Get the free Print Job Accounting

Show details

Print Job AccountingManage and track printer usage company-wide. Cut costs, increase revenue and save resources. OK Print Job Accounting software enables you to charge back departments, bill back

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign print job accounting

Edit your print job accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your print job accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit print job accounting online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit print job accounting. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out print job accounting

How to fill out print job accounting:

01

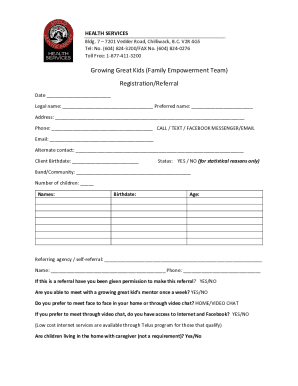

Identify the print job accounting form: The first step in filling out print job accounting is to locate the specific form or template that your organization or printer manufacturer provides for this purpose. This form usually includes fields and sections for recording information related to print jobs.

02

Enter the date and time: Start by entering the date and time when the print job was initiated. This information helps track the timing and volume of print jobs for accounting purposes.

03

Record the user or department: Specify the user or department that initiated the print job. This could be an employee's name, a department code, or any other identifier that helps differentiate between different users and departments.

04

Provide print job details: Fill in the details of the print job, including the document name or description, the number of pages printed, the print settings used, and any additional notes or instructions related to the job. This information helps in assessing the cost and value of each print job.

05

Indicate the printer used: Specify the printer used for the print job. This could be the name or model of the printer, a unique identifier, or any other information that helps identify the specific device used for printing.

06

Calculate the cost: Depending on the system or template being used, you may need to calculate the cost of the print job. This could be based on factors such as the number of pages, ink or toner usage, paper cost, or any other relevant parameters. The calculation should reflect the actual cost incurred for the print job.

07

Submit or store the form: Once you have accurately filled out the print job accounting form, submit it according to your organization's processes. This could involve submitting it to a designated department, accounting personnel, or storing it for future reference or analysis.

Who needs print job accounting?

01

Organizations with high print volume: Print job accounting is particularly useful for organizations that have a high volume of printing activities. By tracking and analyzing print job data, these organizations can gain insights into their printing costs, optimize print resources, and identify opportunities for cost savings.

02

Cost-conscious businesses: Print job accounting can help businesses that are focused on cost efficiency. By monitoring and understanding the expenses related to printing, these businesses can make informed decisions about print-related investments, evaluate the return on investment of printing equipment, and implement measures to reduce printing costs.

03

IT administrators and print managers: IT administrators and print managers are responsible for managing and maintaining printing infrastructure within organizations. Print job accounting allows them to monitor usage patterns, identify excessive or unnecessary printing, implement print policies, and track costs associated with different users or departments.

04

Print service providers: Print job accounting is also relevant for print service providers who offer printing services to external clients. By accurately tracking and recording print job details, these providers can generate accurate invoices, assess profitability, and provide transparency to clients regarding printing costs.

05

Environmentally conscious organizations: Print job accounting can be a tool for organizations that prioritize sustainability and environmental responsibility. By understanding their printing habits, these organizations can implement measures to reduce paper waste, optimize printing resources, and encourage responsible printing practices among employees.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my print job accounting in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your print job accounting and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit print job accounting in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your print job accounting, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my print job accounting in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your print job accounting and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is print job accounting?

Print job accounting is a system used to track and monitor printing activities within an organization. It helps to understand and control printing costs, allocate expenses, and analyze printing behaviors.

Who is required to file print job accounting?

Organizations that have multiple printers or copiers and want to track printing activities and expenses are required to file print job accounting.

How to fill out print job accounting?

Print job accounting can be filled out by using specialized software that tracks and reports printing activities, or manually by documenting printing activities and costs.

What is the purpose of print job accounting?

The purpose of print job accounting is to control printing costs, allocate expenses, and analyze printing behaviors to optimize printing resources.

What information must be reported on print job accounting?

Information that must be reported on print job accounting includes printing activities, number of pages printed, printing costs, user responsible for printing, and printing behaviors.

Fill out your print job accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Print Job Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.