Get the free 401 (k) Plan Contribution Authorization/Change Form - aurorak12

Show details

Division of Human Resources 401 (k) Plan Contribution Authorization/Change Form Complete all information and return this form to Benefits/Human Resources ESC-4 Your ID# Name Home Phone (Last First

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 401 k plan contribution

Edit your 401 k plan contribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 401 k plan contribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

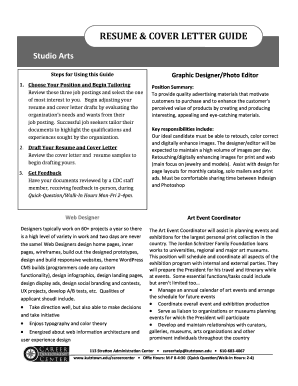

Editing 401 k plan contribution online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 401 k plan contribution. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 401 k plan contribution

How to fill out 401(k) plan contribution:

01

Determine your desired contribution amount: Before filling out a 401(k) plan contribution, it is important to decide how much you want to contribute. Assess your financial goals, budget, and employer matching contributions to determine an appropriate contribution level.

02

Review your employer's 401(k) plan: Familiarize yourself with your employer's 401(k) plan. Understand the eligibility criteria, contribution limits, and available investment options. This information can typically be found in the plan documents or by contacting your employer's HR department.

03

Complete the necessary paperwork: Your employer will provide you with the required forms to fill out for your 401(k) plan contribution. These forms may include personal information, contribution amount, investment allocation, and beneficiary designations. Carefully fill out all the necessary fields and ensure accuracy.

04

Select your investment options: Most 401(k) plans offer a diverse range of investment options, such as mutual funds, target-date funds, or individual stocks. Consider your risk tolerance, investment goals, and time horizon when choosing your investment options. If you are unsure, seek advice from a financial professional.

05

Determine your contribution method: Decide how you would like your contributions to be made. You may have options such as pre-tax or Roth contributions, as well as automatic payroll deductions. Understand the tax implications and benefits of each contribution method before making a decision.

06

Start contributing: Once you have completed the necessary paperwork and made your investment selections, begin making regular contributions to your 401(k) plan. This could be through automatic payroll deductions or making manual contributions, depending on your employer's policies.

Who needs 401(k) plan contribution?

01

Employees seeking retirement savings: 401(k) plan contributions are primarily designed for employees who want to save for retirement. By making regular contributions to a 401(k) plan, individuals can build a retirement nest egg and take advantage of potential employer matching contributions.

02

Individuals looking for tax advantages: Contributing to a traditional 401(k) plan can offer tax advantages. Contributions are typically made on a pre-tax basis, reducing your taxable income for the year. This can help lower your overall tax liability and potentially increase your take-home pay.

03

Employees interested in employer matching contributions: Many employers offer matching contributions to encourage employee participation in a 401(k) plan. This means that the employer will match a portion of the employee's contribution, effectively providing free money towards retirement savings. Taking advantage of employer matching contributions can significantly boost retirement savings.

04

Individuals planning for long-term financial security: A 401(k) plan allows individuals to accumulate savings over their working years, providing a source of income during retirement. By contributing regularly to a 401(k), individuals can work towards achieving long-term financial security and a comfortable retirement lifestyle.

05

Individuals seeking investment growth: 401(k) plans offer a variety of investment options, allowing individuals to potentially grow their savings over time. By contributing to a diversified portfolio, employees can benefit from the growth of the financial markets and build wealth for the future.

Overall, anyone who is employed and interested in saving for retirement, reducing taxes, taking advantage of employer matching contributions, planning for long-term financial security, and seeking investment growth can benefit from contributing to a 401(k) plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 401 k plan contribution?

401(k) plan contribution is a retirement savings plan sponsored by an employer where employees can contribute a portion of their salary on a pre-tax or after-tax basis.

Who is required to file 401 k plan contribution?

Employers who offer a 401(k) plan to their employees are required to file 401(k) plan contributions with the IRS.

How to fill out 401 k plan contribution?

Employers can fill out 401(k) plan contributions by reporting the amount withheld from employees' paychecks and the employer matching contributions.

What is the purpose of 401 k plan contribution?

The purpose of 401(k) plan contributions is to help employees save for retirement and provide tax benefits for both employees and employers.

What information must be reported on 401 k plan contribution?

Employers must report the total amount of employee and employer contributions, as well as any other relevant details such as catch-up contributions.

How can I modify 401 k plan contribution without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your 401 k plan contribution into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for the 401 k plan contribution in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your 401 k plan contribution and you'll be done in minutes.

How do I fill out 401 k plan contribution on an Android device?

Use the pdfFiller mobile app to complete your 401 k plan contribution on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your 401 k plan contribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

401 K Plan Contribution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.