Get the free ARIZONA FORM 140 PY Part-Year Resident Personal Income Tax Return 2014

Show details

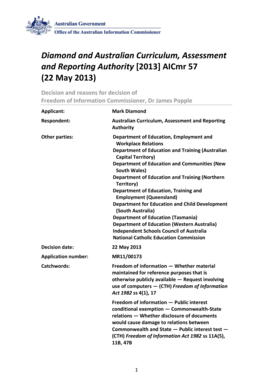

140PYCheck box 82F if filing under extension82FOR FISCAL YEAR BEGINNING MM D 2 0 1 4Last Espouses First Name and Middle Initial (if box 4 or 6 checked)Last Name AND ENDING1 Current Home Address number

We are not affiliated with any brand or entity on this form

Instructions and Help about arizona form 140 py

How to edit arizona form 140 py

How to fill out arizona form 140 py

Instructions and Help about arizona form 140 py

How to edit arizona form 140 py

To edit the Arizona Form 140 PY, you can utilize tools offered by pdfFiller. First, download the form in a compatible format. Next, upload the form to pdfFiller's platform, where you can make necessary adjustments, such as adding your personal information or modifying existing entries. Once you have completed editing the form, ensure to save your changes to avoid losing any modifications.

How to fill out arizona form 140 py

Filling out Arizona Form 140 PY requires careful attention to detail. Begin by providing your personal information, including your name, address, and Social Security number. Then, report your income from all sources, ensuring that you include any deductions and credits applicable to your situation. Follow the guidelines to complete additional schedules if necessary, and double-check all entries for accuracy before submission.

Latest updates to arizona form 140 py

Latest updates to arizona form 140 py

The most recent updates to Arizona Form 140 PY may include changes in tax rates, available deductions, or credits. It's essential to review the Arizona Department of Revenue's official website or consult tax professionals for the latest information to ensure compliance during tax filing.

All You Need to Know About arizona form 140 py

What is arizona form 140 py?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About arizona form 140 py

What is arizona form 140 py?

Arizona Form 140 PY is the state's individual income tax return for part-year residents. This form allows individuals who lived in Arizona for only part of the tax year to report their income earned while residing in the state.

What is the purpose of this form?

The purpose of Arizona Form 140 PY is to calculate the tax liability of part-year residents. It helps determine the amount of income, deductions, and credits that apply specifically to the period one lived in Arizona. This ensures that individuals pay only for the income generated while they were state residents.

Who needs the form?

Individuals who meet the criteria of part-year residence in Arizona must use Form 140 PY. This usually applies to those who have moved into or out of the state during the tax year and have earned income during their period of residency.

When am I exempt from filling out this form?

You may be exempt from filing Arizona Form 140 PY if your income is below the state’s minimum filing threshold, or if you are a full-time resident of another state. Additionally, certain individuals, such as minors with no income, may also be exempt.

Components of the form

Arizona Form 140 PY includes several sections: personal information, income reporting, deductions and credits, and a summary of taxes due. Each section demands specific details, such as wages, pension distributions, or other income types, as well as any applicable deductions permitted under Arizona tax law.

What are the penalties for not issuing the form?

Failing to file Arizona Form 140 PY can lead to penalties and interest on any unpaid tax. The Arizona Department of Revenue may impose a late filing penalty, which is a percentage of the owed tax. Furthermore, not filing the form can complicate future tax filings and may result in legal action.

What information do you need when you file the form?

When filing Arizona Form 140 PY, it is crucial to have various information at hand, including your federal tax return, W-2 forms, 1099 forms, and details about any adjustments to income. Additionally, ensure that you have your Social Security number and any relevant documentation for tax credits and deductions.

Is the form accompanied by other forms?

Arizona Form 140 PY may require accompanying forms or schedules, particularly if you have specific deductions or credits to claim. Commonly required forms include Schedule A for itemized deductions and Schedule CR for credits. It's important to review the form's instructions to determine any additional paperwork needed.

Where do I send the form?

After completing Arizona Form 140 PY, the next step is to submit it to the appropriate address. Generally, this will be the Arizona Department of Revenue. Depending on whether you are filing by mail or electronically, check the specific filing guidelines provided with the form to ensure correct submission.

See what our users say