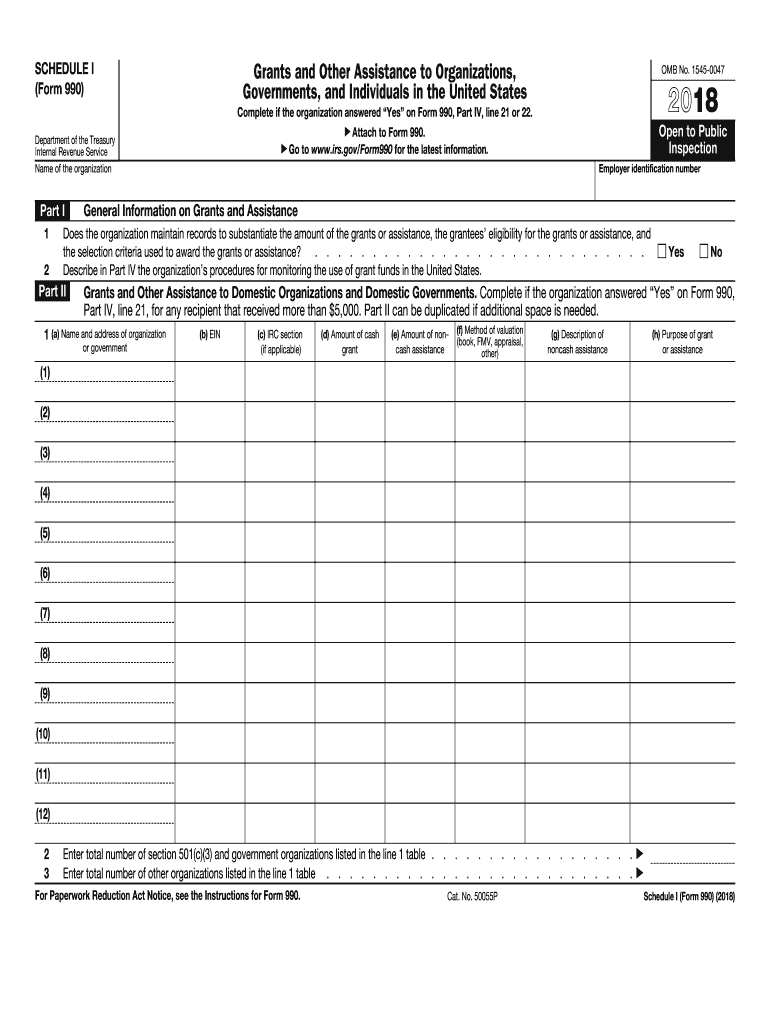

IRS 990 - Schedule I 2018 free printable template

Instructions and Help about IRS 990 - Schedule I

How to edit IRS 990 - Schedule I

How to fill out IRS 990 - Schedule I

About IRS 990 - Schedule I 2018 previous version

What is IRS 990 - Schedule I?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

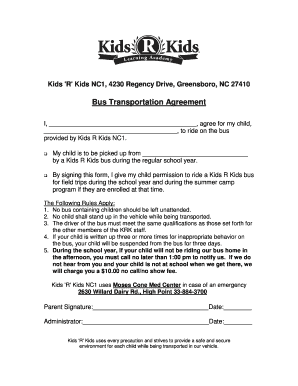

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 990 - Schedule I

What should I do if I realize I've made an error on my 2016 i9 printable after submission?

If you find an error on your 2016 i9 printable after it has been submitted, you should immediately correct the mistake. You can do this by completing a new 2016 i9 printable with the correct information and providing it to your employer. It's crucial to inform them of the error to ensure that your records are accurately updated.

Can I e-file the 2016 i9 printable, and how do I track its status?

The 2016 i9 printable must be submitted in paper format, as electronic filing is not accepted for this form. However, after submission, you can verify receipt and processing by keeping track of any communications from your employer regarding your employment verification process, as they are responsible for maintaining these records.

What are some common mistakes people make when handling the 2016 i9 printable?

Common errors when dealing with the 2016 i9 printable include not signing the document, failing to provide valid identification, or submitting the form after the required timeframe. To avoid these mistakes, always double-check your information and ensure that you are submitting the form promptly following employment.

Are there special considerations for non-resident foreign payees when using the 2016 i9 printable?

Yes, non-resident foreign payees may have specific circumstances when filling out the 2016 i9 printable. If you're acting on behalf of a foreign individual, ensure they understand the identification requirements and how to comply with U.S. laws regarding employment verification, as there may be different criteria for non-residents.

How should I ensure the privacy and security of my data when submitting the 2016 i9 printable?

To maintain the privacy and security of your data when handling the 2016 i9 printable, always submit it securely to your employer, either in person or through secure channels. Ensure your personal identification information is not disclosed to unauthorized parties, and ask your employer about their data retention policies to understand how your data will be protected.