Get the free 2015 Schedule KF Beneficiaries Share of Minnesota Taxable Income

Show details

152112015 Schedule OF, Beneficiaries Share of Minnesota Taxable Income

Fiduciary: Complete and provide Schedule OF to each nonresident beneficiary with Minnesota source income and

any Minnesota

We are not affiliated with any brand or entity on this form

Instructions and Help about 2015 schedule kf beneficiaries

How to edit 2015 schedule kf beneficiaries

How to fill out 2015 schedule kf beneficiaries

Instructions and Help about 2015 schedule kf beneficiaries

How to edit 2015 schedule kf beneficiaries

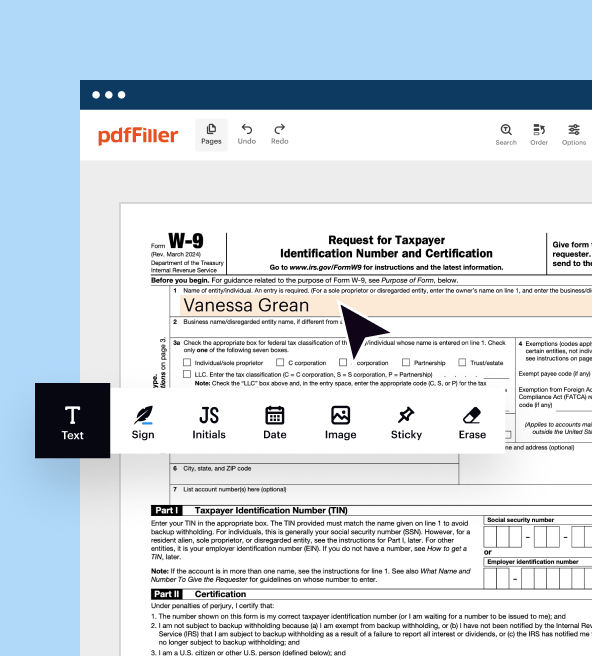

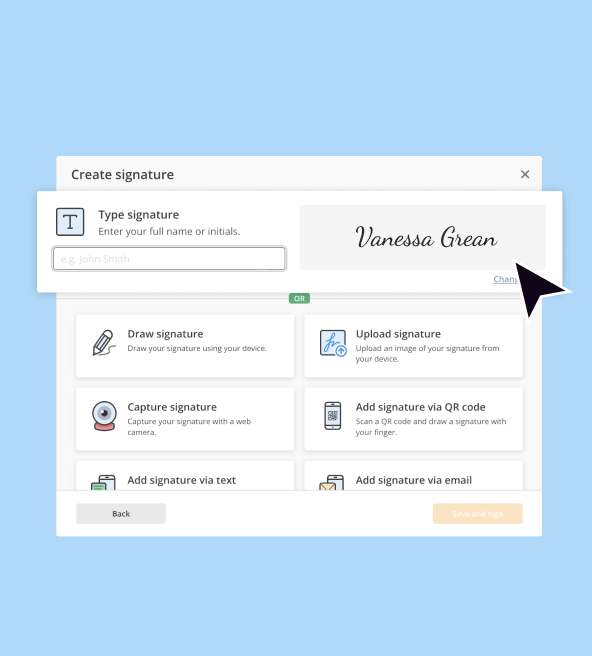

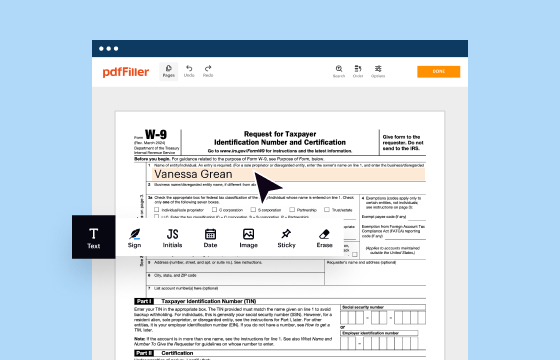

To edit the 2015 Schedule KF Beneficiaries form, download the form in its PDF format. Use a PDF editor, such as pdfFiller, to make necessary changes directly on the form. Ensure all data is accurate before saving the edited version for submission.

