Get the free pnvate foundation)

Show details

Short FormForm990EZReturn of Organization Exempt From Income Tax×OMB No,54550\'00Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or

private

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pnvate foundation

Edit your pnvate foundation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pnvate foundation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pnvate foundation online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pnvate foundation. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pnvate foundation

How to fill out pnvate foundation

01

To fill out a private foundation, follow these steps:

1. Research and understand the legal requirements for setting up a private foundation in your jurisdiction.

02

Decide on the purpose and goals of your private foundation. This could be related to charitable activities, education, healthcare, or any other cause you wish to support.

03

Determine the structure of the foundation, including selecting board members and establishing governance policies.

04

Develop a mission statement and create the necessary legal documents, such as articles of incorporation and bylaws.

05

Register the foundation with the appropriate government authorities and obtain any necessary permits or licenses.

06

Set up a bank account for the foundation to manage its finances.

07

Develop a fundraising strategy and start soliciting donations from individuals, corporations, or other organizations.

08

Comply with all tax regulations and reporting requirements applicable to private foundations.

09

Establish proper record-keeping and accounting systems to ensure transparency and accountability.

10

Regularly evaluate the impact and effectiveness of your foundation's activities and make any necessary adjustments.

11

Continuously engage with stakeholders and communicate the foundation's mission, accomplishments, and future plans.

12

Seek professional guidance from lawyers, accountants, and consultants with expertise in private foundation management if needed.

Who needs pnvate foundation?

01

Private foundations are typically established by individuals, families, or groups who have substantial wealth and want to create a long-lasting charitable legacy.

02

Here are some examples of who may need a private foundation:

03

- High-net-worth individuals or families seeking to consolidate their charitable giving and have more control over how their funds are used.

04

- Entrepreneurs or business owners looking to give back to society and create a lasting impact beyond their business ventures.

05

- Families who want to involve future generations in philanthropy and pass down charitable values.

06

- Corporations or organizations interested in establishing a separate entity for their philanthropic activities.

07

- Trustees or beneficiaries of trusts wishing to establish a formal structure for managing and distributing charitable funds.

08

It is important to consult with legal and financial advisors to determine if establishing a private foundation is the most suitable option based on individual circumstances and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify pnvate foundation without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including pnvate foundation, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Where do I find pnvate foundation?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific pnvate foundation and other forms. Find the template you need and change it using powerful tools.

How do I fill out the pnvate foundation form on my smartphone?

Use the pdfFiller mobile app to fill out and sign pnvate foundation. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is private foundation?

A private foundation is a nonprofit organization that supports charitable activities for the public good.

Who is required to file private foundation?

Private foundations are required to file Form 990-PF with the IRS annually.

How to fill out private foundation?

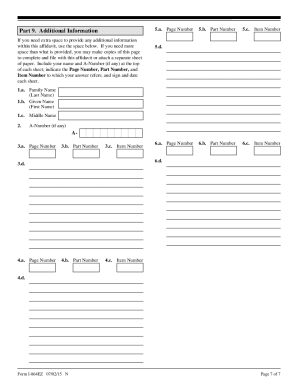

Private foundations must provide detailed financial information, grant information, and information about their activities.

What is the purpose of private foundation?

The purpose of a private foundation is to support charitable causes and activities for the public benefit.

What information must be reported on private foundation?

Private foundations must report financial information, grant details, and information about their governance and activities.

Fill out your pnvate foundation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pnvate Foundation is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.