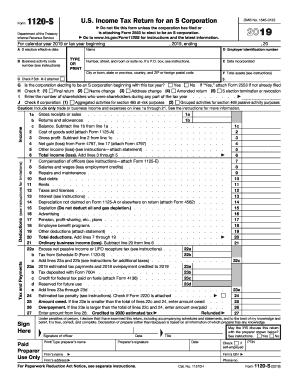

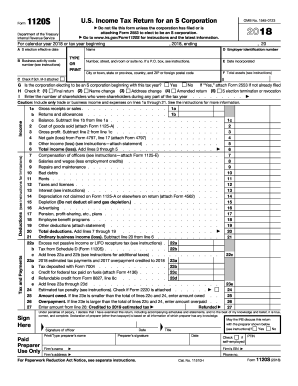

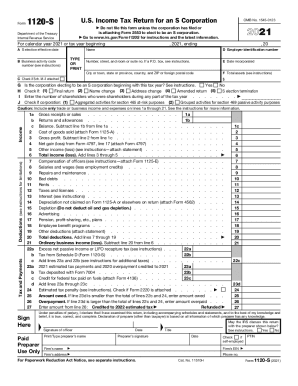

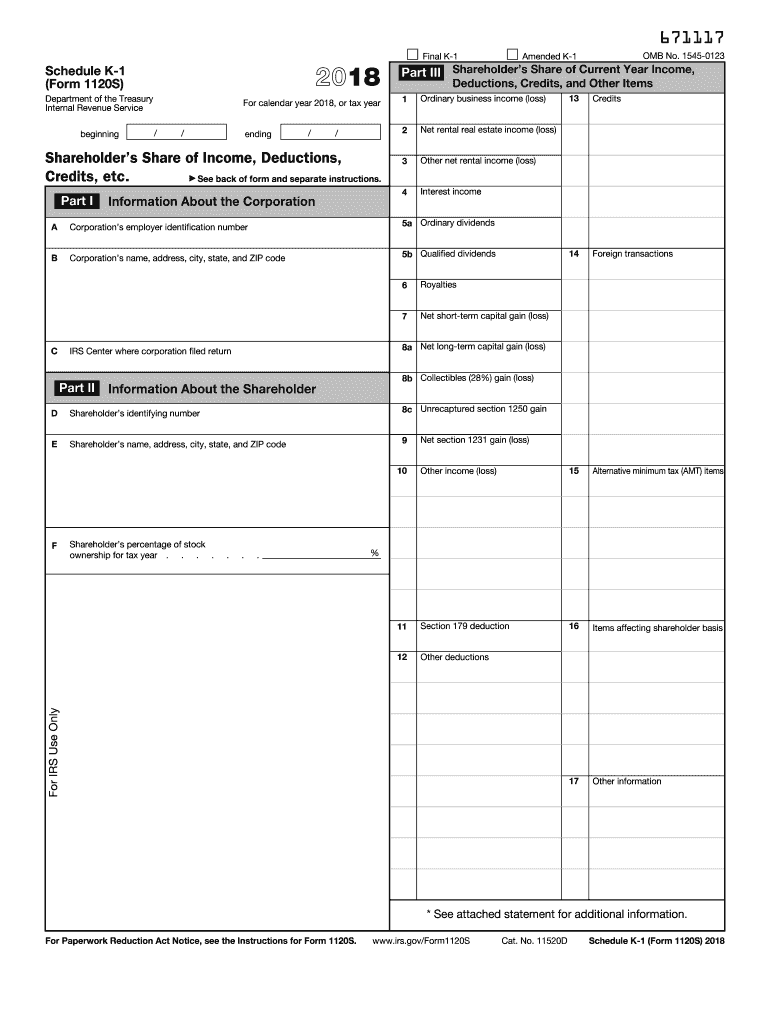

IRS 1120S - Schedule K-1 2018 free printable template

Show details

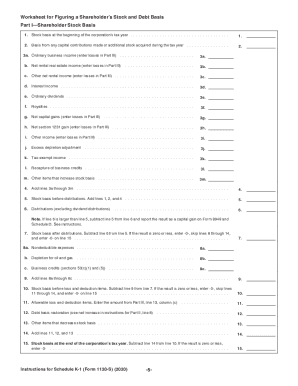

Credits 8b Collectibles 28 gain loss D F 8a Net long-term capital gain loss IRS Center where corporation filed return Part II OMB No. 1545-0123 Amended K-1 See back of form and separate instructions. Credits etc. Final K-1 See attached statement for additional information. For Paperwork Reduction Act Notice see the Instructions for Form 1120S. www.irs.gov/Form1120S Cat. No. 11520D Page This list identifies the codes used on Schedule K-1 for all shareholders and provides summarized reporting...information for shareholders who file Form 1040. For detailed reporting and filing information see the separate Shareholder s Instructions for Schedule K-1 and the instructions for your income tax return. passive or nonpassive and enter on your return as follows Report on Passive loss See the Shareholder s Instructions Passive income Schedule E line 28 column h Nonpassive loss Nonpassive income Net income Net loss Form 1040 line 2b 28 Rate Gain Worksheet line 4 Schedule D instructions 10. 671117...Schedule K-1 Form 1120S Department of the Treasury Internal Revenue Service beginning / Part III Shareholder s Share of Current Year Income Deductions Credits and Other Items For calendar year 2018 or tax year Ordinary business income loss Net rental real estate income loss Other net rental income loss Interest income ending Information About the Corporation A Corporation s employer identification number 5a Ordinary dividends B 5b Qualified dividends C Royalties Net short-term capital gain loss...Shareholder s identifying number 8c Unrecaptured section 1250 gain E Shareholder s name address city state and ZIP code. Section 179 deduction 12. Other deductions A Cash contributions 60 C Noncash contributions 50 E Capital gain property to a 50 organization 30 G Contributions 100 H Investment interest expense Form 4952 line 1 I Deductions royalty income J Section 59 e 2 expenditures K Section 965 c deduction L Deductions portfolio other Schedule A line 16 M Preproductive period expenses N...Commercial revitalization deduction from rental real estate activities See Form 8582 instructions O Reforestation expense deduction P through R Reserved for future use A Low-income housing credit section 42 j 5 from pre-2008 buildings from pre-2008 buildings 42 j 5 from post-2007 buildings Instructions from post-2007 buildings E Qualified rehabilitation expenditures rental real estate F Other rental real estate credits H Undistributed capital gains credit Schedule 5 Form 1040 line 74 box a I...Biofuel producer credit J Work opportunity credit K Disabled access credit L Empowerment zone employment credit M Credit for increasing research activities N Credit for employer social security and Medicare taxes O Backup withholding P Other credits A Name of country or U.S. possession Form 1116 Part I B Gross income from all sources C Gross income sourced at shareholder level Foreign gross income sourced at corporate level D Section 951A category E Foreign branch category F Passive category G...General category H Other Deductions allocated and apportioned at shareholder level I Interest expense income P Total foreign taxes paid R Reduction in taxes available for credit Form 1116 line 12 S Foreign trading gross receipts Form 8873 T Extraterritorial income exclusion U Section 965 information V Other foreign transactions A Post-1986 depreciation adjustment B Adjusted gain or loss C Depletion other than oil gas and the Instructions for Form 6251 D Oil gas geothermal gross income F Other...AMT items A Tax-exempt interest income B Other tax-exempt income C Nondeductible expenses D Distributions E Repayment of loans from A Investment income B Investment expenses other than rental real estate D Basis of energy property E Recapture of low-income housing credit section 42 j 5 Form 8611 line 8 credit other G Recapture of investment credit See Form 4255 H Recapture of other credits I Look-back interest completed long-term contracts See Form 8697 forecast method K Dispositions of property...with L Recapture of section 179 deduction M through U V Section 199A income W Section 199A W-2 wages X Section 199A unadjusted basis Y Section 199A REIT dividends Z Section 199A PTP income AA Excess taxable income AB Excess business interest income.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120S - Schedule K-1

