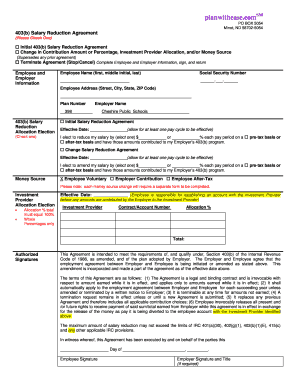

CT 403(b) Salary Reduction Agreement 2018-2025 free printable template

Show details

Planwithease.comm PO BOX 5054 Minot, ND 587025054403(b) Salary Reduction Agreement (Please Check One) Initial 403(b) Salary Reduction Agreement Change in Contribution Amount or Percentage, Investment

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign plan with ease salary

Edit your plan with ease salary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your plan with ease salary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing plan with ease salary online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit plan with ease salary. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out plan with ease salary

How to fill out CT 403(b) Salary Reduction Agreement

01

Start by obtaining the CT 403(b) Salary Reduction Agreement form from your employer or the relevant retirement plan administrator.

02

Fill in your personal information such as your name, employee ID, and the date.

03

Specify the percentage or dollar amount of your salary that you wish to contribute to your 403(b) plan.

04

Indicate whether your contributions will be made on a pre-tax or post-tax basis.

05

Review the plan options provided and select any additional features or catch-up contributions, if applicable.

06

Read the terms and conditions regarding the salary reduction and ensure you understand them.

07

Sign and date the form to confirm your agreement and submit it to your payroll department.

Who needs CT 403(b) Salary Reduction Agreement?

01

Employees of public schools and certain tax-exempt organizations who wish to save for retirement.

02

Individuals looking to reduce their taxable income through retirement contributions.

03

Participants in a 403(b) retirement plan who want to make salary reduction contributions.

Fill

form

: Try Risk Free

People Also Ask about

What is an SRA form?

The Salary Reduction Agreement (SRA) is utilized to establish, change, or cancel salary reductions withheld from your paycheck and contributed to the 403(b) Plan on your behalf. The SRA is also used to change the investment providers that receive your contributions.

Is a salary reduction Plan the same as a 401k?

A salary reduction plan helps workers save and invest for retirement through their employer via several types of retirement accounts. Money is typically deposited in a retirement account such as a 401k, 403b, or SIMPLE IRA on a pre-tax basis through recurring deferrals (a.k.a. contributions) on behalf of the employee.

What is the meaning of salary reduction?

A pay cut is a reduction in an employee's salary. Pay cuts are often made to reduce layoffs while saving the company money during a difficult economic period. A pay cut may be temporary or permanent, and may or may not come with a reduction in responsibilities.

What is the difference between a salary reduction and a salary deduction?

Salary Reductions vs. A reduction may occur when a business is instituting cost-cutting measures, when an employee reduces their working hours, or when an employee changes roles. A salary deduction is a set amount that is deducted from an employee's monthly salary.

What is a salary reduction?

Salary Reductions are an agreement between employee and employer to reduce Employee's salary and direct the amount reduced to the investment account that the employee has established on a pre-tax basis.

Do I have to accept a salary reduction?

Workers must be paid their agreed salaries for the work that they have already performed. This means that employers are required to notify their workers when they intend to reduce their pay, and the employees must either agree to the reductions or quit their jobs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send plan with ease salary for eSignature?

Once your plan with ease salary is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit plan with ease salary in Chrome?

Install the pdfFiller Google Chrome Extension to edit plan with ease salary and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an eSignature for the plan with ease salary in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your plan with ease salary and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is CT 403(b) Salary Reduction Agreement?

The CT 403(b) Salary Reduction Agreement is a legal document that allows employees of eligible public schools and certain tax-exempt organizations to have a portion of their salary deducted and contributed to a retirement savings account, known as a 403(b) plan.

Who is required to file CT 403(b) Salary Reduction Agreement?

Typically, employees who wish to participate in the 403(b) retirement plan offered by their employer are required to file the CT 403(b) Salary Reduction Agreement.

How to fill out CT 403(b) Salary Reduction Agreement?

To fill out the CT 403(b) Salary Reduction Agreement, employees must provide their personal information, specify the amount or percentage of salary to be deducted, and sign the document to authorize the changes.

What is the purpose of CT 403(b) Salary Reduction Agreement?

The purpose of the CT 403(b) Salary Reduction Agreement is to facilitate the employee's participation in the 403(b) retirement plan by allowing regular, pre-tax contributions from their salary to help grow their retirement savings.

What information must be reported on CT 403(b) Salary Reduction Agreement?

The information that must be reported on the CT 403(b) Salary Reduction Agreement includes the employee's name, address, employee identification number, the amount or percentage of salary to be deducted, and the name of the 403(b) plan provider.

Fill out your plan with ease salary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Plan With Ease Salary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.