Get the free Rental Income and Expense Worksheet - Mecklai Tax & Accounting ...

Show details

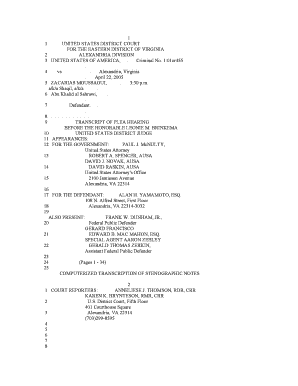

4609 Kings way Bur Navy BC V5H 4L3 Phone/Fax : (604) 433 7050 We BSI the: hit p: // WWW. Metal AI CPA. Chartered Professional AccountantRENTAL INCOME AND EXPENSE WORKSHEET Name: % Ownership: Owners

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rental income and expense

Edit your rental income and expense form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rental income and expense form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rental income and expense online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rental income and expense. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rental income and expense

How to fill out rental income and expense

01

To fill out rental income and expense, follow these steps:

02

Start by gathering the necessary information such as the rental property address, rental income received, and expenses incurred for the property.

03

Calculate the total rental income received during the reporting period. This includes rent payments from tenants, any additional income such as parking fees or laundry income.

04

List all the expenses related to the rental property. This can include mortgage payments, property taxes, insurance premiums, repairs and maintenance costs, property management fees, advertising expenses, and any other expenses directly related to the property.

05

Ensure that you have proper documentation to support each expense listed. This can include receipts, invoices, and any other relevant proof of payment or expense.

06

Calculate the net income or loss from the rental property by subtracting the total expenses from the total rental income.

07

Report the rental income and expenses on the appropriate tax forms, such as Schedule E of the U.S. Individual Income Tax Return (Form 1040). Provide accurate and complete information to avoid any potential issues with the tax authorities.

08

Keep a record of all rental income and expense documents for future reference and potential audits. It's important to maintain accurate and organized records to ensure compliance with tax regulations.

Who needs rental income and expense?

01

Anyone who owns rental property and receives rental income needs to track and report rental income and expense. This can include individual property owners, real estate investors, landlords, property management companies, and anyone else involved in the rental property business.

02

Rental income and expense information is crucial for filing accurate tax returns and reporting the financial performance of rental properties. It helps property owners determine their profitability, assess rental property investments, and comply with tax laws and regulations.

03

Additionally, banks and lending institutions may require rental income and expense information when assessing loan applications or evaluating the financial health of rental property owners.

04

In summary, rental income and expense tracking is essential for individuals and businesses involved in rental property ownership and management to ensure financial transparency, compliance, and informed decision-making.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send rental income and expense to be eSigned by others?

Once your rental income and expense is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete rental income and expense online?

pdfFiller has made it simple to fill out and eSign rental income and expense. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I edit rental income and expense on an iOS device?

Create, modify, and share rental income and expense using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is rental income and expense?

Rental income refers to the amount of money earned from renting out a property, while rental expenses are the costs incurred in managing and maintaining the rental property.

Who is required to file rental income and expense?

Individuals who earn rental income from property are required to file rental income and expenses with the tax authorities.

How to fill out rental income and expense?

Rental income and expenses can be filled out on the appropriate tax forms provided by the tax authorities, detailing the income earned and expenses incurred.

What is the purpose of rental income and expense?

The purpose of reporting rental income and expenses is to calculate the taxable income and determine the tax liability of the individual or entity earning rental income.

What information must be reported on rental income and expense?

Information such as rental income received, expenses incurred for maintenance, repairs, and management of the property, as well as any depreciation expenses must be reported on rental income and expenses.

Fill out your rental income and expense online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rental Income And Expense is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.