Get the free form # 2135 fha

Show details

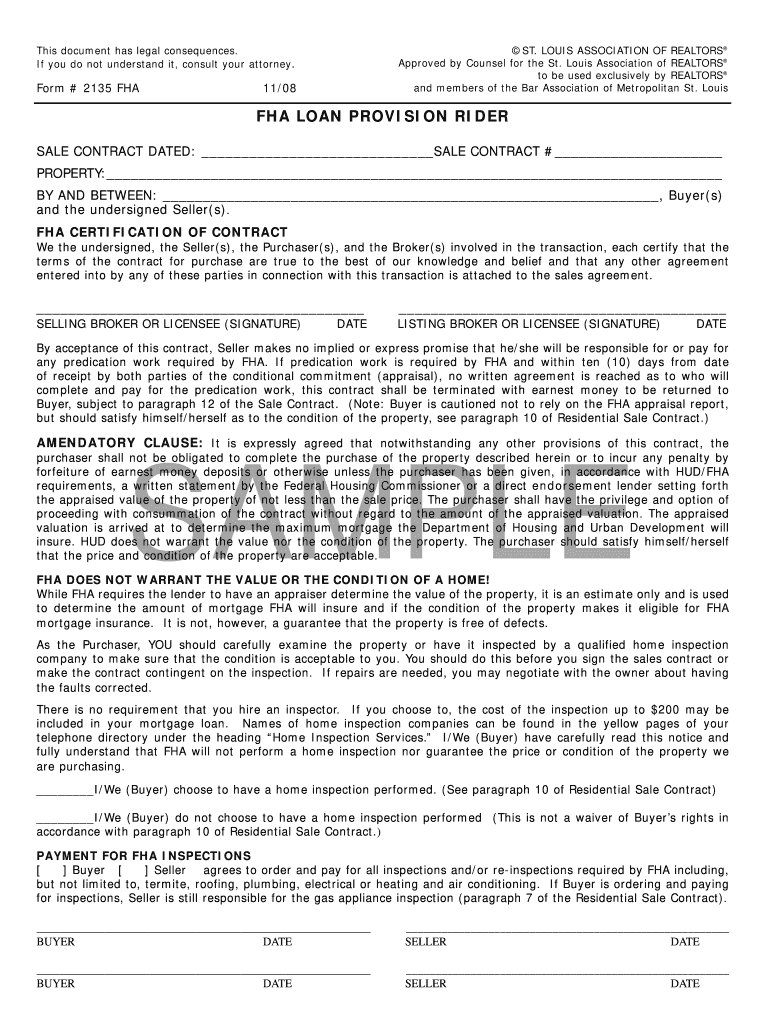

This document is a rider to a sale contract related to FHA loans, detailing responsibilities regarding property conditions, inspections, and the role of the FHA in assessing property values.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form # 2135 fha

Edit your form # 2135 fha form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form # 2135 fha form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 2135 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 2135. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form # 2135 fha

How to fill out form # 2135 fha

01

Obtain form # 2135 from the FHA website or your lender.

02

Provide personal identification information, including your name, address, and Social Security number.

03

Fill out the property information section with details about the property you are applying for.

04

Include your employment and income details, ensuring to document all sources of income.

05

List any debts and liabilities in the financial information section.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the designated sections.

Who needs form # 2135 fha?

01

Homebuyers applying for an FHA-insured mortgage.

02

Individuals seeking to refinance an existing FHA loan.

03

Real estate agents assisting clients with FHA loans.

04

Lenders working with FHA loan applicants.

Fill

form

: Try Risk Free

People Also Ask about

What is a rider on a mortgage loan?

A rider is an addition to a security instrument. The adjustable-rate rider outlines terms and conditions specific to an adjustable-rate loan. It must be recorded along with the security instrument at the county recorder's office.

Can a 70 year old woman get a 30 year mortgage?

Can a 70-year-old choose between a 15- and a 30-year mortgage? Absolutely. The Equal Credit Opportunity Act's protections extend to your mortgage term. Mortgage lenders can't deny you a specific loan term on the basis of age.

What is a rider in the house?

In the U.S. Congress, riders have been a traditional method for members of Congress to advance controversial measures without building coalitions specifically in support of them, allowing the measure to move through the legislative process: "By combining measures, the legislative leadership can force members to accept

How to assume someone's FHA loan?

To assume an FHA loan, you must also pay the lender an assumption fee and closing costs. Assumption fees range from 0.05% to 1% of the original loan amount, whereas closing costs range from 2% to 5% of the remaining loan balance. These fees are typically paid upfront at the time of closing.

What is a rider for real estate?

A rider is a document that addresses additional details, conditions, or terms of a contract. For example, in real estate, an attorney may draft a contract rider to supplement a standard purchase and sale agreement. In this case, the rider may outline details such as: Where and how a down payment is held.

What are the seasoning requirements for FHA loans?

Payment history/mortgage seasoning requirement: Borrowers must have made at least six payments on the FHA-insured mortgage that is being refinanced, at least six months must have passed since the first payment due date of the FHA-insured mortgage that is being refi- nanced, and at least 210 days must have passed from

What is the 90 day flip rule for FHA loans?

In simple terms, if a property has been bought, renovated, and re-listed within 90 days, buyers using FHA loans cannot purchase it. Check your FHA eligibility!

What is a rider on a mortgage?

Riders, also known as addendums or amendments, are additional documents attached to the main purchase and sale (P&S) agreement. Riders serve to modify or add specific terms and conditions to the original contract, offering flexibility and customization for both buyers and sellers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form # 2135 fha?

Form # 2135 FHA is a form used by the Federal Housing Administration (FHA) for various reporting purposes related to housing and mortgage insurance.

Who is required to file form # 2135 fha?

Typically, lenders and mortgage servicers that participate in FHA programs are required to file Form # 2135 to report certain housing and loan data.

How to fill out form # 2135 fha?

To fill out Form # 2135 FHA, users should provide accurate details regarding the loan, borrower information, property details, and any other required information as specified in the form instructions.

What is the purpose of form # 2135 fha?

The purpose of Form # 2135 FHA is to collect data that helps the FHA monitor and manage its programs, ensuring compliance with regulations and guidelines.

What information must be reported on form # 2135 fha?

Form # 2135 FHA typically requires reporting information about the borrower, loan details, property location, and any relevant financial information associated with the FHA-insured mortgages.

Fill out your form # 2135 fha online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 2135 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.