Get the free CERTIFIED PAYROLL PROFESSIONAL - American Payroll ... - info americanpayroll

Show details

APA LOCAL CHAPTER RCH PROGRAM Las Vegas, NV San Antonio, TX Washington, DC Chapter americanpayroll.org APA LOCAL CHAPTER RCH PROGRAM INFORMATION PACKET INTRODUCTION APA Local Chapters offer many opportunities

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certified payroll professional

Edit your certified payroll professional form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certified payroll professional form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing certified payroll professional online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit certified payroll professional. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certified payroll professional

How to fill out certified payroll professional

01

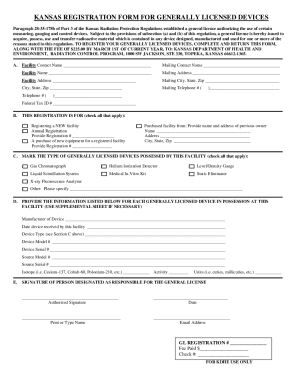

To fill out the certified payroll professional form, follow these steps:

02

Start by entering the name and contact information of the employer or company.

03

Include the project name and number, along with the address and location of the project.

04

Enter the date range for the payroll period, specifying the start and end dates.

05

List all the employees working on the project during the payroll period.

06

Provide the employee's name, social security number, job classification, and the number of hours worked each day.

07

Calculate the gross wages earned by each employee for the payroll period.

08

Deduct any applicable withholdings or deductions from the gross wages to determine the net pay.

09

Include any additional information required, such as overtime hours, fringe benefits, or prevailing wage rates.

10

Sign the certified payroll form and provide any necessary certifications or attachments.

11

Review the completed form for accuracy and submit it to the appropriate party or authority.

12

Please note that the specific requirements for filling out a certified payroll professional form may vary depending on the jurisdiction or organization. It is important to consult the relevant guidelines or instructions.

Who needs certified payroll professional?

01

Certified payroll professionals are typically required in the construction industry and related fields.

02

Employers, contractors, subcontractors, and government agencies may require certified payroll professionals to ensure compliance with labor laws and regulations.

03

Companies or organizations involved in projects that are subject to prevailing wage requirements or funded by government entities often need certified payroll professionals.

04

Certified payroll professionals also play a crucial role in managing and reporting payroll information accurately and transparently.

05

Individuals or businesses seeking to demonstrate their expertise and commitment to payroll management may also choose to become certified payroll professionals.

06

Ultimately, anyone involved in payroll administration, particularly in industries with specific labor compliance requirements, can benefit from having certified payroll professionals on their team.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit certified payroll professional in Chrome?

Install the pdfFiller Google Chrome Extension to edit certified payroll professional and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for the certified payroll professional in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your certified payroll professional in minutes.

How do I fill out certified payroll professional using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign certified payroll professional and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is certified payroll professional?

A certified payroll professional is a designation given to individuals who have successfully passed the certification exam administered by the American Payroll Association. This certification demonstrates expertise in payroll processing and compliance with various laws and regulations.

Who is required to file certified payroll professional?

Any individual working in a payroll position or responsible for payroll processing may choose to obtain the certified payroll professional designation. It is not mandatory, but it can enhance their skills and knowledge in the field.

How to fill out certified payroll professional?

To fill out a certified payroll professional form, the individual must accurately report all payroll information, such as employee wages, hours worked, deductions, and benefits. They must also ensure compliance with state and federal labor laws.

What is the purpose of certified payroll professional?

The purpose of certified payroll professional is to ensure that employee wages are reported accurately and in compliance with prevailing wage laws on government-funded projects. It helps track payments made to workers and prevents wage theft.

What information must be reported on certified payroll professional?

Information that must be reported on certified payroll professional includes employee names, job classifications, hourly rates, daily and weekly hours worked, deductions, benefits, and total wages paid.

Fill out your certified payroll professional online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certified Payroll Professional is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.