How to fill out 2015 schedule kf beneficiaries

Filling out the 2015 Schedule KF Beneficiaries form involves several key steps: identify the beneficiary, provide necessary tax identification numbers, and detail each beneficiary's share of the income. It is essential to cross-check the information with related financial documents to avoid errors. Follow this structured guide for accurate completion.

Latest updates to 2015 schedule kf beneficiaries

Latest updates to 2015 schedule kf beneficiaries

Check for any IRS updates regarding the 2015 Schedule KF Beneficiaries to ensure compliance. This may include modifications to tax rules or filing procedures that could affect how you complete the form.

All You Need to Know About 2015 schedule kf beneficiaries

What is 2015 schedule kf beneficiaries?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About 2015 schedule kf beneficiaries

What is 2015 schedule kf beneficiaries?

The 2015 Schedule KF Beneficiaries is a tax form used by entities to report income that is distributed to beneficiaries. This form specifically details how much each beneficiary receives from trusts or estates, ensuring accurate tax reporting for both the beneficiary and the estate or trust.

What is the purpose of this form?

The purpose of the 2015 Schedule KF Beneficiaries form is to allocate and report the income received by beneficiaries from a trust or estate. This ensures that beneficiaries report their share of the income on their individual tax returns, facilitating the IRS's tracking of tax obligations.

Who needs the form?

Individuals or entities that manage a trust or estate must complete the 2015 Schedule KF Beneficiaries for any beneficiaries receiving distributed income. This typically includes trustees or estate administrators tasked with ensuring proper tax reporting.

When am I exempt from filling out this form?

You may be exempt from filling out the 2015 Schedule KF Beneficiaries if there are no beneficiaries receiving taxable income from the trust or estate in the given year. Additionally, if the entity has not generated any income requiring disclosure, the form may not be necessary.

Components of the form

The 2015 Schedule KF Beneficiaries form consists of several sections, including details about the trust or estate, beneficiary information, and amounts distributed to each beneficiary. Accurate data entry in each component is crucial for compliance with IRS regulations.

What are the penalties for not issuing the form?

Failure to issue the 2015 Schedule KF Beneficiaries form may result in penalties imposed by the IRS. These can include a fine for each form that is not filed or filed late, which can significantly increase the overall tax liability of the estate or trust.

What information do you need when you file the form?

When filing the 2015 Schedule KF Beneficiaries form, you will need beneficiaries' names, contact information, tax identification numbers, and the amounts distributed to each beneficiary. Ensure all figures match the associated financial records for accuracy.

Is the form accompanied by other forms?

The 2015 Schedule KF Beneficiaries form may need to be filed along with the Form 1041, U.S. Income Tax Return for Estates and Trusts, as they complement each other in reporting income. Review IRS guidelines to confirm any additional forms that may be necessary.

Where do I send the form?

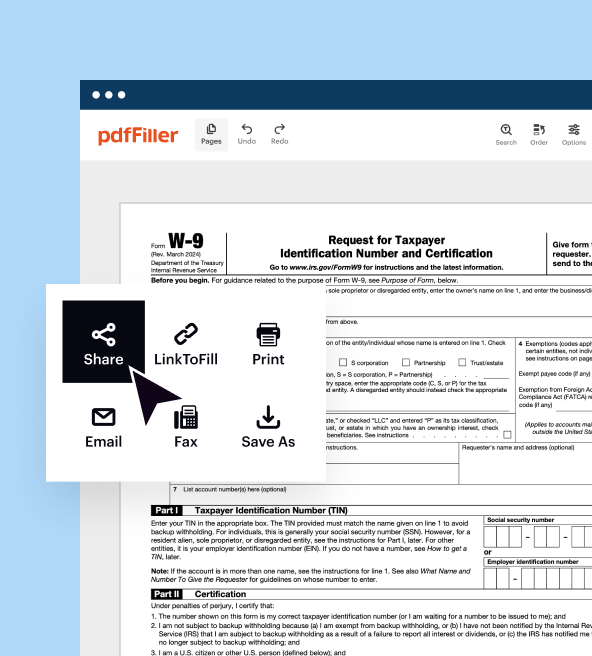

The completed 2015 Schedule KF Beneficiaries form must be mailed to the appropriate IRS address based on the estate or trust's location. Check the latest IRS instructions for exact submission addresses and ensure you are using the correct mailing method to avoid delays.

See what our users say