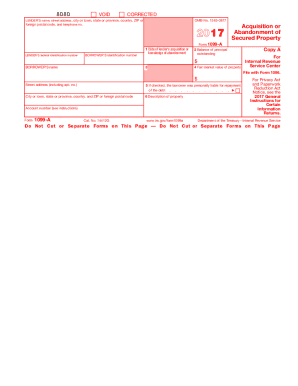

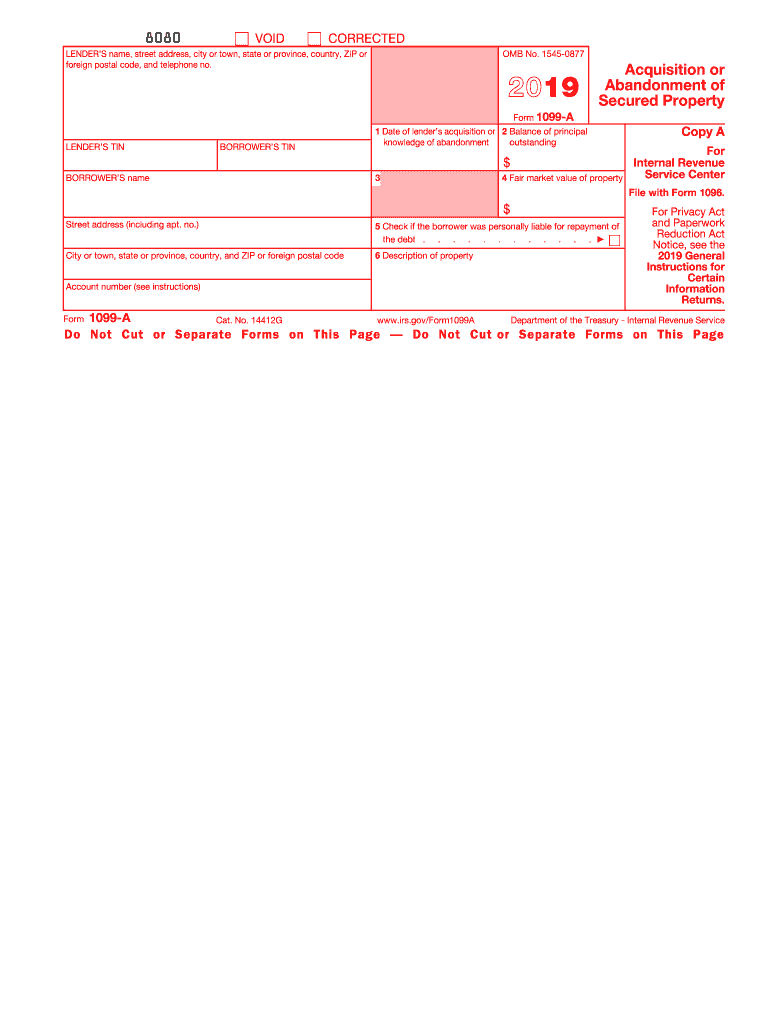

IRS 1099-A 2019 free printable template

Instructions and Help about IRS 1099-A

How to edit IRS 1099-A

How to fill out IRS 1099-A

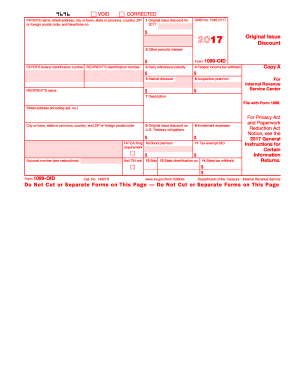

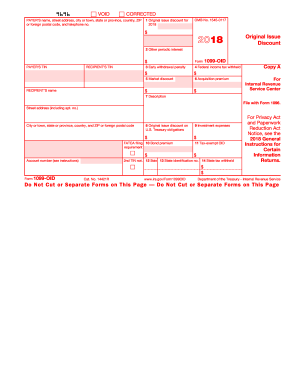

About IRS 1099-A 2019 previous version

What is IRS 1099-A?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

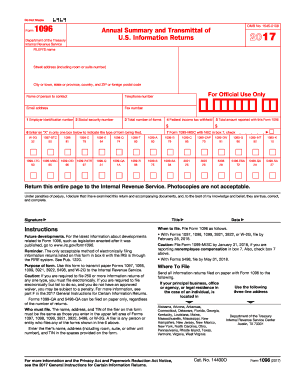

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-A

What should I do if I made a mistake on my IRS 1099-A?

If you discover an error on your IRS 1099-A after filing, you should file a corrected form. This involves submitting the updated information to the IRS along with any applicable explanations. Ensure that you keep the original submission record to track any changes and stay compliant.

How can I verify that my IRS 1099-A has been received and processed?

To verify the status of your IRS 1099-A, you can utilize the IRS's online tools or contact their support. Keep in mind that processing times may vary, and be prepared with your submission details for reference when inquiring.

What should I understand about the privacy and data security related to IRS 1099-A?

When dealing with your IRS 1099-A, it is crucial to ensure that you maintain data security by protecting personal and sensitive information. Consider using encrypted methods for e-filing and store any physical records in a secure location to prevent unauthorized access.

What happens if I receive a notice from the IRS regarding my 1099-A?

If you receive a notice or letter from the IRS about your IRS 1099-A, review the correspondence carefully for details on the issue. Prepare supporting documentation, and respond promptly to resolve any discrepancies or inquiries raised by the IRS.

How can I avoid common errors when filing my IRS 1099-A?

To avoid common mistakes when filing your IRS 1099-A, double-check the recipient's information and ensure the data aligns with IRS expectations. Familiarize yourself with common rejection codes if e-filing, and confirm that your filing methods comply with IRS guidelines to minimize errors.

See what our users say