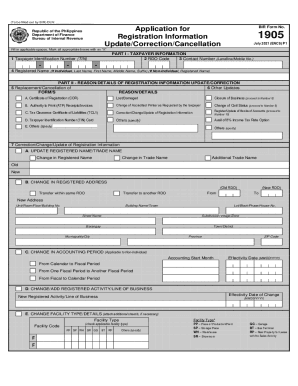

What is BIR Form 1905?

BIR Form 1905 is known as the Application for Registration Information Update. This form must be used by employees who need to transfer their information from one Revenue District Office to another. That is why it is important to complete the form properly and do not miss any required information.

What is BIR Form 1905 for?

You must use this form to give information to a new Revenue District Office or if you need to update their previous data.

When is BIR Form 1905 Due?

This form does not have a certain due date. You must file it either at request or when you have changed something in your revenue information.

Is BIR Form 1905 Accompanied by Other Documents?

Yes, you must attach some following documents if needed:

-

Old certificate of registration;

-

Original receipts and invoices;

-

New application Form 1906;

-

Proof of payment of certification fee;

-

Old TIN card;

-

Letter request for cessation of registration, etc.

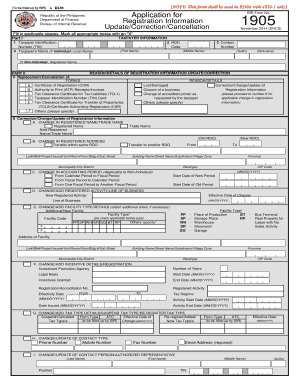

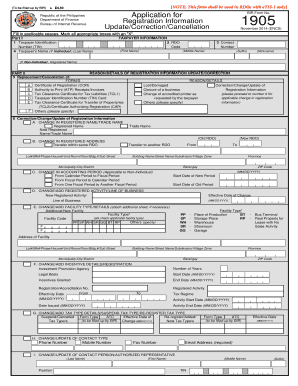

Other attachments are indicated right on the back of the form, so you may check them all and choose the ones that fit your case.

What Information do I Include in BIR Form 1905?

In this form you must indicate the taxpayer identification number, name, DO number, reasons for registration information update and the details of registration information update. The form includes the declaration where you must prove the validity of all indicated information.

Where do I Send BIR Form 1905?

You must forward this completed form to the Revenue District Office for processing.