IRS 8867 2018 free printable template

Show details

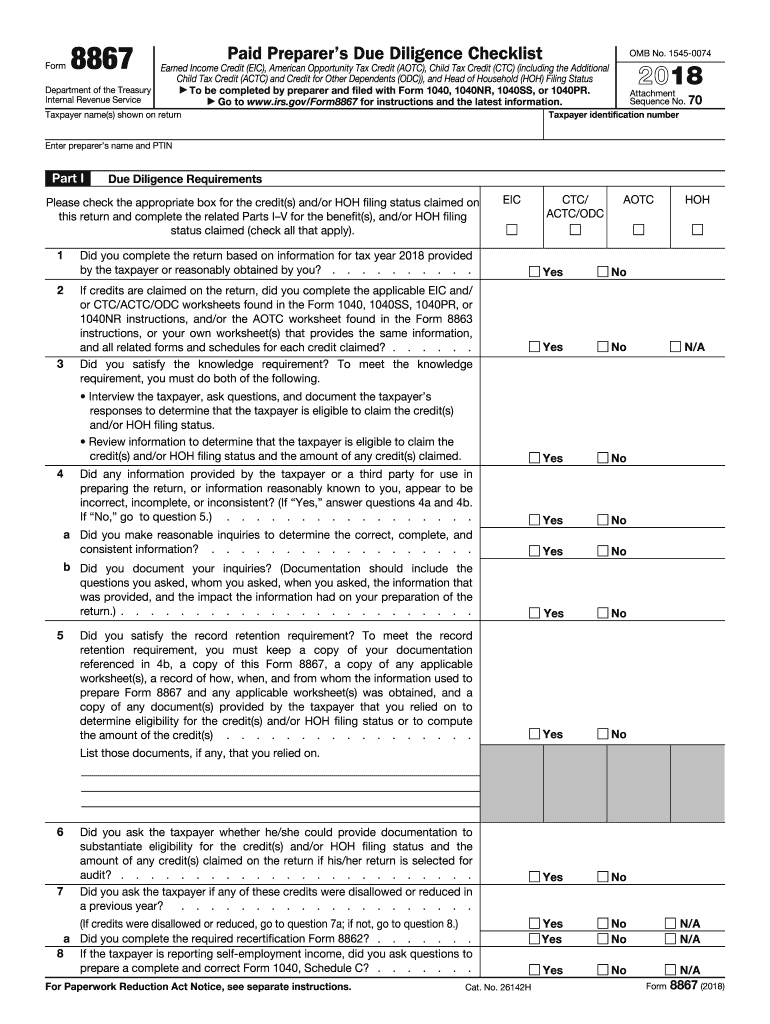

Submit Form 8867 in the manner required and D. Keep all five of the following records for 3 years from the latest of the dates specified in the Form 8867 instructions under Document Retention. 1. A copy of Form 8867 2. The applicable worksheet s or your own worksheet s for any credit s claimed 3. 15 Do you certify that all of the answers on this Form 8867 are to the best of your knowledge true correct and complete. Complete this Form 8867 truthfully and accurately and complete the actions...described in this checklist for any applicable credit s claimed and HOH filing status if claimed C. Submit Form 8867 in the manner required and D. Keep all five of the following records for 3 years from the latest of the dates specified in the Form 8867 instructions under Document Retention. 1. Retention requirement you must keep a copy of your documentation referenced in 4b a copy of this Form 8867 a copy of any applicable worksheet s a record of how when and from whom the information used to...prepare Form 8867 and any applicable worksheet s was obtained and a copy of any document s provided by the taxpayer that you relied on to determine eligibility for the credit s and/or HOH filing status or to compute the amount of the credit s. A copy of Form 8867 2. The applicable worksheet s or your own worksheet s for any credit s claimed 3. Copies of any documents provided by the taxpayer on which you relied to determine eligibility for the credit s and/or HOH filing status 4. For Paperwork...Reduction Act Notice see separate instructions. Cat. No. 26142H 8867 2018 Page 2 Form 8867 2018 9a Have you determined that this taxpayer is in fact eligible to claim the EIC for the number of children for whom the EIC is claimed or to claim the EIC if the taxpayer has no qualifying child Skip 9b and 9c if the taxpayer is claiming the EIC and does not have a qualifying child. Eligibility Certification You will have complied with all due diligence requirements for claiming the applicable credit...s and/or HOH filing status on the return of the taxpayer identified above if you adequate information to determine if the taxpayer is eligible to claim the credit s and/or HOH filing status and to determine B. Complete this Form 8867 truthfully and accurately and complete the actions described in this checklist for any applicable credit s claimed and HOH filing status if claimed C. Form Paid Preparer s Due Diligence Checklist OMB No. 1545-0074 Earned Income Credit EIC American Opportunity Tax...Credit AOTC Child Tax Credit CTC including the Additional Child Tax Credit ACTC and Credit for Other Dependents ODC and Head of Household HOH Filing Status To be completed by preparer and filed with Form 1040 1040NR 1040SS or 1040PR. Department of the Treasury Internal Revenue Service Go to www.irs.gov/Form8867 for instructions and the latest information. Attachment Sequence No. 70 Taxpayer identification number Taxpayer name s shown on return Enter preparer s name and PTIN Part I Due...Diligence Requirements Please check the appropriate box for the credit s and/or HOH filing status claimed on this return and complete the related Parts I V for the benefit s and/or HOH filing status claimed check all that apply. Did you complete the return based on information for tax year 2018 provided by the taxpayer or reasonably obtained by you. If credits are claimed on the return did you complete the applicable EIC and/ or CTC/ACTC/ODC worksheets found in the Form 1040 1040SS 1040PR or...1040NR instructions and/or the AOTC worksheet found in the Form 8863 instructions or your own worksheet s that provides the same information and all related forms and schedules for each credit claimed.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 8867

