This is a Notice of Dishonored Check (Civil). A “dishonoreChehe” k” (also known as a “bounced check”“or “bad Che” k”) is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored. This form is in English language only.

Get the free NOTICE_OF_DISHONORED_CHECK

Show details

This document serves as a notification regarding a dishonored check, outlining the reasons for dishonor, potential legal consequences, and payment instructions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice_of_dishonored_check

Edit your notice_of_dishonored_check form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice_of_dishonored_check form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice_of_dishonored_check

How to fill out NOTICE_OF_DISHONORED_CHECK

01

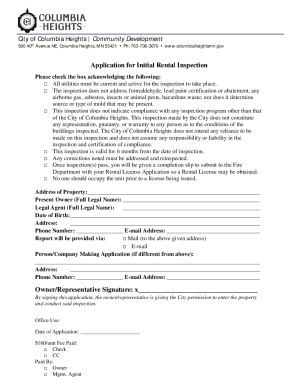

Begin by obtaining the NOTICE OF DISHONORED CHECK form from your bank or online.

02

Fill out the date when the notice is being issued.

03

Enter the name and address of the person or business that issued the check.

04

Provide the check number and the amount of the dishonored check.

05

State the reason for dishonor (e.g., insufficient funds, account closed).

06

Include your own contact information for any inquiries.

07

Sign and date the notice.

08

Send the notice to the check issuer via mail or deliver in person, retaining a copy for your records.

Who needs NOTICE_OF_DISHONORED_CHECK?

01

Individuals or businesses that have received a check that was dishonored, such as due to insufficient funds.

02

Creditors or service providers seeking to inform clients about a bounced check.

03

Financial institutions that manage dishonored check notifications.

Fill

form

: Try Risk Free

People Also Ask about

What is a notice of dishonored payment?

The Dishonored Check or Other Form of Payment Penalty applies if you don't have enough money in your bank account to cover the payment you made for the tax you owe. Your bank dishonors and returns your bad check or electronic payment and declares the amount unpaid.

How do you write a dishonored check on a check stub?

1. Write Dishonored check $105.00 on the line under the heading “Other.” 2. Write the total of the dishonored check in the amount column.

What is a notice of dishonor of a cheque?

Notice of dishonour may be given to a duly authorised agent of the person to whom it is required to be given, or, where he has died, to his legal representative, or, where he has been declared an insolvent, to his assignee; may be oral or written; may, if written, be sent by post; and may be in any form; but it must

Do you add or subtract a dishonored check?

0:22 4:34 It it was deposited and the amount was added to the bank. Account. And so your check stub have aMoreIt it was deposited and the amount was added to the bank. Account. And so your check stub have a different look to it. Now since it's dishonored the amount must be subtracted. From the bank.

How to record a dishonored check?

2:04 3:30 And your company's bank charged you a $25 fee. How would you record this transaction. Well first youMoreAnd your company's bank charged you a $25 fee. How would you record this transaction. Well first you would debit accounts receivable to add back the $300. Check plus the $25 fee for a total of $325.

What is Dishonoured Cheque in English?

When a bank refuses to process a cheque you have submitted, it is known as a dishonour of cheque. This rejection can occur for reasons such as insufficient balance in an account, a signature mismatch, or a post-dated cheque.

What is considered a dishonored check?

Dishonored checks are items deposited at a depository bank and returned due to: Insufficient funds in the accounts the checks are drawn. Other reasons that prevent the bank from honoring the checks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NOTICE_OF_DISHONORED_CHECK?

A NOTICE_OF_DISHONORED_CHECK is a formal notification issued when a check is returned unpaid by the bank due to insufficient funds or other reasons.

Who is required to file NOTICE_OF_DISHONORED_CHECK?

Typically, the payee or the individual/business that received the check is required to file a NOTICE_OF_DISHONORED_CHECK.

How to fill out NOTICE_OF_DISHONORED_CHECK?

To fill out a NOTICE_OF_DISHONORED_CHECK, include details such as the check number, date issued, amount, name of the check writer, the reason for dishonor, and any applicable fees.

What is the purpose of NOTICE_OF_DISHONORED_CHECK?

The purpose of the NOTICE_OF_DISHONORED_CHECK is to formally inform the check writer that their check has not been honored, allowing them the opportunity to rectify the situation.

What information must be reported on NOTICE_OF_DISHONORED_CHECK?

Essential information includes the check number, the date it was written, the amount, the name and address of the check writer, the reason for dishonor, and the date of notification.

Fill out your notice_of_dishonored_check online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice_Of_Dishonored_Check is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.