Get the free Income taxation of estates and trusts - National Law Foundation

Show details

National Law Foundation www.nlfcle.com 104-Page Course Book, Audio Tapes, Audio CDs, DVD and Videotape of Live 2.5-Hour November 2, 2006, Presentation STEVEN G. SIEGEL This Page 104is Lo Book added

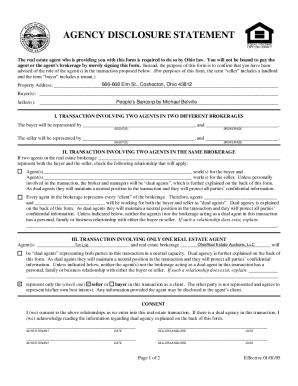

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income taxation of estates

Edit your income taxation of estates form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income taxation of estates form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit income taxation of estates online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit income taxation of estates. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income taxation of estates

How to fill out income taxation of estates:

01

Gather all necessary documents and information related to the estate's income. This may include income statements, receipts, and any relevant financial records.

02

Determine the estate's gross income by adding up all sources of income, such as rental properties, investments, or business income.

03

Subtract any allowable deductions from the gross income. These deductions may include expenses related to the maintenance of the estate, administrative costs, and any allowable tax credits.

04

Calculate the net income of the estate by subtracting the deductions from the gross income.

05

Check if the estate qualifies for any special deductions or exemptions. This may vary based on the specific circumstances and jurisdiction.

06

Determine the applicable tax rate for the estate based on its net income. Consult the relevant tax laws or seek professional advice if necessary.

07

Complete the appropriate tax forms for income taxation of estates. This may include Form 1041 or other relevant forms depending on the jurisdiction.

08

Submit the completed tax forms along with any required supporting documents to the appropriate tax authorities.

09

Make any necessary tax payments or request a refund if the estate is eligible for a tax refund.

Who needs income taxation of estates:

01

Executors or administrators of deceased individuals' estates may need to handle the income taxation of estates. It is their responsibility to ensure that the estate's income is properly reported and taxes are paid.

02

Beneficiaries of estates may also need to be aware of income taxation, as any income generated by the estate may impact their own tax liabilities.

03

Legal professionals, such as estate attorneys or tax advisors, may assist in the management of income taxation for estates and provide guidance on the applicable laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is income taxation of estates?

Income taxation of estates refers to the process of calculating and paying taxes on the income generated from an estate after someone passes away.

Who is required to file income taxation of estates?

The executor or personal representative of an estate is typically responsible for filing income taxation of estates.

How to fill out income taxation of estates?

To fill out income taxation of estates, the executor or personal representative needs to gather all financial information related to the estate, including income and expenses, and accurately report it to the tax authorities.

What is the purpose of income taxation of estates?

The purpose of income taxation of estates is to ensure that the income generated by an estate is properly reported and taxed according to the tax laws.

What information must be reported on income taxation of estates?

The information that must be reported on income taxation of estates includes details of the income earned by the estate, deductions, expenses, and any other relevant financial information.

How do I execute income taxation of estates online?

pdfFiller has made filling out and eSigning income taxation of estates easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit income taxation of estates online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your income taxation of estates to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out income taxation of estates on an Android device?

Use the pdfFiller mobile app and complete your income taxation of estates and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your income taxation of estates online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Taxation Of Estates is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.