How to edit IRS 8867

How to fill out IRS 8867

Instructions and Help about IRS 8867

How to edit IRS 8867

To edit IRS 8867, you can use tools like pdfFiller which allow for easy modifications. Simply upload your initial version of the form, make your changes in the editable fields, and save the updated document. Ensure that you double-check any amendments made for accuracy before resubmission.

How to fill out IRS 8867

Filling out IRS 8867 involves several steps to ensure that you provide accurate information. Begin by entering identifying information such as your name and Social Security number. Next, complete sections detailing eligibility for refundable tax credits and provide answers to questions about your qualifications. Review all entries for clarity and correctness before filing.

About IRS 8 previous version

What is IRS 8867?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 8 previous version

What is IRS 8867?

IRS 8867, known as the Paid Preparer’s Due Diligence Checklist, is a form required for tax preparers who claim certain tax credits on behalf of their clients. This form ensures that the preparer has done the necessary due diligence to verify the taxpayer's eligibility for those credits. It is typically used in conjunction with claims for the Earned Income Tax Credit, Child Tax Credit, and American Opportunity Tax Credit.

What is the purpose of this form?

The purpose of IRS 8867 is to establish a framework for tax preparers to confirm they have taken the appropriate steps to determine their client's eligibility for specific tax benefits. By documenting due diligence efforts, tax preparers can minimize the risk of penalties and audits from the IRS arising from incorrect claims. The form serves as evidence that due diligence was exercised.

Who needs the form?

Any tax preparer who is compensated for preparing a tax return and claims certain tax credits such as the Earned Income Tax Credit or the Child Tax Credit must fill out IRS 8867. It is essential for maintaining compliance with IRS regulations while also protecting the taxpayer from potential issues arising from improper claims. This form is necessary to ensure that the tax preparer has fulfilled all due diligence requirements.

When am I exempt from filling out this form?

Tax preparers are exempt from filling out IRS 8867 in specific situations. If the tax return does not claim any of the refundable credits requiring this form, it is not necessary. Additionally, if the return does not require a paid preparer—for instance, if it is self-prepared or done through a volunteer program—then IRS 8867 is not applicable.

Components of the form

The IRS 8867 consists of multiple sections that require detailed information. Key components include taxpayer identification details, the credit claimed, due diligence questions, and a declaration of compliance by the preparer. Each section is designed to gather specific information necessary to support the claims for the tax credits in question.

What are the penalties for not issuing the form?

Failing to issue IRS 8867 when required can result in significant penalties for tax preparers. The IRS may impose fines for each failure to meet due diligence requirements, which can accumulate quickly. Additionally, preparers may face enhanced scrutiny or penalties for clients' returns that incorrectly claim credits without proper documentation.

What information do you need when you file the form?

When filing IRS 8867, preparers need to have several pieces of information on hand. This includes the taxpayer’s personal identification details, documentation supporting eligibility for the claimed credits, and answers to due diligence questions posed on the form. Ensuring all needed information is collected can lead to smoother filings and compliance with IRS regulations.

Is the form accompanied by other forms?

IRS 8867 is often submitted alongside other forms that pertain to the tax credits being claimed, such as Form 1040 or Form 8862, which is used to claim the Earned Income Tax Credit after disqualification. It is essential to check which specific forms need to accompany IRS 8867 based on the credits claimed to maintain compliance.

Where do I send the form?

IRS 8867 is submitted along with the corresponding tax return, typically sent to the address specified in the Form 1040 instructions. If filing electronically, IRS 8867 and other related forms are incorporated into the electronic submission process. It’s important to follow the latest directions provided by the IRS for accurate filing locations.

See what our users say