IRS 990 or 990-EZ - Schedule E 2018 free printable template

Show details

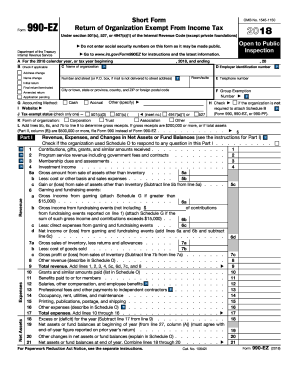

OMB No. 15450047SchoolsSCHEDULE E (Form 990 or 990EZ)Department of the Treasury Internal Revenue Service2018Complete if the organization answered Yes on Form 990, Part IV, line 13, or Form 990EZ,

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 990 or 990-EZ - Schedule

How to edit IRS 990 or 990-EZ - Schedule

How to fill out IRS 990 or 990-EZ - Schedule

Instructions and Help about IRS 990 or 990-EZ - Schedule

How to edit IRS 990 or 990-EZ - Schedule

To edit the IRS 990 or 990-EZ - Schedule, use a digital form editing tool such as pdfFiller. Start by uploading a blank or completed IRS 990 or 990-EZ - Schedule to the platform. Utilize the editing features to make necessary changes, ensuring that all information is accurate.

Once edits are made, review the document carefully for any errors or inconsistencies. After completing the edits, you can save the changes or proceed to sign and submit the form electronically as needed. Always keep a copy of the final document for your records.

How to fill out IRS 990 or 990-EZ - Schedule

Filling out the IRS 990 or 990-EZ - Schedule involves several steps. First, gather all relevant financial information for your organization, such as income, expenses, and assets. Then, follow the sections of the form sequentially, ensuring to fill in all fields accurately.

Use the guidelines provided within the form to clarify any requirements. It's recommended to double-check calculations and ensure that all figures align with existing financial records. Consider consulting a tax professional if any complexities arise during the completion process.

About IRS 990 or 990-EZ - Schedule 2018 previous version

What is IRS 990 or 990-EZ - Schedule?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 990 or 990-EZ - Schedule 2018 previous version

What is IRS 990 or 990-EZ - Schedule?

IRS 990 or 990-EZ - Schedule is a tax form used by nonprofit organizations to provide the IRS with information about their financial activities and operations. This form is essential for maintaining tax-exempt status as it helps demonstrate compliance with federal regulations.

What is the purpose of this form?

The purpose of IRS 990 or 990-EZ - Schedule is to report financial information, including revenue, expenses, and changes in net assets for tax-exempt organizations. This filing is critical for transparency and accountability, ensuring that public charities operate within the regulations set forth by the IRS.

Who needs the form?

Nonprofit organizations that receive annual revenues exceeding $200,000 or have total assets over $500,000 must file the IRS 990 or 990-EZ - Schedule. Additionally, smaller organizations with receipts of less than $200,000 may still choose to file this form for transparency purposes.

When am I exempt from filling out this form?

Organizations that are classified as churches, government units, or certain state colleges and universities may be exempt from filing the IRS 990 or 990-EZ - Schedule. Additionally, organizations whose annual gross receipts are normally $50,000 or less are eligible to file the simpler Form 990-N instead.

Components of the form

The IRS 990 or 990-EZ - Schedule consists of multiple components, including financial statements, details about governance, and compensation information for officers and directors. Key sections require disclosures of revenue sources, program services, and a breakdown of functional expenses.

Understanding each component is vital for accurate reporting and compliance. Key areas such as Part I – Summary, Part II – Signature Block, and various schedules outline specific disclosures required by the IRS.

Due date

The due date for filing the IRS 990 or 990-EZ - Schedule is the 15th day of the 5th month following the end of the organization’s tax year. For organizations that operate on a calendar-year basis, this means the form is due by May 15. Organizations can apply for an extension if additional time is needed to complete the form.

What are the penalties for not issuing the form?

Failure to file the IRS 990 or 990-EZ - Schedule may result in penalties. Organizations could face fines of $20 per day for late filings, up to a maximum penalty of $10,000. Furthermore, failure to file for three consecutive years can result in automatic revocation of tax-exempt status, which has significant implications for the organization.

What information do you need when you file the form?

When filing the IRS 990 or 990-EZ - Schedule, gather comprehensive financial data, including revenue statements, balance sheets, and expense breakdowns. You will also need details about your organization’s mission, governance structure, and relevant tax-exempt status documentation.

Having accurate and thorough information prepared in advance can streamline the filing process, reducing the risk of mistakes that could lead to penalties.

Is the form accompanied by other forms?

The IRS 990 or 990-EZ - Schedule may require the attachment of additional forms or schedules depending on the nature of the organization. These may include Schedule B (Schedule of Contributors), Schedule G (Supplementary Information Regarding Fundraising or Gaming Activities), or other necessary attachments that provide additional disclosures as mandated by the IRS.

Where do I send the form?

Send the completed IRS 990 or 990-EZ - Schedule to the address specified in the form's instructions, which varies based on the organization’s location and whether it is filing electronically or by mail. For electronic submissions, follow the procedures outlined on the IRS e-file website for tax-exempt organizations.

See what our users say