CA BOE-58-AH/OWN-88 2016-2025 free printable template

Show details

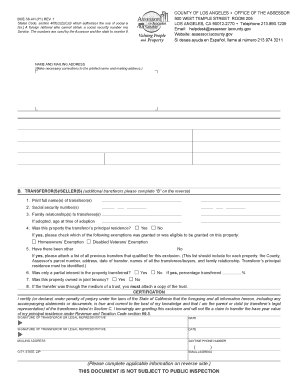

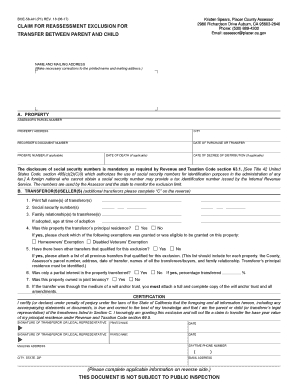

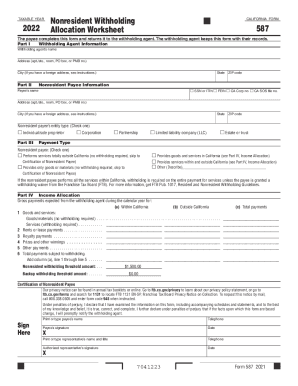

BOE58AH (P1) REV. 17 (0516) OWN88 (REV. 916)CLAIM FOR REASSESSMENT EXCLUSION FOR

TRANSFER BETWEEN PARENT AND CHILDCARE AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign boe 58 ah los angeles form

Edit your california boe 58 ah form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form boe 58 ah los angeles county form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing how to fill out form boe 58 ah online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ca boe 58 ah claim form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA BOE-58-AH/OWN-88 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out california boe 58 ah download form

How to fill out CA BOE-58-AH/OWN-88

01

Obtain the CA BOE-58-AH/OWN-88 form from the California State Board of Equalization website or your local office.

02

Fill out the property owner's name and contact information at the top of the form.

03

Provide the address of the property for which you are filing the application.

04

Indicate the type of property, whether it is residential, commercial, or agricultural.

05

Provide the assessed value of the property as indicated on your property tax statement.

06

State the reason for the application, such as a change in ownership or a request for an exemption.

07

Include any additional information or supporting documentation that may be required.

08

Review the completed form for accuracy and completeness.

09

Sign and date the form to authorize the application.

10

Submit the form to the appropriate county assessor's office by the deadline.

Who needs CA BOE-58-AH/OWN-88?

01

Property owners in California who are applying for a change of ownership or seeking specific property tax exemptions need to fill out the CA BOE-58-AH/OWN-88 form.

Fill

california boe 58 ah

: Try Risk Free

People Also Ask about california boe 58 88 form

What are the exclusion limits under Proposition 58 and 193?

Which transfers of real property are excluded from reassessment by Propositions 58 and 193? Transfers of the first $1 million of real property other than the primary residences. The $1 million exclusion applies separately to each eligible transferor. Transfers may be result of a sale, gift, or inheritance.

What is a transfer exclusion?

The exclusion applies when a joint tenant transfers real property to a living trust in which the other joint tenant is a beneficiary. For example, if A and B Joint Tenants form a revocable trust with each other as beneficiaries, A and B both become Original Transferors.

What is a parent-child exclusion?

Transfers of real property from parents to children (or children to parents) may be excluded from reassessment if a claim is filed and certain requirements are met. This exclusion applies to a principal residence and up to $1,000,000 (taxable value) of additional real estate under Revenue & Taxation Code §63.1.

What is the prop 58 exclusion in California?

California's Proposition 58 which grants the ability to avoid property value reassessment on inherited real estate, went in to effect on November 6, 1986. With certain limitations, California Proposition 58 allows for the exclusion for reassessment of property taxes on transfers between parents and children.

Can a parent gift a house to a child in California?

A transfer of property can occur by purchase or gift; it can also occur through a trust. For example, if a parent's property is put into a trust where upon the death of the parent, the children are the beneficiaries of the trust, a transfer occurs as of the date of death.

What is the parent child transfer exclusion in California?

Specifically, it permits transfers of a family home, or family farm, between parents and their children or grandparents and their grandchildren without causing a change in ownership for property tax purposes. Effectively, the Assessor excludes the otherwise reassessable change in ownership transfer from Assessment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send own 88 form to be eSigned by others?

Once your ca boe 58 ah is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I execute how to fill out online?

pdfFiller has made filling out and eSigning how to fill out easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I sign the how to fill out electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your how to fill out.

What is CA BOE-58-AH/OWN-88?

CA BOE-58-AH/OWN-88 is a form used in California for reporting property ownership information to the Board of Equalization.

Who is required to file CA BOE-58-AH/OWN-88?

Individuals and entities who own taxable real property in California are required to file this form.

How to fill out CA BOE-58-AH/OWN-88?

To fill out CA BOE-58-AH/OWN-88, provide details such as property location, ownership type, and any applicable exemptions or assessments.

What is the purpose of CA BOE-58-AH/OWN-88?

The purpose of CA BOE-58-AH/OWN-88 is to provide the California Board of Equalization with necessary information for property tax assessments.

What information must be reported on CA BOE-58-AH/OWN-88?

The form must report information including the property owner's name, address, property description, and any changes in ownership.

Fill out your how to fill out online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Fill Out is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.