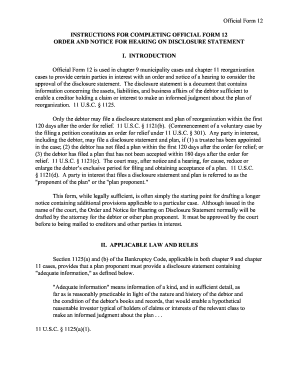

Get the free Levels of Coverage. - RED Shield Dealer Services

Show details

Red shield

pro t e c t i onplansrec service contract

application page contract holder information

contract applicant 1 name phone number contract applicant 2 name email address mailing address

city

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign levels of coverage

Edit your levels of coverage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your levels of coverage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing levels of coverage online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit levels of coverage. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out levels of coverage

How to fill out levels of coverage

01

To fill out levels of coverage, follow these steps:

02

Assess your insurance needs: Determine what types of coverage you require based on your personal circumstances.

03

Research insurance providers: Look for reputable insurance companies that offer the types of coverage you need.

04

Compare coverage options: Analyze the different levels of coverage offered by insurance providers and understand their benefits and limitations.

05

Evaluate costs: Consider the premium rates for each level of coverage and balance it with the value it provides.

06

Determine the appropriate level of coverage: Select the level of coverage that best suits your needs and budget.

07

Fill out the necessary paperwork: Submit the required documents and forms to the insurance provider to initiate your coverage.

08

Review and adjust periodically: Regularly assess your coverage needs and make adjustments as necessary.

09

Seek professional advice: If you're unsure about the process or need guidance, consult an insurance agent or broker who can assist you.

Who needs levels of coverage?

01

Levels of coverage are needed by individuals, families, and businesses who want financial protection against certain risks and liabilities.

02

Specifically, the following groups may benefit from having levels of coverage:

03

- Individuals and families: To safeguard against unexpected events such as accidents, illness, property damage, or loss.

04

- Homeowners: To protect their property and belongings against various perils like fire, theft, or natural disasters.

05

- Vehicle owners: To comply with legal requirements and cover potential damages or injuries that may occur on the road.

06

- Business owners: To mitigate risks associated with operations, employees, liability claims, and property damage.

07

- Professionals and freelancers: To protect against professional errors, malpractice claims, or potential lawsuits.

08

- Travelers: To ensure coverage for medical emergencies, trip cancellations, lost baggage, or other travel-related risks.

09

Ultimately, anyone who wants to safeguard their financial well-being from unexpected circumstances should consider having appropriate levels of coverage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit levels of coverage in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing levels of coverage and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit levels of coverage on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign levels of coverage right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I fill out levels of coverage on an Android device?

Use the pdfFiller app for Android to finish your levels of coverage. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is levels of coverage?

Levels of coverage refer to the amount of protection provided by an insurance policy.

Who is required to file levels of coverage?

Insurance companies are required to file levels of coverage for each policy they issue.

How to fill out levels of coverage?

Levels of coverage are typically filled out by insurance underwriters based on the details of the policy.

What is the purpose of levels of coverage?

The purpose of levels of coverage is to ensure that policyholders have adequate protection against potential risks.

What information must be reported on levels of coverage?

Information such as policy limits, deductibles, and coverage types must be reported on levels of coverage.

Fill out your levels of coverage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Levels Of Coverage is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.