Get the free Eaton Vance Mutual Funds New Account Application

Show details

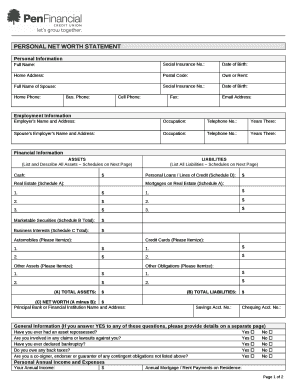

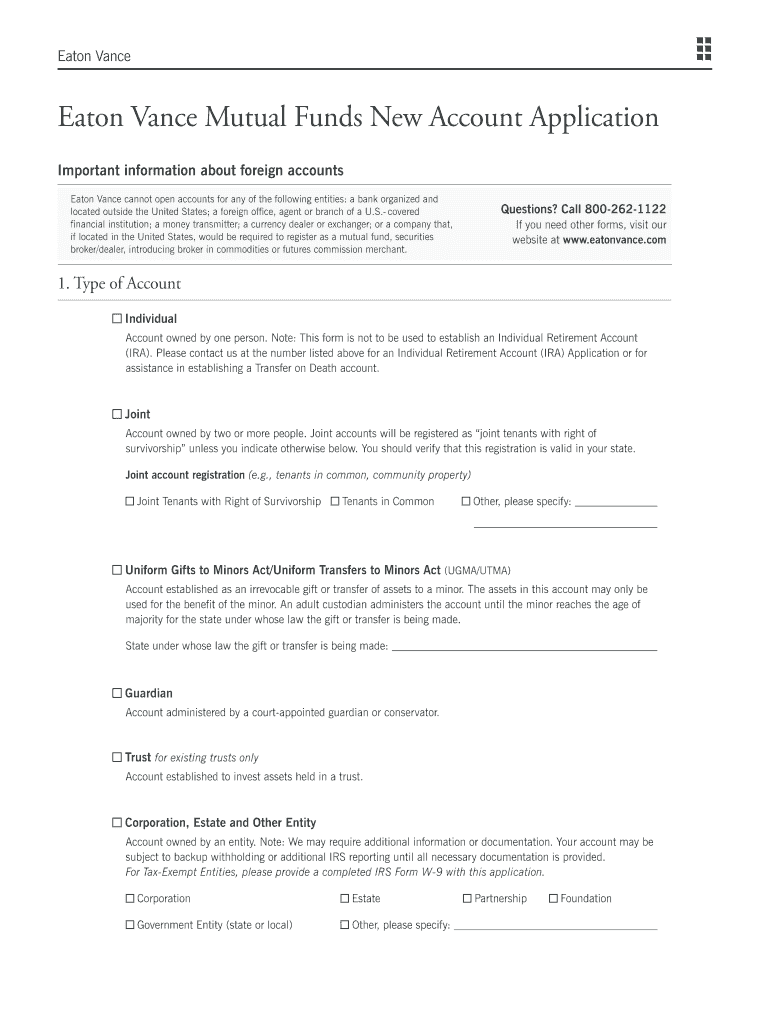

Eaton Vance Mutual Funds New Account Application Important information about foreign accounts Eaton Vance cannot open accounts for any of the following entities: a bank organized and located outside

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign eaton vance mutual funds

Edit your eaton vance mutual funds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your eaton vance mutual funds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing eaton vance mutual funds online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit eaton vance mutual funds. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out eaton vance mutual funds

How to fill out Eaton Vance mutual funds:

01

Gather necessary documents: Before filling out Eaton Vance mutual funds, you will need to have certain documents in hand. These may include your identification proof, social security number, bank details, and any additional information required by the fund.

02

Research available funds: Eaton Vance offers a variety of mutual funds catering to different investment goals and risk levels. Take the time to research and understand the various funds they offer to determine which one aligns with your investment objectives.

03

Contact a financial advisor: If you are unsure about which Eaton Vance mutual fund to invest in, it is recommended to consult a financial advisor. They can evaluate your financial situation, risk tolerance, and investment goals to help you make an informed decision.

04

Open an account: To fill out Eaton Vance mutual funds, you will need to open an account with them. Visit their website or reach out to their customer service to initiate the account opening process.

05

Fill out the application form: Once you have opened an account, you will need to fill out the mutual fund application form. Provide accurate and up-to-date information as requested on the form.

06

Choose investment amount: Select the amount you want to invest in the mutual fund. This can typically be a lump sum or regular contributions through automatic investment plans, depending on the fund's requirements.

07

Determine investment method: Eaton Vance offers various investment methods, including direct investments, investments through financial intermediaries, or employer-sponsored retirement plans. Choose the investment method that suits your needs.

08

Review and submit: Carefully review the filled out application form for any errors or missing information. Submit the completed application along with any required supporting documents to Eaton Vance as instructed on the form.

Who needs Eaton Vance mutual funds?

01

Investors aiming for diversification: Eaton Vance mutual funds provide access to a diversified portfolio, which can be appealing to investors looking to spread their investment risk across different asset classes and sectors.

02

Individuals seeking professional management: Some investors may prefer to have their investments managed by professionals who have expertise in analyzing and selecting securities. Eaton Vance mutual funds are managed by a team of experienced investment managers.

