Get the free Understanding Credit Card APRs & Interest Rates ...

Show details

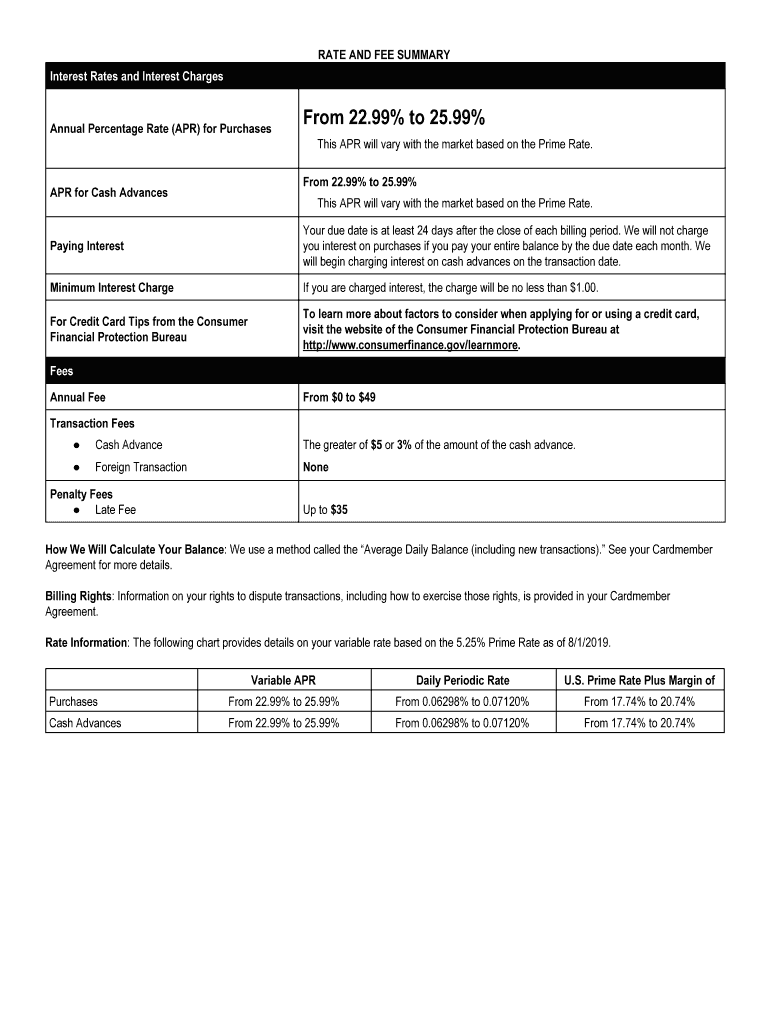

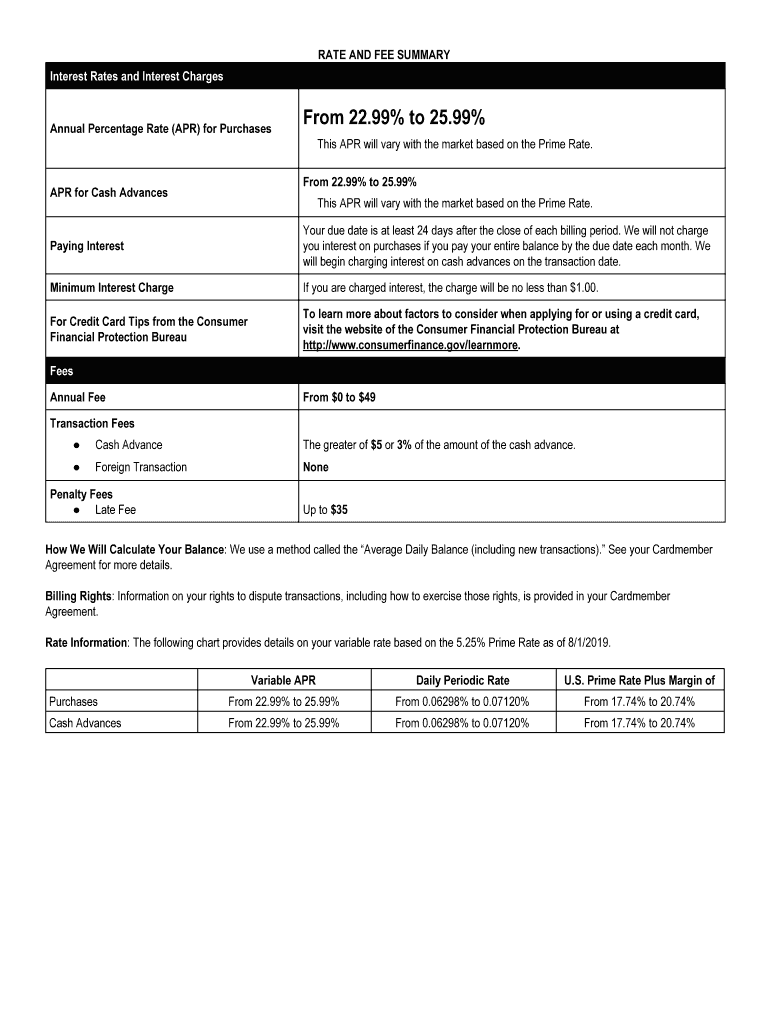

RATE AND FEE SUMMARY

Interest Rates and Interest ChargesAnnual Percentage Rate (APR) for PurchasesFrom 22.99% to 25.99%

This APR will vary with the market based on the Prime Rate.

From 22.99% to 25.99×APR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign understanding credit card aprs

Edit your understanding credit card aprs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding credit card aprs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit understanding credit card aprs online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit understanding credit card aprs. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out understanding credit card aprs

How to fill out understanding credit card aprs

01

To fill out understanding credit card APRs, follow these steps:

02

Start by gathering all your credit card statements.

03

Look for the section of your statement that provides information on APRs.

04

Identify the different APRs listed, such as the purchase APR, balance transfer APR, and cash advance APR.

05

Understand the difference between fixed APRs and variable APRs.

06

Take note of any promotional or introductory APRs and their expiration dates.

07

Determine if there are any penalty APRs that apply if you make late payments or exceed your credit limit.

08

Calculate the average daily balance method used by your credit card issuer to determine the interest charges.

09

Familiarize yourself with the grace period and how it affects the accrual of interest.

10

Consider seeking professional advice or consulting a financial resource to ensure you fully understand the credit card APRs.

11

Keep track of any changes in APRs that may occur in the future due to factors like the Federal Reserve's interest rate adjustments or changes in your creditworthiness.

12

Remember, understanding credit card APRs is crucial to managing your credit card debt effectively and avoiding unnecessary interest charges.

Who needs understanding credit card aprs?

01

Anyone who owns and uses a credit card needs to understand credit card APRs.

02

It is especially important for individuals who carry a balance on their credit cards and make regular use of credit.

