Canada F10.02A 2018-2025 free printable template

Show details

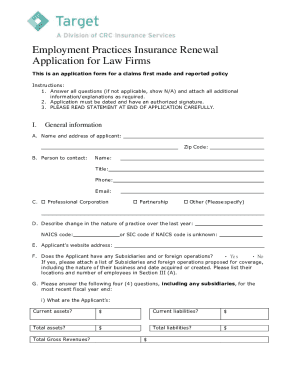

Supreme Court of Newfoundland and LabradorForm F10.02A: Financial Statement (Family Law) Instructions to Complete a Financial StatementInstructionsA Financial Statement (Form F10.02A) is a sworn document

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign f10 02a form

Edit your financial law form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial family canada form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial statement law form online

To use the professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit f10 02a form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial statement f10 02a form

How to fill out Canada F10.02A

01

Obtain the Canada F10.02A form from the official website or local office.

02

Read the instructions carefully to understand the requirements and sections.

03

Fill out personal information in section 1, including your name, address, and contact details.

04

Provide any required identification numbers in section 2, such as social insurance number or tax identification number.

05

In section 3, disclose any previous applications or related documentation.

06

Complete the financial information section, outlining your income and assets as required.

07

Review all the information to ensure accuracy and completeness.

08

Sign and date the form at the designated area.

09

Submit the form through the specified submission method, whether online or by mail.

Who needs Canada F10.02A?

01

Individuals applying for certain government benefits, financial assistance, or specific immigration processes in Canada.

02

Residents who need to provide detailed personal and financial information for government assessment.

Fill

statement family f10 02a

: Try Risk Free

People Also Ask about financial statement ca

What happens if the respondent does not file a response Ontario?

If you miss your deadline to serve and file an answer, the court case can proceed without your involvement and a judge may make final orders without your input.

How long does family court take Ontario?

A trial may take less than one day, multiple days or weeks, depending on multiple factors such as the complexity of the issues, the amount of evidence to be presented by the parties and the availability of counsel and court schedules.

What is family court in Canada?

Family Court deals with many, but not all, of the legal issues that affect families. It handles the following issues under the BC Family Law Act: guardianship of a child and parental responsibilities. parenting time and contact with a child. child support and spousal support.

What forms do I need to file for child custody in Ontario?

To start a new court case, you always have to fill out Form 8: Application (general) in addition to the form that your case is about. For example, if you have to go to court to start a case about child custody and access, you would fill out Form 8 and Form 35.1 Affidavit in Support of Claim for Custody or Access.

What falls under family law in Canada?

Marriage, separation, divorce, parenting, support, dividing property, adoption, and family violence — all fall within this area of law. Learn the basics of family law.

What types of issues does family law address Canada?

Family law Child support. Calculate child support and get help using the Federal Child Support Guidelines. Divorce and separation. Enforcing child or spousal support. Family justice services. Custody and parenting. Spousal support.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send law instructions f1002a to be eSigned by others?

To distribute your 2018 financial form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get financial instructions form?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the financial f10 02a form. Open it immediately and start altering it with sophisticated capabilities.

How can I fill out law instructions canada on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your financial statement law form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is Canada F10.02A?

Canada F10.02A is a tax form used by Canadian residents to report specific types of income, deductions, or credits to the Canada Revenue Agency (CRA).

Who is required to file Canada F10.02A?

Taxpayers who meet certain criteria regarding income sources, deductions claimed, or credits received must file Canada F10.02A with their annual tax return.

How to fill out Canada F10.02A?

To fill out Canada F10.02A, individuals must provide accurate information about their income, deductions, and credits. It is important to follow the instructions provided by the CRA and ensure all required documentation is included.

What is the purpose of Canada F10.02A?

The purpose of Canada F10.02A is to accurately report income and claim applicable deductions and credits, ensuring compliance with Canadian tax laws.

What information must be reported on Canada F10.02A?

Canada F10.02A requires reporting of various income types, allowable deductions, and any tax credits being claimed by the taxpayer.

Fill out your financial statement law form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Statement Law Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.