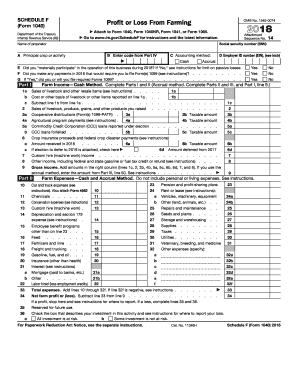

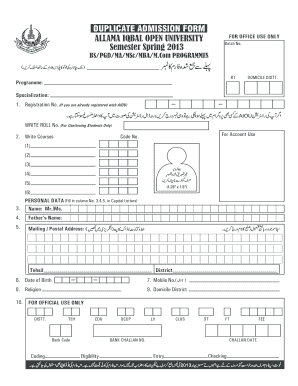

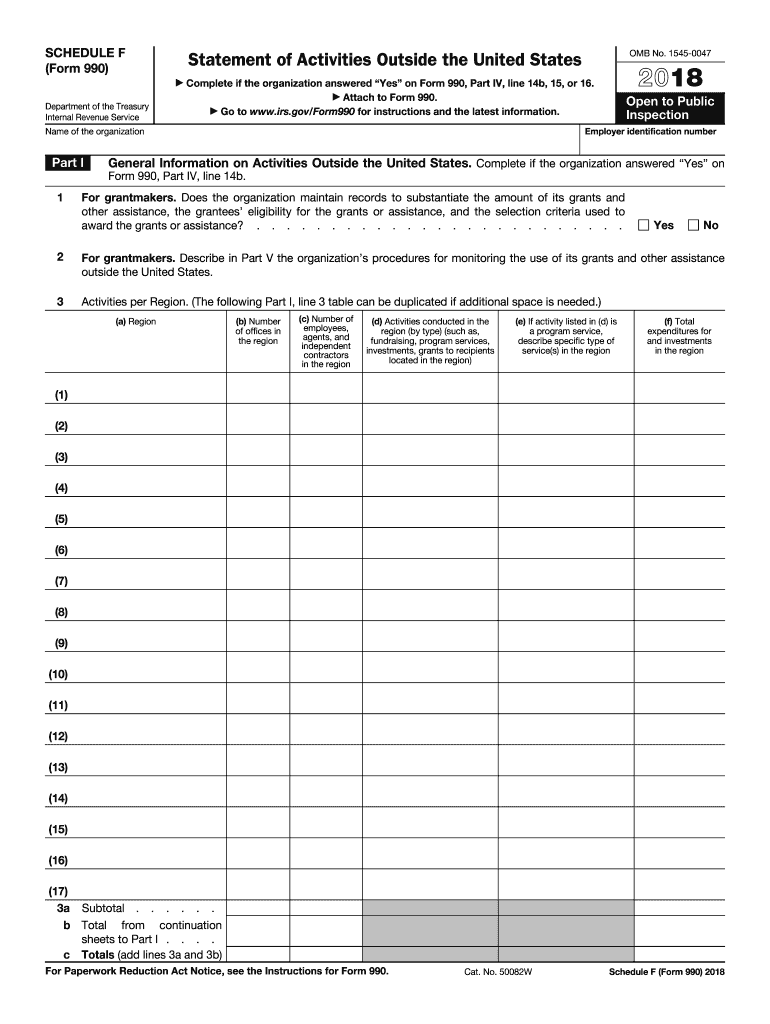

IRS 990 - Schedule F 2018 free printable template

Instructions and Help about IRS 990 - Schedule F

How to edit IRS 990 - Schedule F

How to fill out IRS 990 - Schedule F

About IRS 990 - Schedule F 2018 previous version

What is IRS 990 - Schedule F?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

What information do you need when you file the form?

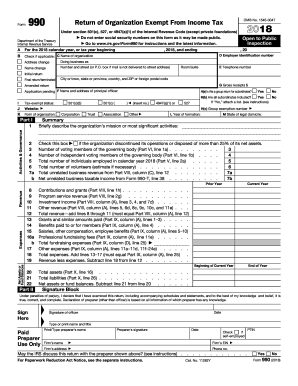

What is the purpose of this form?

Who needs the form?

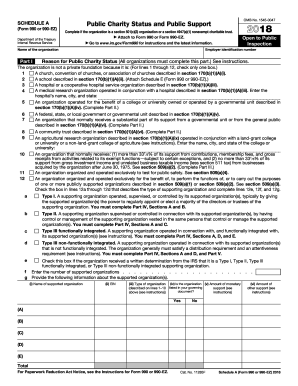

Components of the form

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 990 - Schedule F

What should I do if I realize I've made a mistake on a submitted Schedule F 2016?

If you've made an error on your submitted Schedule F 2016, you should file an amended return using Form 1040X, which includes the corrected Schedule F. It's important to provide a clear explanation of the amendments and ensure all necessary corrections are accurately reported to avoid potential issues.

How can I check the status of my filed Schedule F 2016?

To verify the status of your filed Schedule F 2016, you can use the IRS's 'Where's My Refund?' tool if you are expecting a refund. Additionally, tracking options may be available through your e-filing software, which can indicate whether the IRS has accepted or rejected your submission.

Are there specific legal considerations for filing Schedule F 2016 if I am a nonresident?

When filing Schedule F 2016 as a nonresident, be aware that you may have different requirements regarding income allocation and tax treatment. It is crucial to consult IRS guidelines specific to nonresident filers or seek advice from a tax professional experienced in international tax issues to ensure compliance.

What are common pitfalls to avoid when filing Schedule F 2016?

Common errors in filing Schedule F 2016 include failing to report all income, not matching entries with supporting documents, and misunderstanding allowable deductions. To minimize mistakes, review the form instructions carefully and cross-check your entries before submission.

What should I do if I receive a notice from the IRS regarding my Schedule F 2016?

If you receive a notice from the IRS concerning your Schedule F 2016, read the notice carefully to understand the issue. Respond promptly, providing any requested documentation or clarification as needed. If you disagree with the notice, it's advisable to consult a tax professional to discuss your options.