Get the free delinquent property tax sale pursuant to tca67-5-2502, the ...

Show details

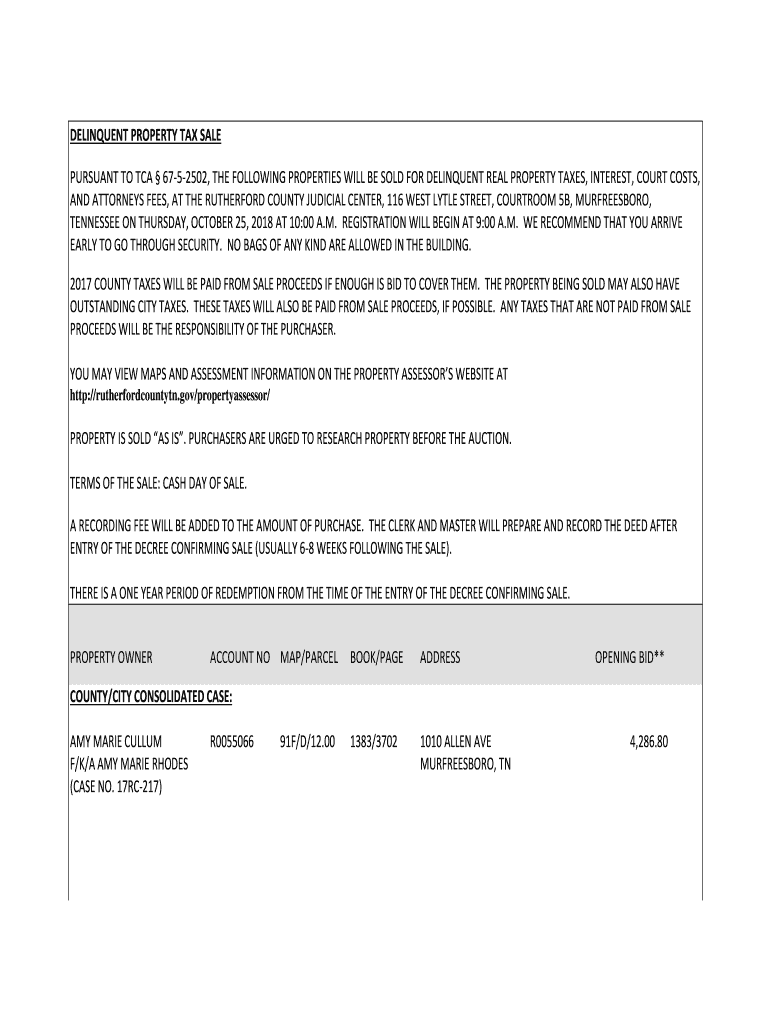

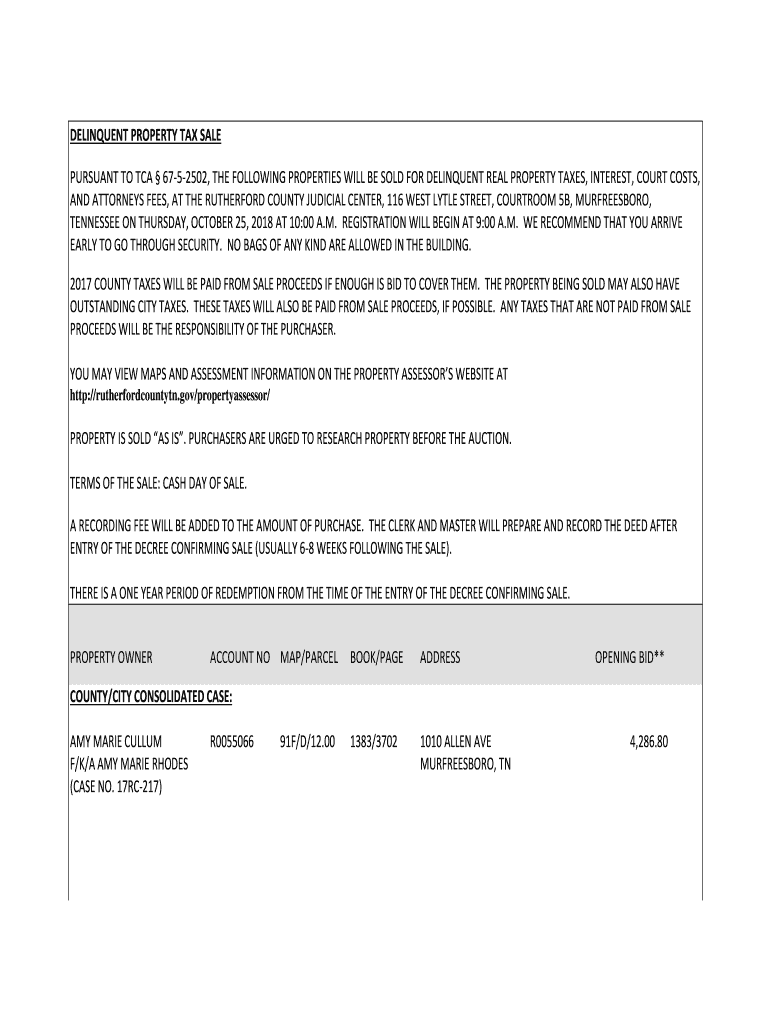

DELINQUENT PROPERTY TAX SALE PURSUANT TO TCA 6752502, THE FOLLOWING PROPERTIES WILL BE SOLD FOR DELINQUENT REAL PROPERTY TAXES, INTEREST, COURT COSTS, AND ATTORNEYS FEES, AT THE RUTHERFORD COUNTY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign delinquent property tax sale

Edit your delinquent property tax sale form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your delinquent property tax sale form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing delinquent property tax sale online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit delinquent property tax sale. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out delinquent property tax sale

How to fill out delinquent property tax sale

01

Gather all necessary documents such as property tax sale notice, tax sale list, and bidding registration form.

02

Review the tax sale list and identify the properties you are interested in purchasing.

03

Attend the tax sale auction in person or online.

04

Register as a bidder by filling out the bidding registration form and providing the required documents.

05

Familiarize yourself with the auction rules and procedures.

06

Determine your maximum bid and set a budget for the purchase.

07

Participate in the bidding process and place bids on the desired properties.

08

If your bid is successful, complete the necessary paperwork and pay the required deposit.

09

Ensure timely payment of the remaining balance within the specified timeframe.

10

Complete all legal requirements and transfer the property title to your name.

Who needs delinquent property tax sale?

01

Real estate investors who are looking for potential investment opportunities.

02

Individuals or companies who are interested in acquiring properties at a discounted price.

03

Property developers who want to purchase vacant or undeveloped properties.

04

Individuals seeking to purchase foreclosed properties to live in or rent out.

05

Speculators who aim to buy properties for future resale or profit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete delinquent property tax sale online?

Easy online delinquent property tax sale completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make changes in delinquent property tax sale?

The editing procedure is simple with pdfFiller. Open your delinquent property tax sale in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for the delinquent property tax sale in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is delinquent property tax sale?

A delinquent property tax sale is an auction of properties that have unpaid property taxes.

Who is required to file delinquent property tax sale?

Property owners who have unpaid property taxes are required to file for delinquent property tax sale.

How to fill out delinquent property tax sale?

To fill out a delinquent property tax sale, property owners must provide information about the property and the unpaid taxes.

What is the purpose of delinquent property tax sale?

The purpose of a delinquent property tax sale is to recoup unpaid property taxes and transfer ownership of the property to a new owner.

What information must be reported on delinquent property tax sale?

Information such as property details, tax amounts owed, and contact information must be reported on delinquent property tax sale.

Fill out your delinquent property tax sale online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Delinquent Property Tax Sale is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.