Get the free Discounted Long-Term Care Insurance Premiums

Show details

Discounted Longer Care Insurance Premiums

Long term care insurance is available through the Pennsylvania Medical Society Insurance

Agency from carriers such as Gen worth, John Hancock×, Met Life×,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign discounted long-term care insurance

Edit your discounted long-term care insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your discounted long-term care insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing discounted long-term care insurance online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit discounted long-term care insurance. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out discounted long-term care insurance

How to fill out discounted long-term care insurance:

01

Start by researching insurance providers that offer discounted long-term care insurance policies. Look for reputable companies with a track record of providing reliable coverage.

02

Contact the chosen insurance provider and request a quote for discounted long-term care insurance. Provide them with necessary information such as your age, health condition, and desired coverage amount.

03

Review the quote and policy terms carefully. Make sure you understand the coverage, exclusions, and any limitations associated with the discounted long-term care insurance.

04

If you have any questions or concerns, reach out to the insurance provider for clarification. It's important to have a clear understanding of the policy before moving forward.

05

Once you are satisfied with the quote and policy terms, complete the application form provided by the insurance company. Be truthful and accurate while filling out personal information and medical history.

06

Submit the completed application form along with any required documents or evidence of insurability.

07

Pay the premium for the discounted long-term care insurance policy either as a lump sum or in installments, as per the provider's payment options.

08

After submitting the application and paying the premium, wait for the insurance company to review your application. They may request additional information or medical exams if needed.

09

Once your application is approved, carefully review the policy documents provided by the insurance company. Familiarize yourself with the claims process, policy renewals, and other important terms and conditions.

10

Store your discounted long-term care insurance policy documents in a safe place for easy reference in the future.

Who needs discounted long-term care insurance:

01

Individuals who are concerned about the potential high costs of long-term care in the future may benefit from discounted long-term care insurance. This includes people who want to safeguard their savings and assets from being depleted by long-term care expenses.

02

Those who have a family history or personal risk factors that increase the likelihood of needing long-term care may consider discounted long-term care insurance. Examples of such risk factors include chronic health conditions or disabilities.

03

People who wish to have more options and control over their long-term care choices may find value in discounted long-term care insurance. This coverage can enable them to receive care at home, in assisted living facilities, or nursing homes, depending on their preferences and needs.

04

Individuals who are not eligible for government-funded long-term care programs or want to supplement their existing coverage may choose discounted long-term care insurance. This can provide additional financial security and flexibility in accessing the required care.

05

Planning early for long-term care expenses is crucial, and discounted long-term care insurance can be a viable option for those who want to take proactive steps to secure their future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is discounted long-term care insurance?

Discounted long-term care insurance is a type of insurance policy that provides coverage for long-term care services at a reduced premium rate.

Who is required to file discounted long-term care insurance?

Individuals who purchase discounted long-term care insurance policies are required to file them.

How to fill out discounted long-term care insurance?

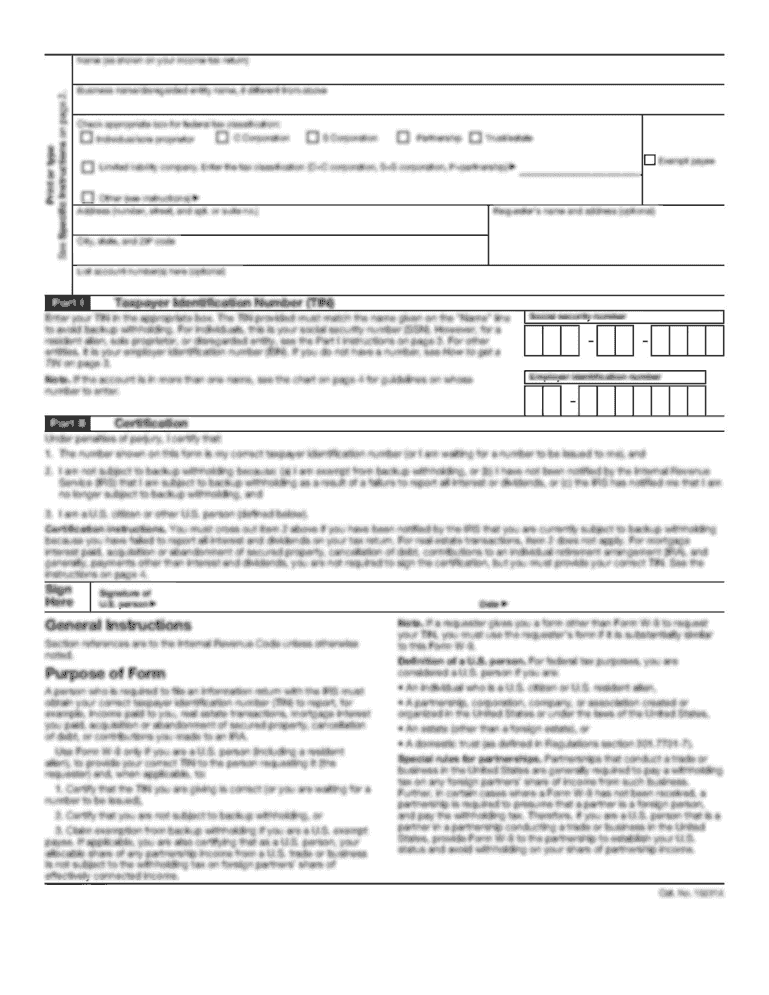

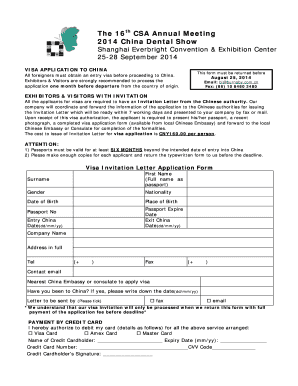

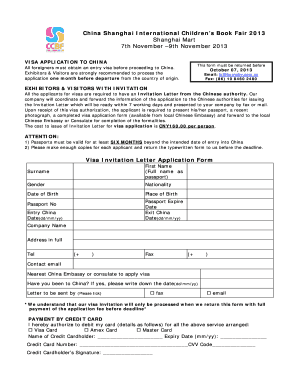

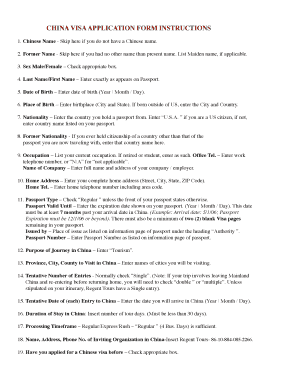

Discounted long-term care insurance can be filled out by providing personal information, policy details, and premium payment information on the designated form.

What is the purpose of discounted long-term care insurance?

The purpose of discounted long-term care insurance is to help individuals plan and prepare for potential long-term care needs while saving on premium costs.

What information must be reported on discounted long-term care insurance?

Discounted long-term care insurance must include details such as the policyholder's name, contact information, policy coverage, premium payment schedule, and beneficiary information.

Can I sign the discounted long-term care insurance electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your discounted long-term care insurance in minutes.

Can I create an eSignature for the discounted long-term care insurance in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your discounted long-term care insurance right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I fill out discounted long-term care insurance on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your discounted long-term care insurance, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your discounted long-term care insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Discounted Long-Term Care Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.