Get the free Business combinations under SFAS 141R - Grant Thornton

Show details

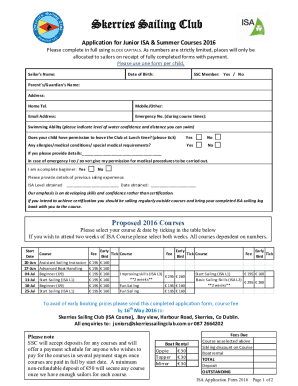

Business combinations under SEAS 141R Advisory services Valuation Revisions to Statement of Financial Accounting Standard No. 141, Business Combinations, referred to as SEAS 141R, will be adopted

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business combinations under sfas

Edit your business combinations under sfas form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business combinations under sfas form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business combinations under sfas online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit business combinations under sfas. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business combinations under sfas

How to fill out business combinations under SFAS:

01

Identify the acquirer and the acquiree: Determine which entity will be acquiring the other and which entity will be acquired. This is usually based on control, where the acquirer is the entity that obtains control over the acquiree.

02

Determine the acquisition date: The acquisition date is the date on which the acquirer obtains control over the acquiree. It is important to correctly identify this date as it will be used for subsequent accounting calculations.

03

Measure the fair value of the acquiree: Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. The fair value of the acquiree's identifiable assets, liabilities, and any non-controlling interests should be determined.

04

Determine the fair value of consideration transferred: Consideration transferred includes any assets, liabilities, equity instruments, or contingent consideration given by the acquirer to the acquiree in exchange for control. Fair value should be assigned to each element of consideration.

05

Recognize and measure goodwill or a gain from a bargain purchase: Goodwill is recognized when the consideration transferred exceeds the fair value of the acquiree's identifiable net assets. On the other hand, a gain from a bargain purchase may arise when the consideration transferred is less than the fair value of the acquiree's identifiable net assets.

Who needs business combinations under SFAS:

01

Companies involved in Mergers and Acquisitions: Businesses that are looking to acquire or be acquired by another entity will need to understand and apply SFAS guidelines for business combinations. This includes companies in various industries, such as technology, finance, healthcare, and manufacturing.

02

Investors and Analysts: Investors and analysts who analyze financial statements and make investment decisions also need to be familiar with business combinations under SFAS. Understanding how business combinations are accounted for can provide valuable insights into the financial health and potential future performance of a company.

03

Regulatory Agencies: Regulatory agencies responsible for overseeing financial reporting and ensuring compliance with accounting standards also need to be knowledgeable about business combinations under SFAS. This allows them to assess the accuracy and reliability of financial statements and make informed decisions regarding regulatory requirements and enforcement actions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is business combinations under SFAS?

Business combinations under SFAS refer to the process where one company acquires another company or merges with another company, resulting in the combining of financial statements and operations.

Who is required to file business combinations under SFAS?

Companies that engage in business combinations that meet the criteria set by SFAS are required to file the necessary disclosures and financial statements.

How to fill out business combinations under SFAS?

Business combinations under SFAS should be filled out by following the guidelines and requirements outlined in SFAS, which include providing detailed information about the acquisition or merger.

What is the purpose of business combinations under SFAS?

The purpose of business combinations under SFAS is to provide transparency and accuracy in financial reporting, by ensuring that all relevant information related to the acquisition or merger is properly disclosed.

What information must be reported on business combinations under SFAS?

Information that must be reported on business combinations under SFAS includes details about the acquiring company, the acquired company, the purchase price, the fair value of the acquired company's assets and liabilities, and any goodwill or intangible assets.

How can I edit business combinations under sfas from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including business combinations under sfas. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I sign the business combinations under sfas electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your business combinations under sfas in minutes.

Can I edit business combinations under sfas on an Android device?

You can make any changes to PDF files, such as business combinations under sfas, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your business combinations under sfas online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Combinations Under Sfas is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.