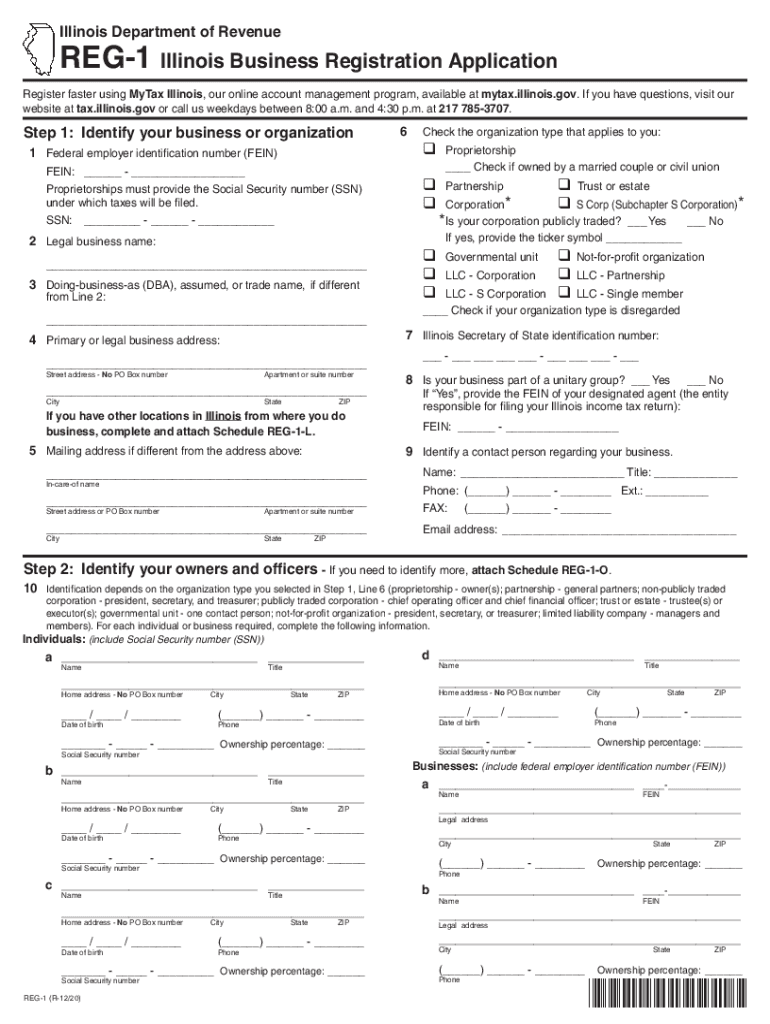

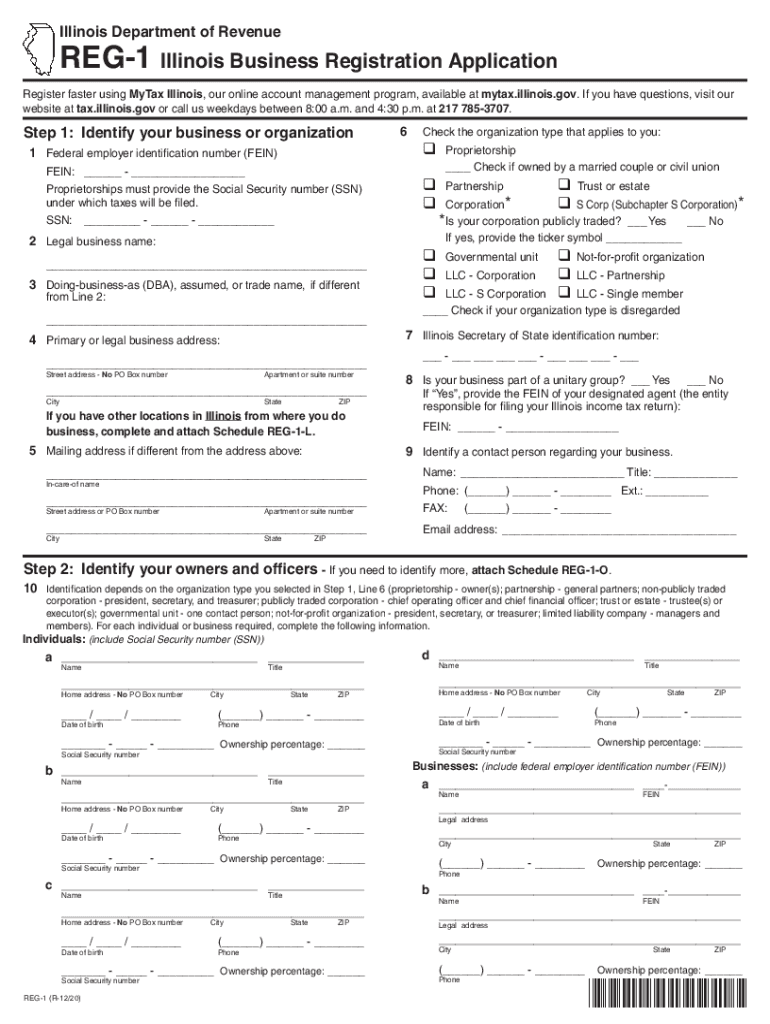

IL DoR REG-1 2020 free printable template

Show details

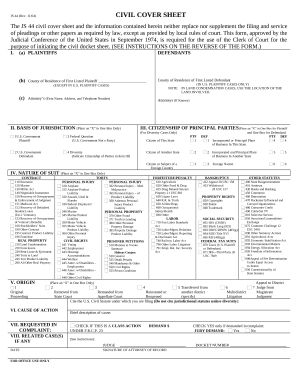

Use your 'Mouse or the 'Tab key to move through the fields and 'Mouse or 'Space bar to enable the checkboxes. Illinois Department of RevenueREG1 Illinois Business Registration Application Register

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL DoR REG-1

Edit your IL DoR REG-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL DoR REG-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IL DoR REG-1 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IL DoR REG-1. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL DoR REG-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL DoR REG-1

How to fill out IL DoR REG-1

01

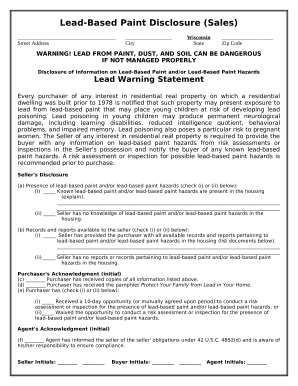

Download the IL DoR REG-1 form from the Illinois Department of Revenue website.

02

Fill out the 'Basic Information' section, including your name, address, and business type.

03

Provide your Social Security Number (SSN) or Employer Identification Number (EIN) in the appropriate fields.

04

Complete the 'Business Information' section by detailing your business activities and whether you expect to collect sales tax.

05

Indicate the type of ownership (e.g., sole proprietorship, partnership, corporation) that applies to your business.

06

Sign and date the form at the bottom where indicated.

07

Submit the completed form to the Illinois Department of Revenue by mail or online as instructed.

Who needs IL DoR REG-1?

01

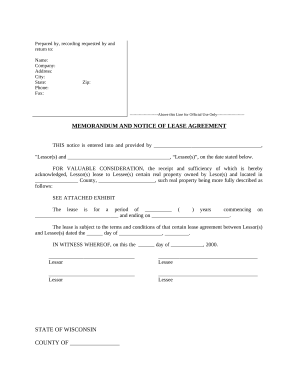

Individuals or entities starting a new business in Illinois.

02

Existing businesses that need to register for sales tax or any other taxes.

03

Businesses that have changed ownership or structure and need to update their registration.

Fill

form

: Try Risk Free

People Also Ask about

Can you write off sales tax in Illinois?

