Get the free Ewaybill - What is e-Way Bill? E way Bill Rules ... - ClearTax

Show details

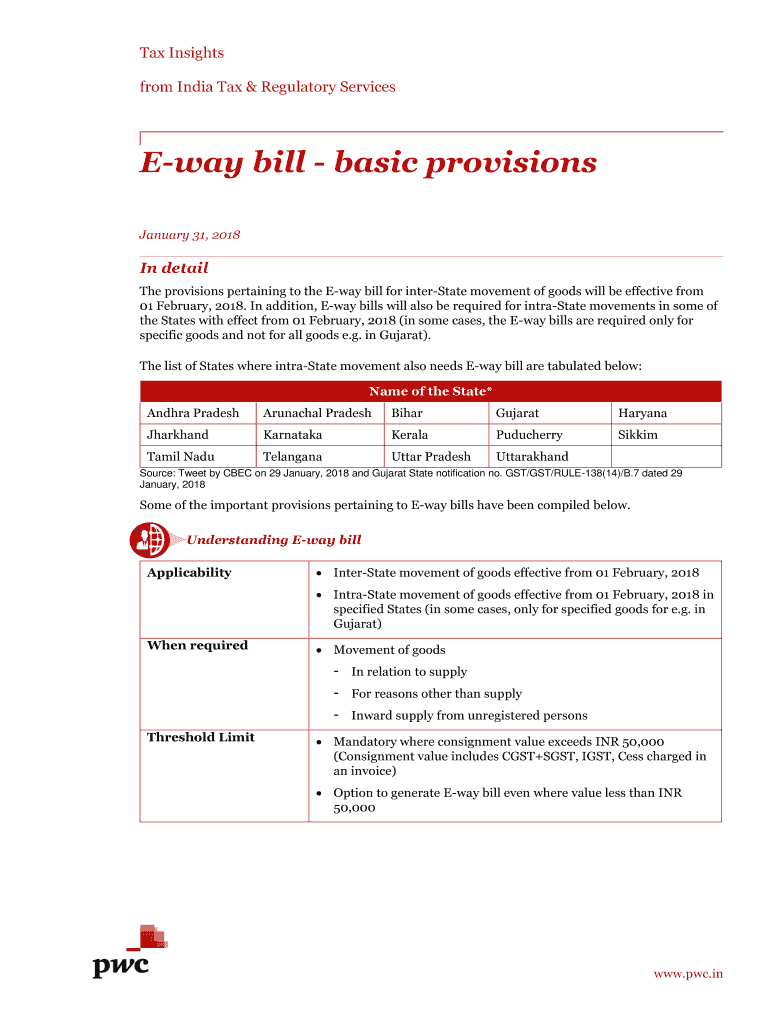

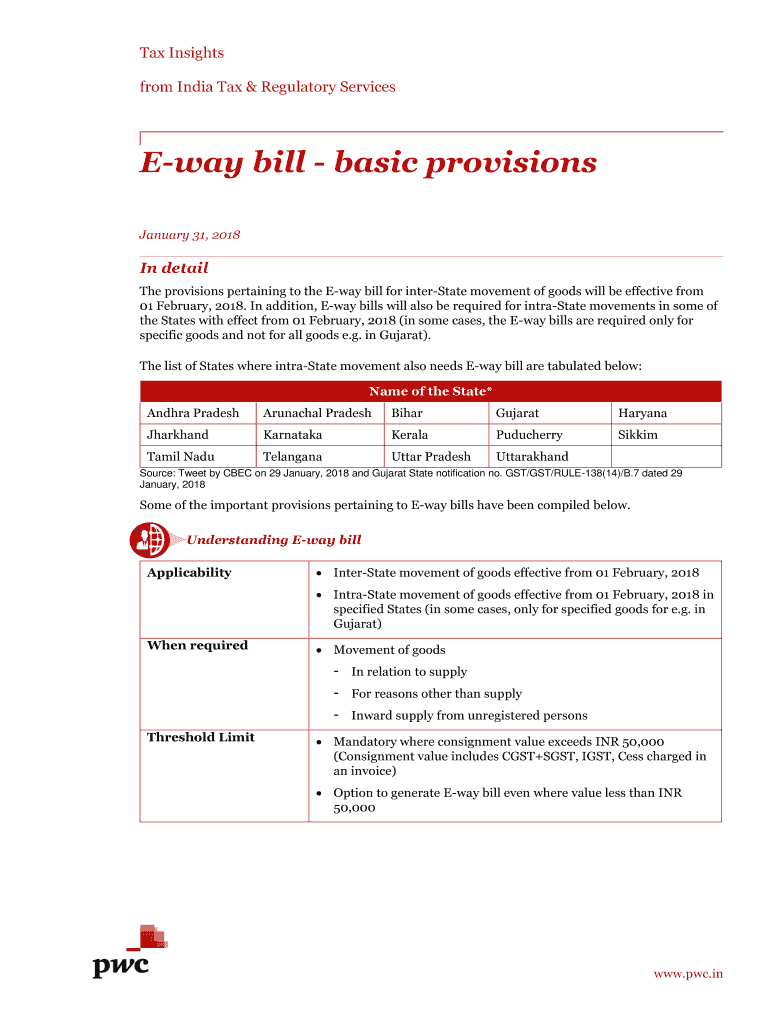

Tax Insights from India Tax & Regulatory ServicesEway bill basic provisions January 31, 2018In detail The provisions pertaining to the Away bill for interstate movement of goods will be effective

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ewaybill - what is

Edit your ewaybill - what is form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ewaybill - what is form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ewaybill - what is online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ewaybill - what is. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ewaybill - what is

How to fill out ewaybill - what is

01

To fill out an eWaybill, follow these steps:

02

Visit the eWaybill portal or app.

03

Login to your account using your username and password.

04

Select the option to create a new eWaybill.

05

Fill in the required fields such as your name, address, and contact details.

06

Enter the details of the goods being transported, such as their description, quantity, and value.

07

Fill in the details of the transporter, including their name, vehicle number, and contact information.

08

Provide the details of the place of loading and unloading.

09

Enter the relevant tax information.

10

Review the filled information and make any necessary corrections.

11

Submit the eWaybill and obtain a unique eWaybill number for future reference.

Who needs ewaybill - what is?

01

An eWaybill is required by anyone involved in the transportation of goods exceeding a certain value. This includes:

02

- Suppliers and manufacturers sending goods to customers.

03

- Transporters responsible for the movement of goods.

04

- Registered taxpayers under the Goods and Services Tax (GST) regime.

05

- Businesses involved in inter-state trade or commerce.

06

- Individuals or entities transporting goods for personal use exceeding specified limits.

07

It is important to note that the exact requirements for eWaybills may vary by country or jurisdiction. It is advisable to consult the relevant regulations and authorities for detailed information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ewaybill - what is directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your ewaybill - what is and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I modify ewaybill - what is without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your ewaybill - what is into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit ewaybill - what is straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit ewaybill - what is.

What is ewaybill - what is?

Ewaybill is an electronic document required for the movement of goods worth over Rs. 50,000 between states in India.

Who is required to file ewaybill - what is?

Businesses and transporters are required to file ewaybill for the movement of goods.

How to fill out ewaybill - what is?

Ewaybill can be filled out online on the official portal by providing details such as GSTIN, invoice number, and vehicle number.

What is the purpose of ewaybill - what is?

The purpose of ewaybill is to track the movement of goods and prevent tax evasion.

What information must be reported on ewaybill - what is?

Details such as the GSTIN of the supplier and recipient, invoice number, product description, and HSN code must be reported on ewaybill.

Fill out your ewaybill - what is online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ewaybill - What Is is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.