Get the free RENTERS INSURANCE REQUIREMENT - DFpeoplecom

Show details

RENTERS INSURANCE REQUIREMENT This Addendum to the Lease Agreement is incorporated in and made a part of the Lease Agreement (Lease) dated between (Lessor) and (Lessee). Each Lessee shall obtain,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign renters insurance requirement

Edit your renters insurance requirement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your renters insurance requirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing renters insurance requirement online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit renters insurance requirement. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out renters insurance requirement

How to fill out renters insurance requirement?

01

Contact your landlord or property management to understand the specific renters insurance requirements for your rental property.

02

Research and find an insurance provider that offers renters insurance policies. You can ask for recommendations from friends, family, or do online research.

03

Reach out to the insurance provider and provide them with the necessary information, such as your name, address, and any other required personal details.

04

Review the coverage options offered by the insurance provider and choose the one that best suits your needs and budget. Consider factors like liability coverage, personal property coverage, and additional endorsements.

05

Provide the insurance provider with the required documents or information, such as proof of income, identification documents, and details about your rental property.

06

Pay the premium for your renters insurance policy. Depending on your insurance provider, it can be a one-time annual payment or divided into monthly installments.

07

Review the policy document carefully to understand the coverage, exclusions, deductibles, and any other terms and conditions.

08

Keep a copy of your renters insurance policy in a safe place and ensure that your landlord or property management has a copy as well.

Who needs renters insurance requirement?

01

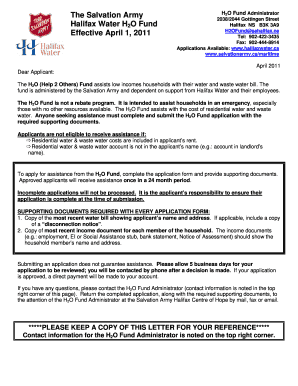

Renters who live in apartments, condos, or houses that have landlords or property management that require renters insurance.

02

Individuals who want to protect their personal belongings, such as furniture, electronics, and clothing, from theft, fire, or other covered perils.

03

Renters who want to have liability coverage in case someone is injured on their property or their belongings cause damage to another person's property.

04

Students living in dormitories or college housing that requires renters insurance.

05

Individuals who want peace of mind and financial protection in case of unforeseen events, such as natural disasters or accidents.

Fill

form

: Try Risk Free

People Also Ask about

What is the most common amount for renters insurance?

ing to NerdWallet, the average renters policy costs about $15 per month for up to $30,000 in personal property coverage.

Why is lemonade renters insurance so cheap?

Lemonade uses AI technology to make insurance way more efficient, enabling renters to score great coverage for incredible prices. How is Lemonade able to provide these prices? Lemonade works hard to lower fraud costs by aligning interests, and slashing expenses through technology.

How much is renters insurance in California?

How much is renters insurance in California? The average cost of renters insurance in California is $204 a year, or approximately $17 a month. That's higher than the national average of $179 a year. Los Angeles is one of the most expensive areas for renters insurance in California, with an average cost of $221 a year.

What does renters insurance cover in CA?

Renters insurance can cover items damaged by fire, smoke, and other situations. Water Damage: Similar to fire and smoke, your renters insurance may cover items caused by certain types of water damage. Temporary Living Expenses: If your apartment is damaged by a covered loss, you may need to find a place to stay.

Is renters insurance required in NYC?

Is renters insurance required in New York? No, there is no federal law that requires tenants to carry renters insurance; however, some landlords may require proof of renters insurance as part of the lease agreement.

Is renters insurance mandatory in California?

While renters insurance is not required by law in California, some landlords may require it for you to live in their building. It's generally a good idea to have at least some form of coverage as your landlord's insurance is not liable for any damage to your personal property.

Is it OK to have 2 renters insurance policies?

Although it is uncommon, you technically can have two renters insurance policies. That said, you likely do not need two policies because renters insurance covers your belongings when they are both on and off your rental property.

What are the three major parts of a renters insurance policy?

Renters insurance typically includes three types of coverage: Personal property, liability and additional living expenses. Personal property coverage can help pay to replace your belongings if they're stolen or damaged by a covered risk.

How often should you shop around for renters insurance?

How often should you shop around for renters insurance? Renters insurance policies typically provide coverage for one year. While it may be easier to renew without shopping around, we always recommend comparing insurers and quotes just before the policy expires because there is no penalty for switching companies.

How much is renters insurance in California on average?

Average Cost of Renters Insurance in California. California renters insurance is 49.0% more than the U.S. average. The average cost of renters insurance in California is $238 per year.

Is it mandatory to have renters insurance in Texas?

While renters insurance is not required by law in Texas, some landlords may require it for you to live in their building. It's generally a good idea to have at least some form of coverage as your landlord's insurance won't cover any damage to your personal property.

How to get the most out of renters insurance reddit?

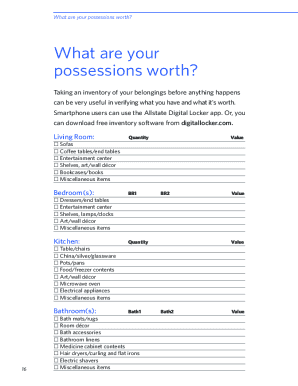

8 Essential Tips to Get the Most Out of Renters Insurance Set coverage limits to match your needs. Pay attention to coverage sublimits. Additional living expenses (ALE) and liability protection are must-haves. Choose replacement cost value (RCV). Create a detailed home inventory with photos and, when possible, receipts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit renters insurance requirement from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including renters insurance requirement, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I sign the renters insurance requirement electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your renters insurance requirement in seconds.

How do I edit renters insurance requirement on an Android device?

You can make any changes to PDF files, such as renters insurance requirement, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is renters insurance requirement?

Renters insurance requirement refers to the obligation for tenants to obtain a specific insurance policy that covers their personal belongings from risks such as theft, fire, and other damages.

Who is required to file renters insurance requirement?

Typically, tenants or renters are required to file renters insurance requirements, often mandated by landlords or property management companies as part of the lease agreement.

How to fill out renters insurance requirement?

To fill out renters insurance requirement, tenants should contact an insurance provider, provide necessary personal details, select coverage options, and complete any required forms or applications as specified by the insurer.

What is the purpose of renters insurance requirement?

The purpose of renters insurance requirement is to protect the tenant's personal property and provide liability coverage, safeguarding both the tenant and the landlord from potential financial losses due to unforeseen events.

What information must be reported on renters insurance requirement?

Information that must be reported on renters insurance requirement typically includes the tenant's contact information, the address of the rented property, coverage amounts desired, and any special items that need additional coverage.

Fill out your renters insurance requirement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Renters Insurance Requirement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.