03

Investors with specific investment goals: Eaton Vance offers a wide range of mutual funds, each with its own investment objective. As such, investors with specific goals, such as long-term growth, income generation, or capital preservation, can find suitable funds to align with their objectives.

04

Those looking for convenience and accessibility: Mutual funds generally offer ease of access and convenience, allowing investors to buy and sell fund shares at the net asset value. Eaton Vance provides online access and various account options to make investing more convenient for individuals.

05

Individuals interested in professional advice: Eaton Vance mutual funds can be beneficial for individuals seeking personalized investment advice. Their network of financial advisors can help guide investors based on their unique circumstances, financial goals, and risk tolerance.

Fill

form

: Try Risk Free

People Also Ask about

How to open mutual fund account without broker?

You could invest in a Direct Plan online through the websites of the respective mutual funds or via online platforms of stock exchanges platform or Mutual Funds Utility (MFU) or other various digital channel. There are also a few online portals which offer a facility to invest in Direct Plans.

Can I buy mutual funds without a financial advisor?

Once upon a time, back in the analog age, investors could only buy and sell mutual funds through financial professionals: brokers, money managers, and financial planners. But online investment platforms have made traders of us all, and today, anyone with a computer, a tablet, or even a smartphone can buy mutual funds.

Can I invest in a mutual fund on my own?

If you don't have access to an employer-sponsored retirement account or are investing for a goal outside of retirement, you can invest in mutual funds by opening a brokerage account on your own and investing in the following plans: Individual retirement accounts (IRAs).

How much money is needed to open a mutual fund account?

Mutual funds often have a required minimum from $500 to $3,000, but several brokers offer funds with lower minimums, or no minimum at all.

How to open mutual account online?

How To Open A Mutual Fund Account Online? Fill in your details on our Registration page. Enter the OTP you receive on registered mobile number and email ID. Enter your PAN details to check KYC compliance. Check the auto-populated FATCA and Compliance Questionnaire fields and click Proceed.

How much money do you need to start a mutual fund?

Mutual funds require minimum investments of anywhere from $1,000 to $5,000, unlike stocks and ETFs where the minimum investment is one share. Mutual funds trade only once a day after the markets close. Stocks and ETFs can be traded at any point during the trading day.

How do I open a mutual fund account directly?

How to invest in a Mutual Fund. One can invest in mutual funds by submitting a duly completed application form alongwith a cheque or bank draft at the branch office or designated Investor Service Centres (ISC) of mutual Funds or Registrar & Transfer Agents of the respective the mutual funds.

Do you need a bank account to open a mutual fund?

To start investing in a fund scheme you need a PAN, bank account and be KYC (know your client) compliant. The bank account should be in the name of the investor with the Magnetic Ink Character Recognition (MICR) and Indian Financial System Code (IFSC) details.

How to open a mutual fund account online?

How To Open A Mutual Fund Account Online? Fill in your details on our Registration page. Enter the OTP you receive on registered mobile number and email ID. Enter your PAN details to check KYC compliance. Check the auto-populated FATCA and Compliance Questionnaire fields and click Proceed.

How do I start a mutual fund for beginners?

Beginners Guide to Mutual Funds Start with any amount (as low as 500) Diversify across multiple stocks and other instruments like debt, gold, etc. Start automated monthly investments (SIP) Invest without requiring to open a DEMAT account.

How do I avoid brokerage in mutual funds?

You can invest in various mutual fund schemes without payment or brokerage by buying the mutual fund's direct plan. Direct plans can be bought by approaching the branch office of the mutual fund and filling in an application form by yourself.

How do I apply for a new mutual fund?

One can invest in mutual funds by submitting a duly completed application form alongwith a cheque or bank draft at the branch office or designated Investor Service Centres (ISC) of mutual Funds or Registrar & Transfer Agents of the respective the mutual funds.

How can I open a mutual account?

How to open your account Decide which mutual funds to buy. Explore different types of mutual funds. Choose an account type based on your savings goal. Decide which type of account you need. Open your account online in about 10 minutes. Get started with as little as $1,000.*

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is eaton vance mutual funds?

Eaton Vance mutual funds are investment funds managed by Eaton Vance that pool money from multiple investors to invest in securities such as stocks, bonds, and other assets.

Who is required to file eaton vance mutual funds?

Investment companies like Eaton Vance are required to file their mutual funds with the Securities and Exchange Commission (SEC) and provide periodic reports to shareholders.

How to fill out eaton vance mutual funds?

To fill out Eaton Vance mutual funds, investors need to review the fund's prospectus, choose the fund that meets their investment objectives, and complete the necessary paperwork to invest in the fund.

What is the purpose of eaton vance mutual funds?

The purpose of Eaton Vance mutual funds is to provide investors with an opportunity to diversify their investments and gain exposure to a variety of asset classes and investment strategies.

What information must be reported on eaton vance mutual funds?

Eaton Vance mutual funds must report information such as performance data, portfolio holdings, expenses, and other relevant information to shareholders and regulatory authorities.

Can I create an electronic signature for signing my eaton vance mutual funds in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your eaton vance mutual funds right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete eaton vance mutual funds on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your eaton vance mutual funds by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Can I edit eaton vance mutual funds on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute eaton vance mutual funds from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your eaton vance mutual funds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Eaton Vance Mutual Funds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.