03

Understanding credit card APRs allows cardholders to make informed decisions about their borrowing and repayment strategies.

04

It helps people avoid high interest charges, take advantage of promotional offers, and choose credit cards with favorable APR terms.

05

By understanding credit card APRs, consumers can better manage their credit card debt and avoid falling into a debt trap.

06

Therefore, everyone who owns a credit card should invest time in learning and understanding credit card APRs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send understanding credit card aprs for eSignature?

Once your understanding credit card aprs is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I execute understanding credit card aprs online?

pdfFiller has made filling out and eSigning understanding credit card aprs easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an eSignature for the understanding credit card aprs in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your understanding credit card aprs and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is understanding credit card aprs?

Understanding credit card APRs refers to comprehending the annual percentage rate charged by credit card companies on outstanding balances.

Who is required to file understanding credit card aprs?

Consumers who hold credit cards are required to understand credit card APRs in order to make informed financial decisions.

How to fill out understanding credit card aprs?

To fill out understanding credit card APRs, consumers need to review their credit card agreements and statements to find information on the APRs.

What is the purpose of understanding credit card aprs?

The purpose of understanding credit card APRs is to help consumers make informed decisions about managing their credit card debt and payments.

What information must be reported on understanding credit card aprs?

Information such as the APR on purchases, balance transfers, and cash advances, as well as any promotional APRs or variable APRs, must be reported on understanding credit card APRs.

Fill out your understanding credit card aprs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Understanding Credit Card Aprs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.