IL Form IDOR-6-SETR 2016 free printable template

Show details

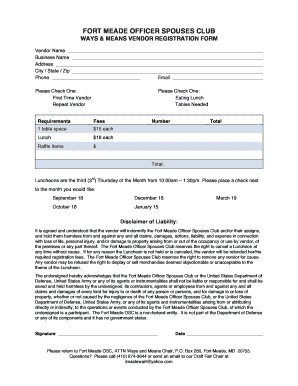

Special Event Tax Collection Report and Payment Coupon

Form IDOR6SETR (R03/16)Read this first

Exhibitors: All exhibitors making sales in Illinois are required to report and pay all tax due based on

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL Form IDOR-6-SETR

Edit your IL Form IDOR-6-SETR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL Form IDOR-6-SETR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL Form IDOR-6-SETR online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IL Form IDOR-6-SETR. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL Form IDOR-6-SETR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL Form IDOR-6-SETR

How to fill out IL Form IDOR-6-SETR

01

Start by downloading the IL Form IDOR-6-SETR from the official Illinois Department of Revenue website.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

04

Provide details regarding your qualifying tax exemption, including the type and amount.

05

Include any relevant documentation that supports your claim for the exemption.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the designated section.

08

Submit the filled-out form to the appropriate address provided in the instructions.

Who needs IL Form IDOR-6-SETR?

01

Individuals or businesses who believe they qualify for a tax exemption in Illinois should fill out IL Form IDOR-6-SETR.

02

Taxpayers who have received a notice regarding an exemption claim they need to validate.

03

Anyone seeking to claim a specific exemption for sales tax purposes in the state of Illinois.

Fill

form

: Try Risk Free

People Also Ask about

What are the tax implications on artwork?

At the time of the purchase there are no personal tax implications (meaning that you do not have to pay income tax or any social security contributions). Income tax implications may arise if the work of art is sold, but only if sale of art is a regular activity for you.

What is the sales tax on artwork in Illinois?

A 10.25% sales tax must be charged on all art being sold in the State of Illinois and remaining in this State. It is each exhibitor's responsibility to collect and remit this sales tax.

What is sales tax on art in Chicago?

However, in Illinois, services (like art installation, proofreading, and editing), are NOT taxed. In Chicago, there are two sales taxes. “The state of Illinois collects 6.25% sales tax. Cook County (collects) an additional 4%, so thatʼs why the sales tax in Chicago is 10.25%,” explains Ecklebarger.

How do I pay taxes on sold art?

The sale would be reported as General Income in your business income unless the gallery gave you a 1099-MISC. You would be able to deduct the materials and supplies that you purchased to create your art, and any other ordinary and necessary business expenses, such as advertising, business cards, etc.

What is the tax rate for sale of art?

When investors sell works of art, they are acquiring gains on their investments, similar to selling stock for a profit. As such, those sales are subject to the capital gains tax rate, which is 20% for taxpayers in the highest tax bracket.

What is the tax rate in Oak Brook Mall?

Oak Brook, Illinois Sales Tax Rate 2023 The 10% sales tax rate in Oak Brook consists of 6.25% Illinois state sales tax, 1.75% Dupage County sales tax, 1% Oak Brook tax and 1% Special tax. The sales tax jurisdiction name is Westchester, which may refer to a local government division.

What is the state income tax in Illinois?

Income tax: 4.95 percent Illinois has a flat income tax rate of 4.95 percent.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IL Form IDOR-6-SETR from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including IL Form IDOR-6-SETR, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in IL Form IDOR-6-SETR?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your IL Form IDOR-6-SETR to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit IL Form IDOR-6-SETR on an Android device?

You can edit, sign, and distribute IL Form IDOR-6-SETR on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is IL Form IDOR-6-SETR?

IL Form IDOR-6-SETR is a form used by the Illinois Department of Revenue for the purpose of reporting certain information related to the operations of an entity in the state.

Who is required to file IL Form IDOR-6-SETR?

Entities that are engaged in specific activities and meet certain criteria set by the Illinois Department of Revenue are required to file IL Form IDOR-6-SETR.

How to fill out IL Form IDOR-6-SETR?

To fill out IL Form IDOR-6-SETR, you must provide the required information related to your entity's specific operations, follow the instructions on the form carefully, and ensure that all data is accurate.

What is the purpose of IL Form IDOR-6-SETR?

The purpose of IL Form IDOR-6-SETR is to collect detailed information from entities for compliance and regulatory purposes in relation to their activities in Illinois.

What information must be reported on IL Form IDOR-6-SETR?

The information that must be reported on IL Form IDOR-6-SETR includes entity identification details, descriptions of operations, and any other information as required by the form instructions.

Fill out your IL Form IDOR-6-SETR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL Form IDOR-6-SETR is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.