IL MFUT-76 2018-2025 free printable template

Show details

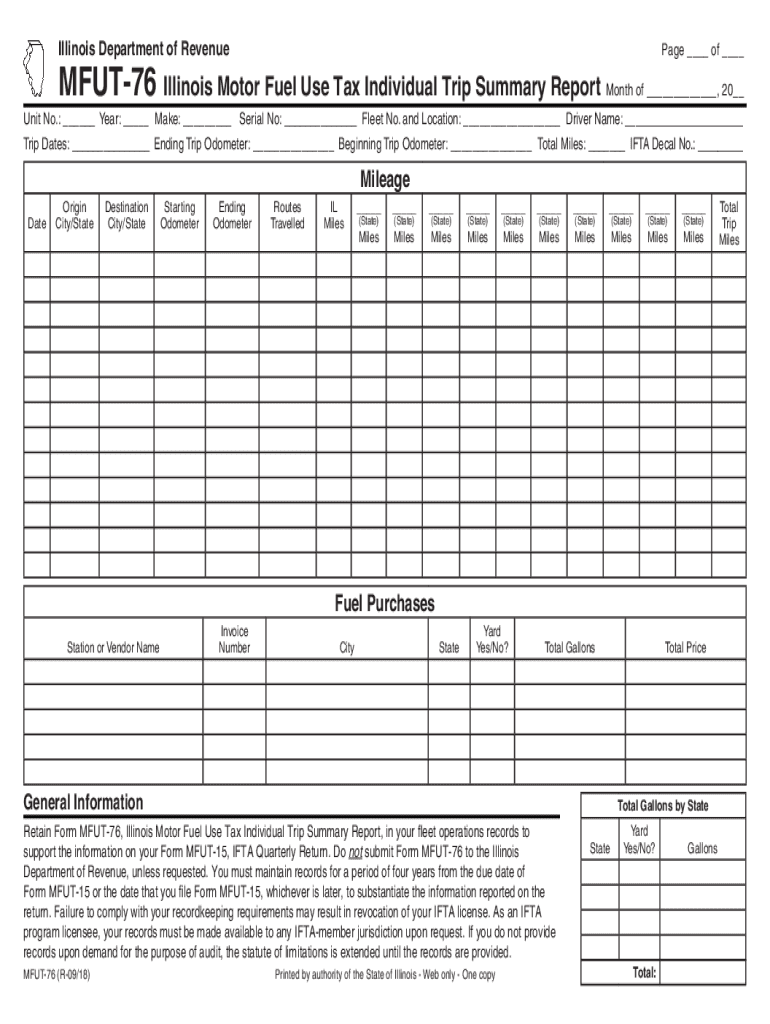

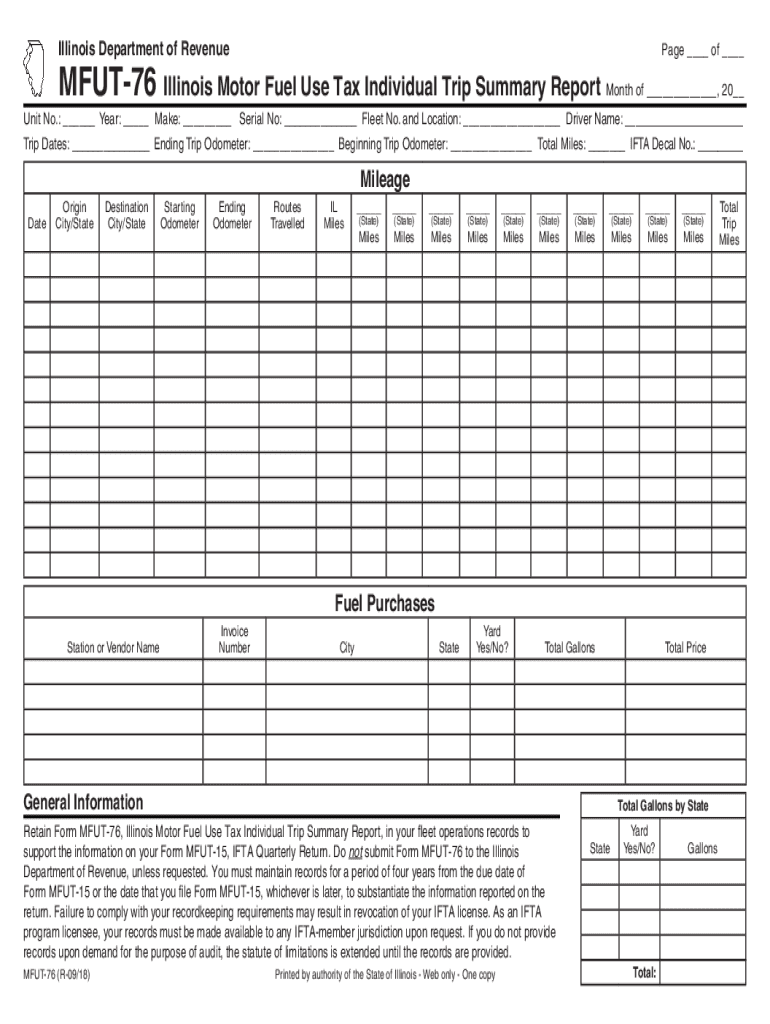

Illinois Department of Revenue Page of MFUT76Illinois Motor Fuel Use Tax Individual Trip Summary Deportment of, 20 Unit No.: Year: Make: Serial No: Fleet No. and Location: Driver Name: Trip Dates:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mfut 76 form

Edit your il mfut76 printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2018 mfut 76 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mfut 76 motor online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mfut 76 fillable form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL MFUT-76 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out illinois individual trip form

How to fill out IL MFUT-76

01

Obtain the IL MFUT-76 form from the official website or local office.

02

Carefully read the instructions provided with the form.

03

Fill in your personal information, including name, address, and contact details, in the designated sections.

04

Provide any required financial information as specified in the form.

05

Attach any necessary documentation that supports your application.

06

Review the completed form for accuracy and ensure all sections are filled out.

07

Sign and date the form where indicated.

08

Submit the form either online, by mail, or in person, as per the instructions.

Who needs IL MFUT-76?

01

Individuals and organizations applying for a specific permit or funding opportunity as indicated by the IL MFUT-76 form.

Fill

mfut 76

: Try Risk Free

People Also Ask about fuel individual trip

What is the motor fuel tax in Illinois 2023?

The Illinois Department of Revenue on May 25 announced the amount of the July 1 hike will be 3.1 cents – the same hike issued at the start of the year – for a grand total in 2023 of 6.2 cents per gallon.

Do local trucks need IFTA?

Yes, federal law requires that commercial truck companies abide by IFTA regulations.

How do I claim my motor fuel tax refund in Illinois?

How do I file a claim for refund? You may file a claim for refund by completing and submitting Form RMFT-11-A. If you already have a Motor Fuel Refund account with the Illinois Department of Revenue, you may also submit your claim electronically using MyTax Illinois.

What is the fuel tax rate in Illinois?

