AT ZS-QU1 2007-2025 free printable template

Show details

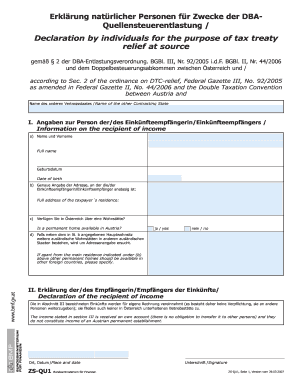

Dieses Dokument dient der Erklärung von natürlichen Personen zur Beantragung von Steuererleichterungen gemäß dem Doppelbesteuerungsabkommen zwischen Österreich und einem anderen Vertragsstaat.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign zs qu 1 form

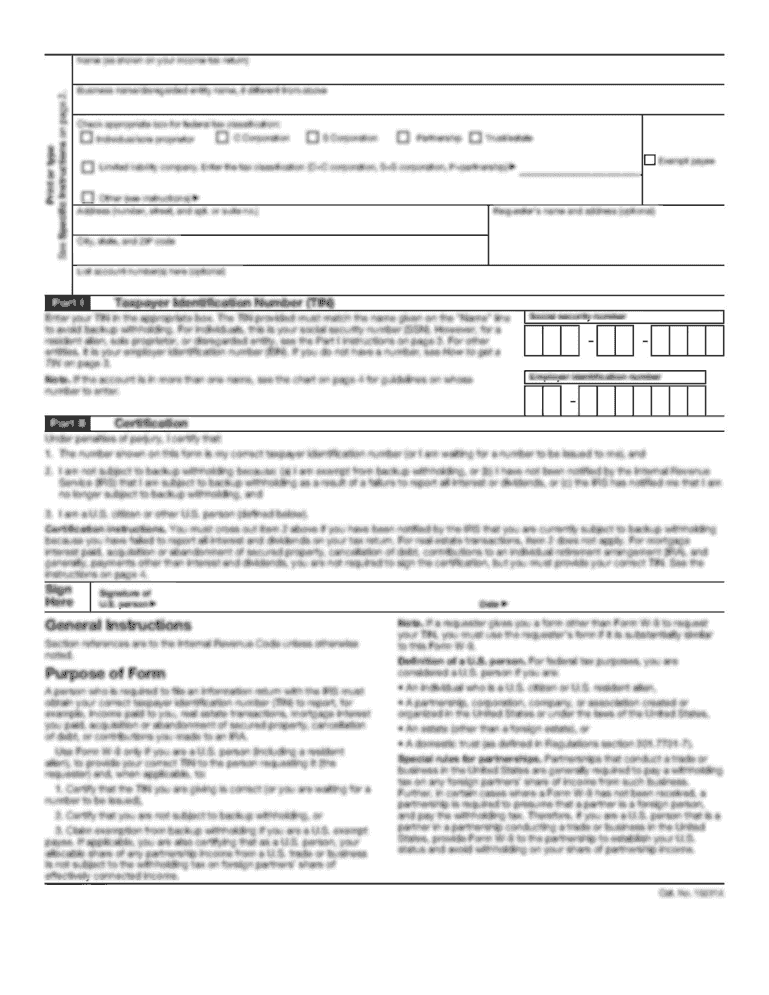

Edit your formular zs qu1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your zs qu1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing zs qu1 formular online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit zs qu1 formular. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out zs qu1 formular

How to fill out AT ZS-QU1

01

Begin by collecting all required personal information such as name, address, and contact details.

02

Review the instructions on the AT ZS-QU1 form carefully to understand each section.

03

Fill out the personal information section with accurate data.

04

Move on to the specific questions or fields required on the form, providing honest and complete answers.

05

Attach any necessary supporting documents that are required with your submission.

06

Review the entire form for completeness and accuracy before signing.

07

Submit the AT ZS-QU1 form to the appropriate office or online portal.

Who needs AT ZS-QU1?

01

Individuals who are applying for specific government services requiring this form.

02

Organizations that need to provide information as part of their compliance requirements.

03

Anyone who has been specifically instructed to fill out the AT ZS-QU1 form by a government official.

Fill

form

: Try Risk Free

People Also Ask about

Does a US citizen living in Australia pay US taxes?

Yes, U.S. expats in Australia file taxes—both American and Australian. For starters, Americans and U.S. green card holders living in Australia should continue to file a U.S. tax return each year. However, filing taxes while overseas comes with new considerations and questions.

Does US have a tax treaty with Austria?

CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE REPUBLIC OF AUSTRIA FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON INCOME, SIGNED AT VIENNA ON MAY 31, 1996.

Does Austria tax foreign income?

All individuals resident in Austria are subject to Austrian income tax on their worldwide income, including income from trade or business, profession, employment, investments, and property. Non-residents are taxed on income from certain sources in Austria only.

What countries have no tax treaty with the US?

For example, depending on the local country laws, taxpayers could be considered to be doing business if they are merely soliciting sales. Some notable examples of countries for which the U.S. does not currently have an income tax treaty include Brazil, Argentina, Chile, Vietnam and Singapore.

What is withholding tax on capital gains?

Short-term capital gains on transfer of shares of a company or units of an equity-oriented fund would be taxable at 15% if they have been subjected to STT. There is no threshold for payment to non-resident companies up to which no tax is required to be withheld.

What is the Austrian withholding tax on dividends?

Dividend income Domestic earnings from dividends are definitively taxed for income tax purposes with the 27.5% WHT deduction by the corporation distributing the dividend. Foreign dividend earnings paid to a domestic deposit account are also subject to final taxation through the 27.5% WHT deduction.

What countries does the US have a tax treaty with?

The United States has tax treaties with a number of foreign countries.Tax treaties. ArmeniaIcelandPhilippinesdeshIsraelRussiaBarbadosItalySlovak RepublicBelarusJamaicaSloveniaBelgiumJapanSouth Africa17 more rows • Jan 20, 2023

How much is Austrian withholding tax?

Dividend WHT Under Austrian domestic law, there is generally a 25% WHT for corporations and 27.5% WHT for other recipients on dividends (profit distributions) paid to a foreign parent company. The WHT has to be deducted and forwarded by the Austrian subsidiary to the tax office.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my zs qu1 formular in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your zs qu1 formular and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send zs qu1 formular to be eSigned by others?

Once your zs qu1 formular is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an eSignature for the zs qu1 formular in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your zs qu1 formular right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is AT ZS-QU1?

AT ZS-QU1 is a form used to report specific tax-related information required by regulatory authorities.

Who is required to file AT ZS-QU1?

Entities or individuals who meet certain criteria set by tax regulations are required to file AT ZS-QU1.

How to fill out AT ZS-QU1?

AT ZS-QU1 should be filled out by providing accurate information as outlined in the guidelines, including personal details, financial information, and relevant attachments.

What is the purpose of AT ZS-QU1?

The purpose of AT ZS-QU1 is to ensure compliance with tax laws by collecting necessary information for assessment and verification.

What information must be reported on AT ZS-QU1?

The information required includes identification details, income figures, deductions, credits, and any other relevant financial data.

Fill out your zs qu1 formular online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Zs qu1 Formular is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.