Get the free CONSOLIDATE YOUR SAVINGS Roll Over to the Fund - yretirement

Show details

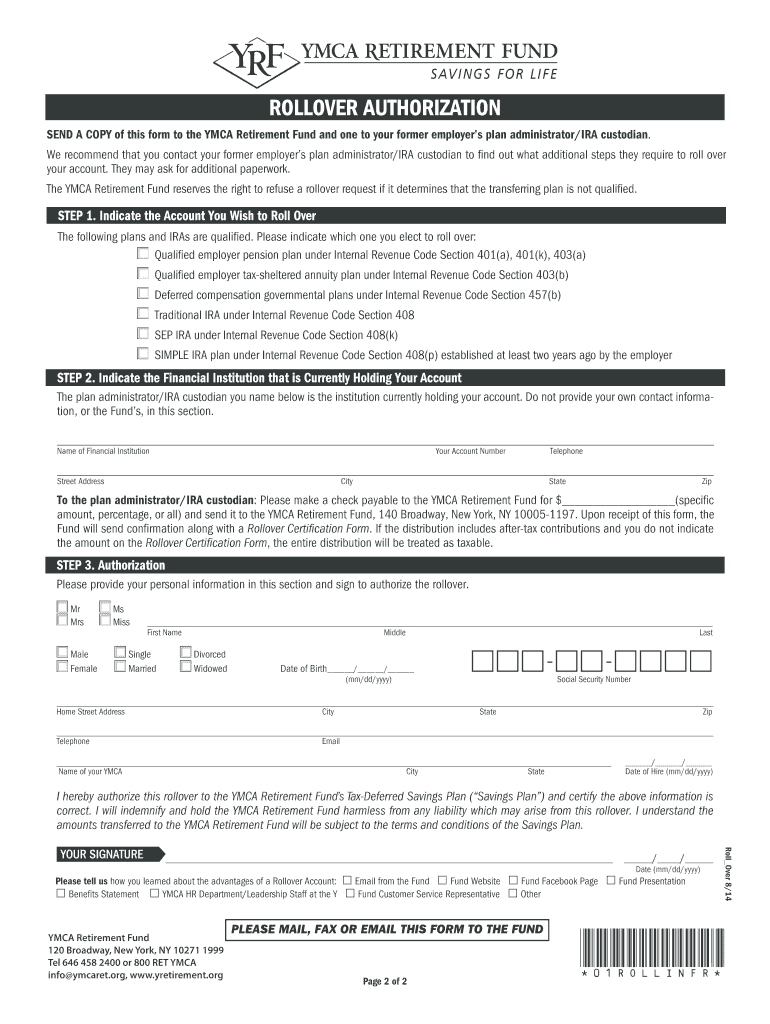

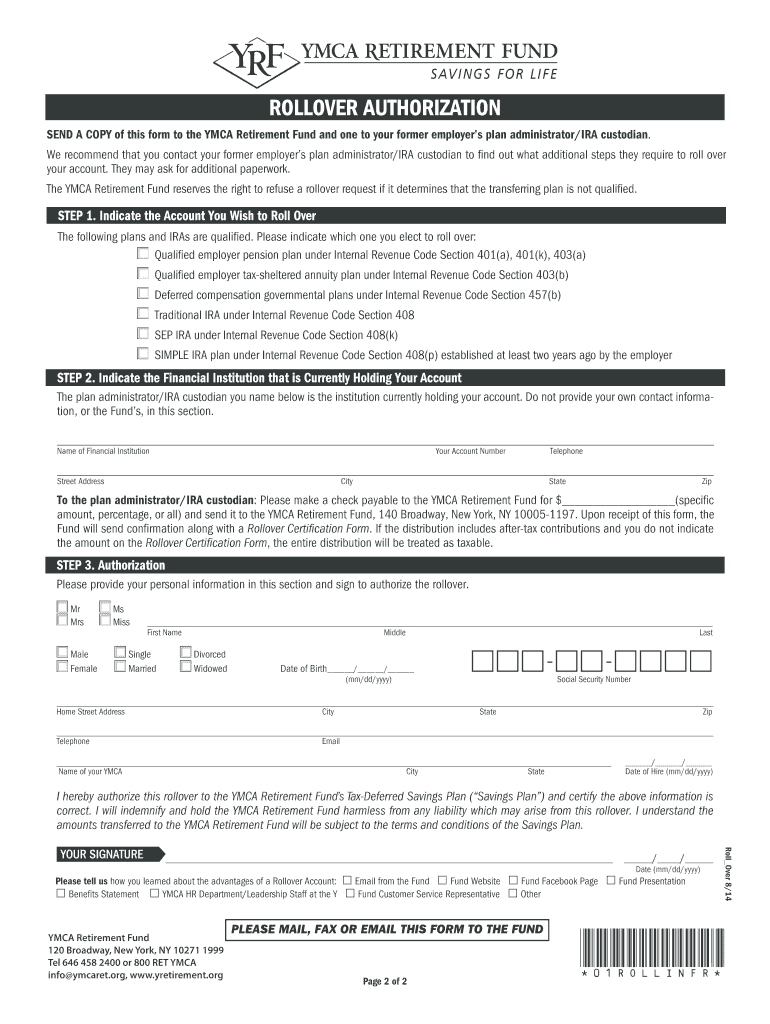

CONSOLIDATE YOUR SAVINGS Roll Over to the Fund Whatever your age, length of YMCA service, hours worked, or eligibility in the Retirement Plan, you can roll over qualified retirement savings into a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consolidate your savings roll

Edit your consolidate your savings roll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consolidate your savings roll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consolidate your savings roll online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit consolidate your savings roll. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consolidate your savings roll

How to Fill Out Consolidate Your Savings Roll:

01

Gather your financial information: Start by collecting all the necessary financial information, such as your bank statements, investment statements, credit card statements, and any other documentation related to your savings and investments.

02

Review your financial goals: Before consolidating your savings roll, it is important to have clear financial goals in mind. Assess your short-term and long-term objectives to determine how consolidating your savings can align with your overall financial plans.

03

Evaluate the fees and benefits: Analyze the fees and benefits associated with the accounts you currently have. Look for any hidden charges, management fees, or other costs that may be impacting your savings. Compare these fees to the potential fees of consolidating your savings.

04

Research consolidation options: Explore different consolidation options available to you. This can include moving funds into a high-yield savings account, investing in low-cost index funds, or consolidating multiple bank accounts into one.

05

Consider tax implications: Consolidating your savings may have tax consequences. Consult with a financial advisor or tax professional to understand any potential tax implications of moving your savings.

06

Review terms and conditions: Before making any decisions, carefully read the terms and conditions of the financial institutions or investment platforms you are considering for consolidation. Pay attention to minimum balance requirements, withdrawal restrictions, and any additional account policies that may affect your savings.

07

Make an informed decision: Based on your research and analysis, make an informed decision on whether consolidating your savings roll is the right choice for you. Consider factors such as potential cost savings, convenience, and how it aligns with your financial goals.

Who Needs to Consolidate Their Savings Roll?

01

Individuals with multiple unconnected bank accounts: If you have multiple bank accounts that are not integrated or working together towards your financial goals, consolidating them can provide a clearer overview of your finances and potentially save you money on fees and charges.

02

