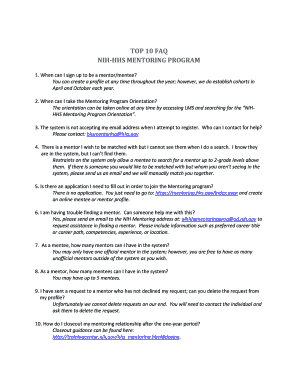

Get the free Business Tax Receipt Holders FY 2019. BTR Current Holders

Show details

Business Tax Receipt Holders FY 2019 Company NameBusiness NameCityZipState304 Indian Trace, PMB 307Weston33326FL1108 Weston RoadWeston33326FL13 Glades Investments LLC2850 Glades Circle, Ste 10Weston33327FL1754

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business tax receipt holders

Edit your business tax receipt holders form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business tax receipt holders form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business tax receipt holders online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business tax receipt holders. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business tax receipt holders

How to fill out business tax receipt holders

01

Gather all necessary information and documents, such as your business registration number, proof of ownership or lease agreement, and any other required permits or licenses.

02

Determine the appropriate business tax receipt application form based on your business type and location. This information can usually be obtained from your local government website or the office responsible for issuing business tax receipts.

03

Fill out the application form accurately and completely. Provide all the requested information, including your business name, address, contact details, and any applicable tax or registration numbers.

04

Pay the required fees associated with obtaining a business tax receipt. The fee amount will depend on various factors, such as your business type, size, and location.

05

Submit your completed application form and payment to the designated office or authority responsible for processing business tax receipts. Make sure to follow any specific submission instructions provided.

06

Await processing and approval of your application. This may involve a review of your submitted information, verification of documents, and compliance with any applicable regulations or requirements.

07

Once your application is approved, you will receive your business tax receipt. Ensure to keep it in a safe place and display it prominently at your business premises as required by local regulations.

Who needs business tax receipt holders?

01

Business tax receipt holders are required by individuals or entities engaged in businesses that are subject to local tax regulations.

02

This can include various business types, such as sole proprietors, partnerships, corporations, and limited liability companies.

03

The specific requirements for business tax receipt holders may vary depending on the jurisdiction and the nature of the business.

04

It is important for business owners to consult with their local government or tax authorities to determine if they are required to hold a business tax receipt and to understand the related obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get business tax receipt holders?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the business tax receipt holders. Open it immediately and start altering it with sophisticated capabilities.

How do I edit business tax receipt holders in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your business tax receipt holders, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I edit business tax receipt holders on an iOS device?

You certainly can. You can quickly edit, distribute, and sign business tax receipt holders on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is business tax receipt holders?

Business tax receipt holders are individuals or entities that have obtained a business tax receipt or license to operate a business in a specific jurisdiction.

Who is required to file business tax receipt holders?

Any individual or entity that operates a business within a jurisdiction that requires a business tax receipt is required to file for one.

How to fill out business tax receipt holders?

Business tax receipt holders can typically fill out the necessary forms online or in-person at the local government office responsible for issuing business tax receipts.

What is the purpose of business tax receipt holders?

The purpose of business tax receipt holders is to ensure that businesses are operating legally within a jurisdiction and to track tax revenue generated from business activities.

What information must be reported on business tax receipt holders?

Business tax receipt holders must report information such as the type of business, location, ownership details, and estimated annual revenue.

Fill out your business tax receipt holders online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Tax Receipt Holders is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.