Get the free 2017 Schedule KF Beneficiary's Share of Minnesota Taxable Income

Show details

*177111×2017 Schedule OF, Beneficiaries Share of Minnesota Taxable Income

Fiduciary: Complete and provide Schedule OF to each nonresident beneficiary with Minnesota source income and

any Minnesota

We are not affiliated with any brand or entity on this form

Instructions and Help about 2017 Schedule KF Beneficiaries

How to edit 2017 Schedule KF Beneficiaries

How to fill out 2017 Schedule KF Beneficiaries

Instructions and Help about 2017 Schedule KF Beneficiaries

How to edit 2017 Schedule KF Beneficiaries

To edit the 2017 Schedule KF Beneficiaries, open the form in a PDF editing tool like pdfFiller. Ensure that you have the correct version of the form by downloading it from the IRS website, or use your previously completed copy. Once opened, use the editing features to update any necessary information such as beneficiary details or financial data. Save your edits once complete.

How to fill out 2017 Schedule KF Beneficiaries

When filling out the 2017 Schedule KF Beneficiaries, start by gathering the required information such as the beneficiaries' names, addresses, Social Security numbers, and the relevant financial data. Ensure you are applying the correct amounts in each section as outlined in the instructions provided with the form. You can also fill it directly using online tools like pdfFiller for a streamlined process.

Latest updates to 2017 Schedule KF Beneficiaries

Latest updates to 2017 Schedule KF Beneficiaries

For the 2017 Schedule KF Beneficiaries, there are no significant updates from the IRS, but it is important to always review the latest IRS guidelines to ensure compliance with current tax regulations.

All You Need to Know About 2017 Schedule KF Beneficiaries

What is 2017 Schedule KF Beneficiaries?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About 2017 Schedule KF Beneficiaries

What is 2017 Schedule KF Beneficiaries?

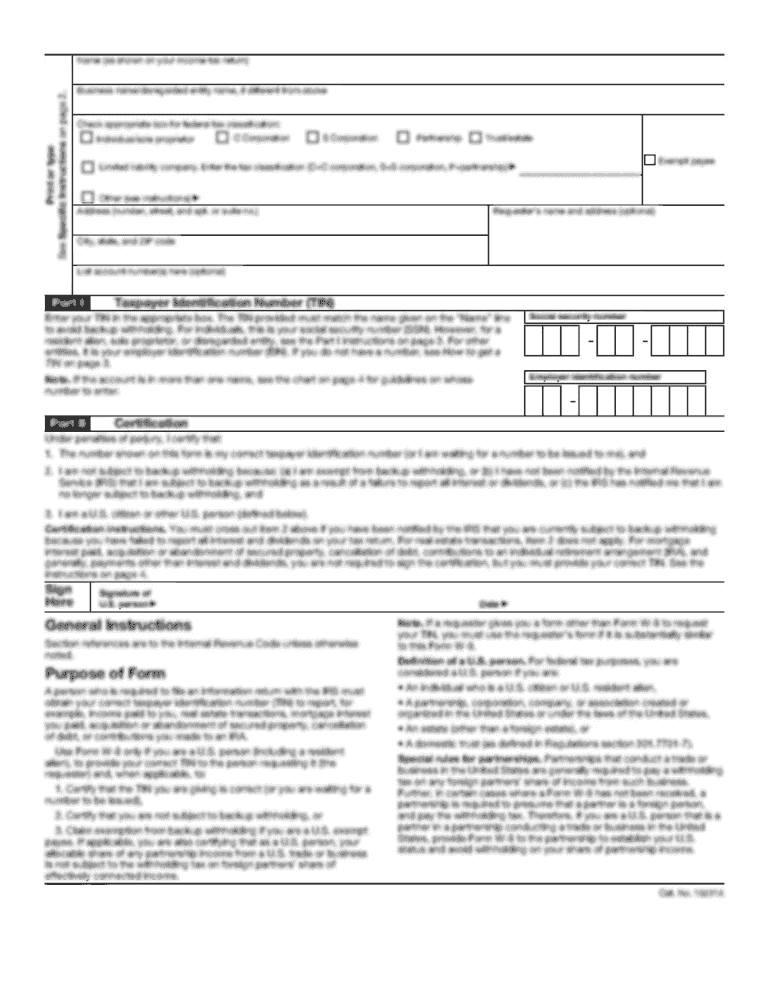

The 2017 Schedule KF Beneficiaries is a form utilized to report income and distributions made to beneficiaries of certain trusts or estates. It is specifically designed to provide the IRS with details on income received by beneficiaries, which they need for proper tax identification and reporting.

What is the purpose of this form?

The purpose of the 2017 Schedule KF Beneficiaries is to ensure that all income distributed to beneficiaries is reported accurately to the IRS. This helps in maintaining tax compliance and in calculating the tax owed by the beneficiaries on that income. The form serves as a critical document for reporting and can affect the tax liabilities of the recipients.

Who needs the form?

Trustees or executors of estates must file the 2017 Schedule KF Beneficiaries if they are distributing income to beneficiaries. This form is required for tax purposes, ensuring that the income reported is aligned with the distributions made. Beneficiaries who receive these distributions should also be aware of this form for their individual tax filing.

When am I exempt from filling out this form?

Exemptions from filing the 2017 Schedule KF Beneficiaries typically apply to scenarios where no distributions are made to beneficiaries during the tax year. If the trust or estate has no income or realizes no distributable funds, the filing is not necessary. However, all conditions should be reviewed conscientiously to avoid penalties.

Components of the form

The 2017 Schedule KF Beneficiaries includes several key components: the trust name, the type of trust, and the detailed information for each beneficiary. It consists of sections for reporting distributions, types of payments received, and the total income allocated to each beneficiary. Accurate filling of all sections is crucial for tax compliance.

What are the penalties for not issuing the form?

If a trustee or executor fails to issue the 2017 Schedule KF Beneficiaries when required, they may face penalties from the IRS. These can include financial penalties assessed per form not filed or submitted timely. The exact amount may depend on the duration of the failure to file and whether the trustee acted with reasonable cause.

What information do you need when you file the form?

When filing the 2017 Schedule KF Beneficiaries, you will need accurate information regarding each beneficiary, including their Social Security number, names, and addresses. Additionally, the total amounts distributed to each beneficiary over the tax year should be included. Ensure all data is precise to avoid any issues with the IRS.

Is the form accompanied by other forms?

The 2017 Schedule KF Beneficiaries may necessitate the inclusion of other forms, such as the Form 1041 (U.S. Income Tax Return for Estates and Trusts) if the estate or trust is required to file that tax return. It is essential to verify any additional forms needed based on the specific situation of the estate or trust.

Where do I send the form?

The completed 2017 Schedule KF Beneficiaries should be sent to the appropriate IRS service center based on the location of the executor or trustee. The mailing address will depend on whether the trust has a balance due or is requesting a refund, and this should be checked according to IRS mailing guidelines.

See what our users say