Yes. Illinois law allows a retailer to claim a discount of 1.75 (. 0175) percent of the sales and use tax collected, provided the retailer timely files its Form ST-1, Sales and Use Tax and E911 Surcharge Return, and pays the applicable tax by the due date.

Does Illinois require a resale license?

Illinois businesses may purchase items tax free to resell. Sales tax is then collected and paid when the items are sold at retail. To document tax-exempt purchases of such items, retailers must keep in their books and records a certificate of resale.

How do I pay my sales tax in Illinois?

Make a Payment MyTax Illinois. Credit Card. Check or money order (follow the payment instructions on the form or voucher associated with your filing) ACH Credit - ACH credit is NOT the preferred payment option for most taxpayers.

How do I remit sales tax in Illinois?

You have three options for filing and paying your Illinois sales tax: File online – File online at MyTax Illinois. You can remit your state sales tax payment through their online system. File by mail – You can use Form ST-1 and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

Who is responsible for sales tax in Illinois?

Sales tax 101 Sales and use tax in Illinois is administered by the Illinois Department of Revenue (DOR). Any sales tax collected from customers belongs to the state of Illinois, not you. It's your responsibility to manage the taxes you collect to remain in compliance with state and local laws.

Where do I pay vehicle sales tax in Illinois?

To do so, you may submit your tax return and any tax payment either to the Illinois Office of the Secretary of State or directly to the Illinois Department of Revenue.

How do I register as a reseller in Illinois?

To register as a reseller, you may choose one of the following options: Register electronically using MyTax Illinois. Complete and mail Form REG-1, Illinois Business Registration Application. Visit a regional office.

What is an Illinois certificate of resale?

A Certificate of Resale is a statement signed by the purchaser that indicates the merchandise purchased is for resale purposes only, not a sale to an end user, and therefore no tax is due. A completed and signed Form CRT-61, Certificate of Resale, is a valid Certificate of Resale.

Who qualifies as a reseller?

A reseller is an individual person or business that buys a product, marks up the price and sells it for a profit. It's the middle-men between manufacturers and customers. Resellers can be 4 different people: Distributor: Buys a product from the manufacturer and resells to either a wholesaler or retailer.

How much does it cost to register a business in Illinois?

Illinois Corporation Incorporation: $150 filing fee + franchise tax ($25 minimum) + optional $100 expedite fee. The expedite fee is required if you file online. Franchise tax is calculated as $1.50 per $1,000 on the paid-in capital represented in this state.

What is a Reg-1 form Illinois?

REG-1 - Illinois Business Registration Application.

How much does it cost to get a resale license in Illinois?

It is free to apply for a sales tax permit in Illinois. Other business registration fees may apply. Contact each state's individual department of revenue for more about registering your business. 6.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IL DoR REG-1 to be eSigned by others?

Once your IL DoR REG-1 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I execute IL DoR REG-1 online?

Easy online IL DoR REG-1 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for the IL DoR REG-1 in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is IL DoR REG-1?

IL DoR REG-1 is a form used by businesses in Illinois to register for state tax obligations and report their business activities to the Illinois Department of Revenue.

Who is required to file IL DoR REG-1?

Businesses that are starting operations in Illinois, including those creating a new business entity, or those that are changing their business structure or tax status are required to file IL DoR REG-1.

How to fill out IL DoR REG-1?

To fill out IL DoR REG-1, provide the required business information such as the legal name, address, tax identification number, and specific tax types for which you are registering. Follow the instructions provided with the form for accurate completion.

What is the purpose of IL DoR REG-1?

The purpose of IL DoR REG-1 is to provide the Illinois Department of Revenue with necessary information about new or existing businesses to ensure compliance with state tax laws and to facilitate proper tax assessment.

What information must be reported on IL DoR REG-1?

Information that must be reported on IL DoR REG-1 includes the business's legal name, address, federal employer identification number (FEIN), type of business, and the specific taxes the business intends to collect or pay.

Fill out your IL DoR REG-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL DoR REG-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.