Get the free form nri 11 2

Show details

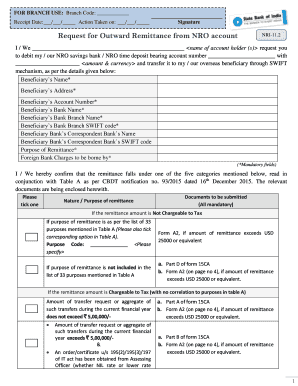

FOR BRANCH USE: Branch Code: Receipt Date: / / Action Taken on: / / SignatureRequest for Outward Remittance from NRO accountNRI11.2I / We name of account holder (s) request you to debit my / our NRO

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form nri 11 2

Edit your form nri 11 2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form nri 11 2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form nri 11 2 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form nri 11 2. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form nri 11 2

How to fill out form nri 11 2:

01

Begin by downloading the form nri 11 2 from a reliable source or get it from the relevant authority.

02

Carefully read the instructions and guidelines provided with the form to ensure you understand the requirements and process.

03

Collect all the necessary information and documents that are required to complete the form, such as personal details, identification proof, supporting documents, etc.

04

Fill in the required personal details accurately and legibly, including your full name, address, contact information, and any other relevant information as specified in the form.

05

Pay attention to the sections that require specific information, such as employment details, income details, or any other relevant details mentioned in the form.

06

Double-check all the entered information to make sure there are no mistakes or missing details.

07

Attach all the required supporting documents as mentioned in the instructions. This may include identification proof, address proof, photographs, or any other documents specified in the form.

08

Review the completed form and supporting documents to ensure everything is in order and nothing is missing.

09

Sign and date the form wherever required, following the provided instructions.

10

Submit the completed form and attached documents to the designated authority or as per the instructions provided.

Who needs form nri 11 2:

01

Individuals who are non-resident Indians (NRIs) and wish to avail certain facilities or services provided by the concerned authority may need to fill out form nri 11 2.

02

Form nri 11 2 may be required for various purposes such as opening a non-resident bank account, applying for specific investment schemes, obtaining loans, or transferring funds abroad.

03

The specific requirements for needing form nri 11 2 may vary depending on the jurisdiction and the purpose for which the form is required. It is important to refer to the relevant guidelines and instructions to determine if form nri 11 2 is necessary for your situation.

Fill

form

: Try Risk Free

People Also Ask about

What is the process of outward remittance?

An outward remittance (aka wire transfer outward remittance) is the process of transferring money (in the form of foreign exchange) from a worker or business, to another country. Incredibly, money transferred this way is now on par with the amount given in financial aid to some countries.

How much money can be transferred from NRO account to abroad?

Upto $1 million can be remitted outside India or transferred to your NRE account every year subject to some procedural compliances from NRO account. The money in NRO account can also be used for making regular local payments in rupee like rents for property, taxes.

What documents are required for outward remittance under LRS?

The following documentation is required from the remitter: Designating a branch of an authorised dealer bank through which all the remittances will be made. Furnishing Form A2 for purchase of foreign exchange. Providing Permanent Account Number (PAN)

How much money can NRI transfer out of India?

How much money can an NRI repatriate out of India? An NRI can freely transfer without any upper transaction limit from NRE and FCNR accounts. On the other hand, an NRI can remit only up to 1 USD million out of the balances of an NRO account, provided they meet the eligibility criteria. 2.

What is outward remittance certificate?

As the name suggests, outward remittance refers to sending money out, into the bank account of a beneficiary living overseas (except Nepal and Bhutan) by a resident Indian account holder. Ideally, these transfers can only be made in ance with purposes listed by the Foreign Exchange Management Act (FEMA) of 1999.

What is the purpose code S0021?

under Financial derivative transactions. S0021 Payments made on account of sale of share under Employee stock option. S0022 Investment in Indian Depositories Receipts (IDRs).

What are the rules for foreign remittance?

Liberalised Remittance Scheme (LRS) was brought into effect by the Reserve Bank of India in 2004. ing to it, residents of India can remit a maximum of $250,000 within a given financial year to individuals living overseas. This includes both capital and current account transactions.

What are the documents required for outward remittance?

The said Rule provides in case of foreign payment, the person making the payment is required to furnish Form 15CA and 15CB subject to certain exceptions. Form 15CB is a certificate issued by a Chartered Accountant as regards to rate of tax to be deducted on foreign payment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form nri 11 2 for eSignature?

When your form nri 11 2 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make changes in form nri 11 2?

With pdfFiller, it's easy to make changes. Open your form nri 11 2 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit form nri 11 2 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share form nri 11 2 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is form nri 11 2?

Form NRI 11 2 is a tax form used by Non-Resident Indians (NRIs) to report their income and fulfill tax obligations in India.

Who is required to file form nri 11 2?

Non-Resident Indians (NRIs) who have income earned in India are required to file Form NRI 11 2.

How to fill out form nri 11 2?

To fill out Form NRI 11 2, gather necessary financial information, input details about your income, deductions, and tax liability, and submit it to the relevant tax authorities.

What is the purpose of form nri 11 2?

The purpose of Form NRI 11 2 is to ensure that NRIs comply with Indian tax laws by reporting their income and calculating their tax obligations.

What information must be reported on form nri 11 2?

Form NRI 11 2 requires reporting personal details, income earned in India, applicable deductions, and the calculation of tax payable.

Fill out your form nri 11 2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Nri 11 2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.