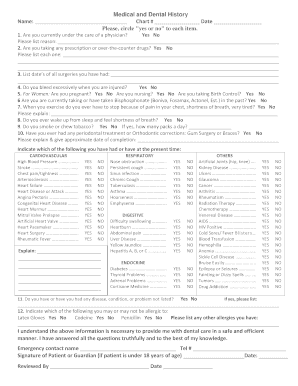

How to fill out NY DFS RPAPL 1304

01

Obtain the NY DFS RPAPL 1304 form from the appropriate website or office.

02

Fill in the lender's information, including name, address, and contact details.

03

Provide the borrower's information, including name, address, and loan details.

04

Ensure to include property information, such as the property address and any relevant identifying details.

05

Clearly state the purpose of the notice and the required deadlines.

06

Review the completed form for accuracy and completeness.

07

Print the form and sign it where required.

08

Deliver the form to the borrower following the guidelines for proper notification.

Who needs NY DFS RPAPL 1304?

01

Property owners facing foreclosure.

02

Lenders or mortgage servicers initiating foreclosure actions.

03

Legal representatives handling foreclosure cases.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit reverse mortgage pre foreclosure from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like reverse mortgage pre foreclosure, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I complete reverse mortgage pre foreclosure online?

With pdfFiller, you may easily complete and sign reverse mortgage pre foreclosure online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit reverse mortgage pre foreclosure in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing reverse mortgage pre foreclosure and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is NY DFS RPAPL 1304?

NY DFS RPAPL 1304 is a form required under New York's Real Property Actions and Proceedings Law that mandates certain disclosures to be made by lenders and servicers before initiating foreclosure proceedings.

Who is required to file NY DFS RPAPL 1304?

Lenders or mortgage servicers that are seeking to initiate a foreclosure proceeding against a homeowner in New York are required to file NY DFS RPAPL 1304.

How to fill out NY DFS RPAPL 1304?

To fill out NY DFS RPAPL 1304, the filer must provide details such as the mortgagor's name, property address, loan number, and specify whether a loss mitigation option is available, among other required information.

What is the purpose of NY DFS RPAPL 1304?

The purpose of NY DFS RPAPL 1304 is to ensure that homeowners are properly notified about foreclosure actions and to provide them with information on available resources and loss mitigation options before legal proceedings commence.

What information must be reported on NY DFS RPAPL 1304?

The information that must be reported on NY DFS RPAPL 1304 includes the mortgagor's name, the property address, details of the loan in default, contact information for the lender or servicer, and a statement regarding loss mitigation options.

Fill out your reverse mortgage pre foreclosure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reverse Mortgage Pre Foreclosure is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.