Get the free TRUST U/W WINTHROP ROCKEFELLER

Show details

FormReturn of Private Foundation99,0 Department of the Treasury Internal Revenue Service0701For calendar year 2009, or tax year beginningHInitial return Amended returnAddress change label. Otherwise,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trust uw winthrop rockefeller

Edit your trust uw winthrop rockefeller form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trust uw winthrop rockefeller form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit trust uw winthrop rockefeller online

To use the professional PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit trust uw winthrop rockefeller. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trust uw winthrop rockefeller

How to fill out trust uw winthrop rockefeller

01

To fill out the trust UW Winthrop Rockefeller, follow the steps below:

02

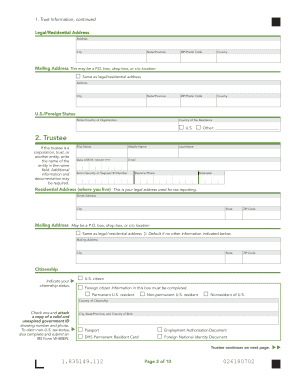

Gather all necessary personal information and documentation, such as your full name, contact details, social security number, and financial records.

03

Review the trust document and understand its purpose and provisions. If you need assistance, consult a legal professional.

04

Complete the trust form by entering the required information accurately and clearly. Pay attention to any specific instructions or additional documents needed.

05

Review the filled-out trust document for any errors or missing information. Make necessary corrections or additions.

06

Sign the trust document according to the specified requirements. This may require a notary public or witness(es) depending on the jurisdiction and trust provisions.

07

Submit the completed trust form along with any supporting documents to the appropriate authority or trustee as specified in the trust document.

08

Keep a copy of the filled-out trust document and supporting documents for your records.

09

Remember, it is highly recommended to seek legal advice or consult an attorney when dealing with trust documents to ensure compliance with applicable laws and achieving your intended goals.

Who needs trust uw winthrop rockefeller?

01

Trust UW Winthrop Rockefeller is typically needed by individuals or families who have significant assets or wealth and wish to establish a trust to manage and distribute their assets in a controlled and tax-efficient manner.

02

Some scenarios where someone might need Trust UW Winthrop Rockefeller include:

03

- High net worth individuals looking to protect and preserve their wealth for future generations.

04

- Individuals looking for estate planning solutions to minimize estate taxes and probate costs.

05

- Those who want to establish a legacy or charitable trust to support specific causes or philanthropic activities.

06

- Families with complex financial situations or blended families wanting to ensure fair and equitable distribution of assets.

07

It is important to consult with a legal professional or financial advisor to determine if Trust UW Winthrop Rockefeller is suitable for your specific circumstances and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete trust uw winthrop rockefeller online?

With pdfFiller, you may easily complete and sign trust uw winthrop rockefeller online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for signing my trust uw winthrop rockefeller in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your trust uw winthrop rockefeller and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit trust uw winthrop rockefeller on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share trust uw winthrop rockefeller from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is trust uw winthrop rockefeller?

Trust uw Winthrop Rockefeller is a type of trust named after Winthrop Rockefeller, an American politician and philanthropist.

Who is required to file trust uw winthrop rockefeller?

Trust uw Winthrop Rockefeller may need to be filed by the trustee or the executor of the trust.

How to fill out trust uw winthrop rockefeller?

To fill out trust uw Winthrop Rockefeller, you will need to gather all necessary financial and personal information related to the trust and complete the required forms.

What is the purpose of trust uw winthrop rockefeller?

The purpose of trust uw Winthrop Rockefeller is to manage and distribute the assets and property held in the trust according to the wishes of the grantor.

What information must be reported on trust uw winthrop rockefeller?

Information such as income, expenses, investments, distributions, and beneficiaries must be reported on trust uw Winthrop Rockefeller.

Fill out your trust uw winthrop rockefeller online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trust Uw Winthrop Rockefeller is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.