NY EXC-0728 - City of New York 2018 free printable template

Show details

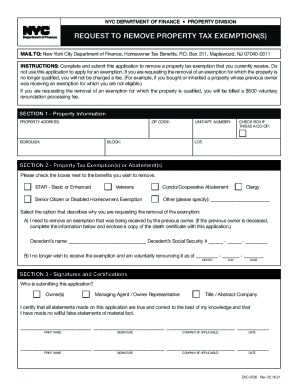

NYC DEPARTMENT OF FINANCE PROPERTY DIVISION REQUEST TO REMOVE PROPERTY TAX EXEMPTION(S) MAIL TO: NYC Dept. of Finance, Property Exemptions Administration/Compliance Unit, 59 Maiden Lane, 22nd Floor,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY EXC-0728 - City of New York

Edit your NY EXC-0728 - City of New York form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY EXC-0728 - City of New York form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY EXC-0728 - City of New York online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY EXC-0728 - City of New York. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY EXC-0728 - City of New York Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY EXC-0728 - City of New York

How to fill out NY EXC-0728 - City of New York

01

Download the NY EXC-0728 form from the official City of New York website.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide any required identification numbers, such as your Social Security number or tax identification number.

05

Complete the relevant sections regarding the property or situation the form addresses.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form by the specified method, either by mail or electronically, as instructed.

Who needs NY EXC-0728 - City of New York?

01

Individuals or businesses seeking to apply for a specific tax exemption or correction regarding property in New York City.

02

Property owners who believe they qualify for benefits under New York City's tax exemption programs.

03

Real estate professionals assisting clients with tax-related matters in New York City.

Fill

form

: Try Risk Free

People Also Ask about

How do I remove tax exemption in NYC?

To remove a personal exemption, you must submit a completed Property Tax Exemption Removal Form with the Department of Finance. All owners must sign, date, and provide their Social Security numbers on the form.

Does Virginia have a property tax exemption?

Owner/Applicant must be at least 65 or permanently disabled as of December 31 of the previous year. Sworn affidavits from two medical doctors licensed in Virginia or two military officers who practice medicine in the United States Armed Forces - use the Tax Relief Affidavit of Disability (PDF) for their completion.

Who is exempt from personal property tax in Virginia?

Most Virginia cities, counties, and towns offer some form of personal property tax relief to homeowners age 65 and older, and to homeowners with disabilities.

How do I become exempt from property taxes in Virginia?

Real Estate Tax Relief and Exemptions Tax Relief for Seniors and People with Disabilities. Disabled Veterans or Surviving Spouse Exemption. Exemption for Surviving Spouse of a Member of the U.S. Armed Forces Killed in Action. Exemption for Surviving Spouse of a First Responder Killed in the Line of Duty.

What is VA property tax exemption?

The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans who, due to a service-connected injury or disease, have been rated 100% disabled or are being compensated at the 100% rate due to unemployability.

How do I get Virginia personal property tax relief?

General Information. Personal property tax relief is provided for any passenger car, motorcycle, or pickup or panel truck having a registered gross weight with DMV of 10,000 pounds or less on January 1. Qualifying vehicles must be owned or leased by an individual and be used 50% or less for business purposes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get NY EXC-0728 - City of New York?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific NY EXC-0728 - City of New York and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete NY EXC-0728 - City of New York online?

pdfFiller makes it easy to finish and sign NY EXC-0728 - City of New York online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I complete NY EXC-0728 - City of New York on an Android device?

Use the pdfFiller app for Android to finish your NY EXC-0728 - City of New York. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is NY EXC-0728 - City of New York?

NY EXC-0728 is a tax form used by businesses in the City of New York to report and remit the Excise tax on specific activities and transactions.

Who is required to file NY EXC-0728 - City of New York?

Businesses and individuals who engage in activities subject to the Excise tax as defined by New York City tax regulations are required to file this form.

How to fill out NY EXC-0728 - City of New York?

To fill out NY EXC-0728, taxpayers must provide their business information, report taxable activities, calculate the Excise tax due, and submit the form along with payment to the city’s Department of Finance.

What is the purpose of NY EXC-0728 - City of New York?

The purpose of NY EXC-0728 is to facilitate the collection of Excise taxes for activities that are regulated by the City of New York, ensuring compliance with local tax laws.

What information must be reported on NY EXC-0728 - City of New York?

NY EXC-0728 requires reporting of the business name, address, tax identification number, details of the taxable activities, total revenue, and the calculated Excise tax due.

Fill out your NY EXC-0728 - City of New York online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY EXC-0728 - City Of New York is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.