Motor Fuel Use Tax From July 1, 2022, through December 31, 2022, the rates are as follows: gasoline/gasohol – $0.559 per gallon. diesel fuel – $0.627 per gallon. liquefied petroleum gas (LPG) – $0.617 per DGE.

Do I need an IFTA sticker in Illinois?

IFTA licenses are effective from January 1 through December 31 each year. You must renew with us every year (usually beginning in late October) and may begin displaying your decals for the following year beginning December 1st. Current-year decals must be affixed to your vehicles by February 28th.

What is the complete tax breakdown for a regular gallon of gas in Illinois?

From July 1, 2021, through December 31, 2021, the rates are as follows: gasoline/gasohol – $0.506 per gallon. diesel fuel – $0.586 per gallon.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit il fuel trip in Chrome?

mfut76 use online can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for the mfut76 motor in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your illinois mfut76 summary in seconds.

Can I create an eSignature for the mfut76 trip in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your illinois tax trip and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is IL MFUT-76?

IL MFUT-76 is a tax form used in Illinois for the reporting of certain financial transactions and tax calculations.

Who is required to file IL MFUT-76?

Individuals or entities that are engaged in specific financial activities subject to regulation in Illinois are required to file IL MFUT-76.

How to fill out IL MFUT-76?

To fill out IL MFUT-76, you must provide accurate financial data as instructed on the form, including personal identification details and any relevant transaction information.

What is the purpose of IL MFUT-76?

The purpose of IL MFUT-76 is to ensure proper reporting of financial activities and compliance with Illinois tax regulations.

What information must be reported on IL MFUT-76?

IL MFUT-76 requires reporting of personal identification, transaction details, financial calculations, and any other information as specified on the form.

Fill out your mfut 76 printable 2018-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Illinois Fuel Summary is not the form you're looking for?Search for another form here.

Keywords relevant to mfut76 use fillable

Related to mfut76 fuel form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.