Those seeking simplified financial management: Consolidating your savings roll can make financial management simpler and more efficient. By having all your savings in one place, it becomes easier to track and manage your money.

03

Individuals looking for potential cost savings: Consolidating your savings roll can often result in lower fees and expenses. By assessing the fees associated with your current accounts and comparing them to the fees of consolidating, you may be able to find cost savings opportunities.

04

Those aiming to align their savings with financial goals: Consolidating your savings roll can help in aligning your savings with your financial goals. By streamlining your accounts and investments, you can have a clearer picture of how your savings are contributing to your overall financial plans.

05

Individuals seeking a better overview of their finances: If you find it challenging to keep track of multiple accounts, consolidating your savings roll can provide a better overview of your financial situation. It allows you to view your savings as a whole, making it easier to monitor progress and make informed financial decisions.

By following the steps to fill out consolidate your savings roll and understanding who can benefit from this consolidation, individuals can improve their financial management and potentially save money in the process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in consolidate your savings roll?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your consolidate your savings roll to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I fill out consolidate your savings roll on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your consolidate your savings roll. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Can I edit consolidate your savings roll on an Android device?

You can make any changes to PDF files, such as consolidate your savings roll, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is consolidate your savings roll?

Consolidate your savings roll is a report that combines all of your savings and investment accounts into one comprehensive overview.

Who is required to file consolidate your savings roll?

Individuals with multiple savings and investment accounts are required to file consolidate your savings roll.

How to fill out consolidate your savings roll?

To fill out consolidate your savings roll, gather all account statements and enter the relevant information into the designated sections of the form.

What is the purpose of consolidate your savings roll?

The purpose of consolidate your savings roll is to provide a complete picture of an individual's savings and investment portfolio.

What information must be reported on consolidate your savings roll?

Information such as account balances, account numbers, and types of savings and investment accounts must be reported on consolidate your savings roll.

Fill out your consolidate your savings roll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consolidate Your Savings Roll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.