How to edit IRS 1120S - Schedule K-1

How to fill out IRS 1120S - Schedule K-1

Instructions and Help about IRS 1120S - Schedule K-1

How to edit IRS 1120S - Schedule K-1

To edit the IRS 1120S - Schedule K-1, you can utilize pdfFiller's editing tools. Upload the form to the platform, where you can make any necessary adjustments to the text or numerical values. Once edited, you can save your changes and prepare for submission.

How to fill out IRS 1120S - Schedule K-1

To fill out the IRS 1120S - Schedule K-1, follow these steps:

01

Obtain the form from the IRS website or local tax offices.

02

Enter your business' name and address at the top of the form.

03

Include the partner's name, address, and identification number in the designated sections.

04

Fill in the partner's share of income, deductions, and credits as applicable.

05

Review all entries for accuracy and completeness.

About IRS 1120S - Schedule K-1 2018 previous version

What is IRS 1120S - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120S - Schedule K-1 2018 previous version

What is IRS 1120S - Schedule K-1?

IRS 1120S - Schedule K-1 is used to report income, deductions, and credits from S corporations to their shareholders. It provides details necessary for shareholders to correctly report their share of the S corporation's income on their personal tax returns. This form is essential for ensuring proper tax compliance at both the corporate and individual levels.

What is the purpose of this form?

The purpose of the IRS 1120S - Schedule K-1 is to allocate the income, deductions, and tax credits of an S corporation to its shareholders. This ensures that all shareholders report their share of income correctly, which is taxed at the individual level rather than at the corporate level.

Who needs the form?

Shareholders of S corporations need to receive the IRS 1120S - Schedule K-1. If you are an owner of an S corporation, you are required to issue this form to each of your shareholders to report their share of income, losses, deductions, and credits.

When am I exempt from filling out this form?

You are exempt from filling out the IRS 1120S - Schedule K-1 if your entity is not an S corporation or if you as a partner have not participated in the business any time during the tax year. Additionally, if there are no transactions requiring reporting for the shareholder, a K-1 may not need to be issued.

Components of the form

The IRS 1120S - Schedule K-1 includes several components, such as:

01

Identifying information of the S corporation and shareholder.

02

Details regarding the shareholder's share of income, deductions, and credits.

03

Any special allocations made to the shareholder that differ from standard distributions.

What are the penalties for not issuing the form?

Failure to issue IRS 1120S - Schedule K-1 can result in penalties for the S corporation. The IRS may impose fines for each K-1 that is not issued correctly or timely. This could lead to additional scrutiny on the corporation's tax filings and an increased likelihood of audits.

What information do you need when you file the form?

When filing the IRS 1120S - Schedule K-1, you need the following information:

01

Name and address of the S corporation.

02

Name and identifying number of the shareholder.

03

Details of each shareholder’s income, losses, and other allocations.

Is the form accompanied by other forms?

Yes, the IRS 1120S - Schedule K-1 often needs to be filed alongside IRS Form 1120S, which is the S Corporation tax return. Additionally, depending on specific circumstances, other forms may be required to report certain types of income or deductions.

Where do I send the form?

The IRS 1120S - Schedule K-1 should be sent along with the IRS Form 1120S to the IRS service center designated for your state. It's important to check the latest IRS guidelines to ensure you are sending it to the correct address.

See what our users say