Get the free 760 IP - Automatic Extension Payment 2015

Show details

2015

FORM 760IPVirginia Automatic Extension Payment

Voucher for Individuals

MAKE THE MOVE TO ELECTRONIC Filing you owe tentative tax, use the Departments website: www.tax.virginia.gov.

It is the

We are not affiliated with any brand or entity on this form

Instructions and Help about 760 ip - automatic

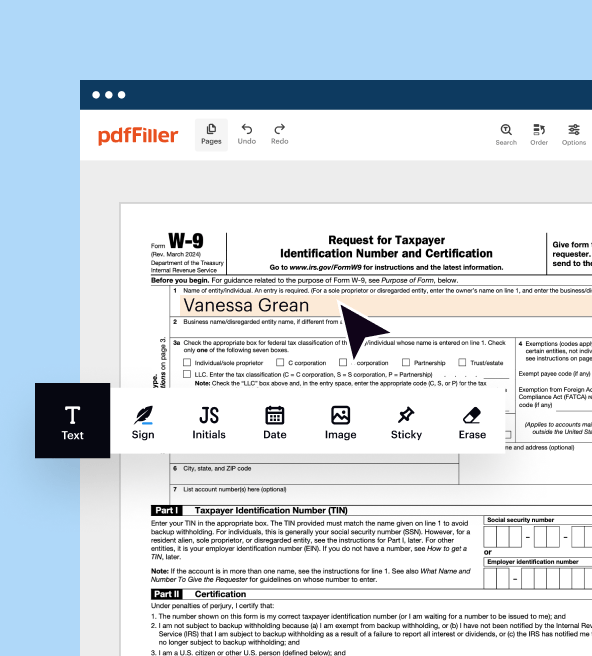

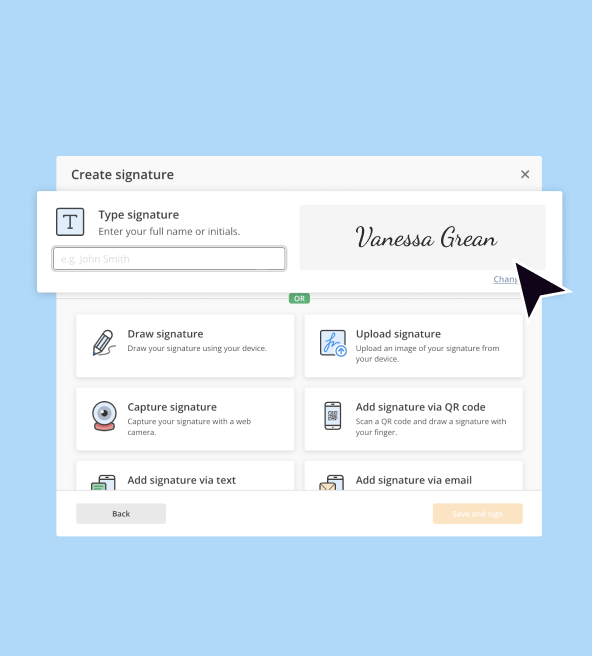

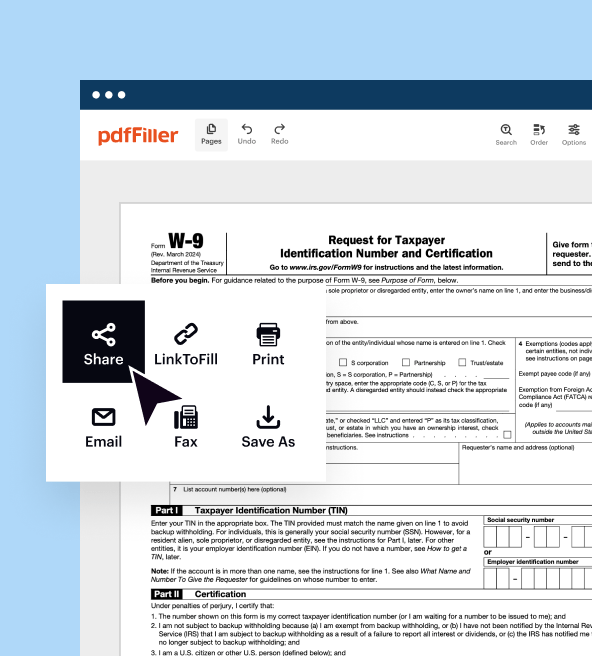

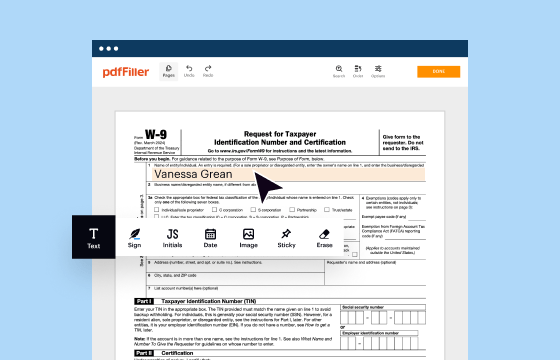

How to edit 760 ip - automatic

How to fill out 760 ip - automatic

Instructions and Help about 760 ip - automatic

How to edit 760 ip - automatic

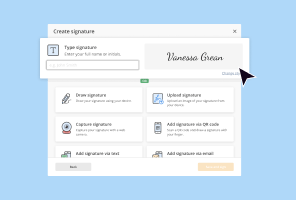

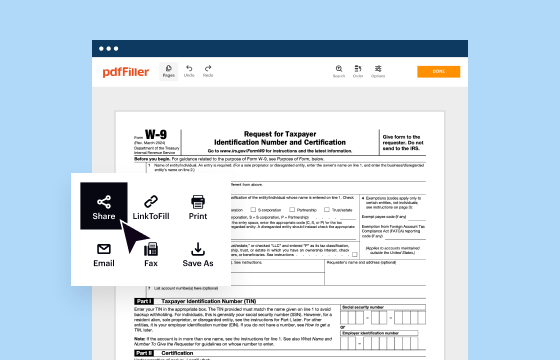

To edit the 760 ip - automatic tax form, start by downloading the form from the Virginia Department of Taxation's website. Once downloaded, open the form using a PDF editing tool like pdfFiller. After making the necessary changes, save your edited document to preserve the modifications.

How to fill out 760 ip - automatic

Filling out the 760 ip - automatic form requires careful attention to detail. Follow these steps to ensure accuracy:

01

Obtain the correct version of the form from the Virginia Department of Taxation's website.

02

Gather all necessary financial documents, including income statements and exemption certificates.

03

Complete each section of the form, ensuring that all required fields are filled out.

04

Review the completed form for errors or omissions before submitting it.

Latest updates to 760 ip - automatic

Latest updates to 760 ip - automatic

Stay informed about any changes to the 760 ip - automatic tax form by regularly checking the Virginia Department of Taxation's website. Updates may include changes to filing procedures, deadlines, or eligibility criteria.

All You Need to Know About 760 ip - automatic

What is 760 ip - automatic?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About 760 ip - automatic

What is 760 ip - automatic?

The 760 ip - automatic form is an income tax return designed specifically for individuals who qualify for a simplified tax filing process in Virginia. It is primarily aimed at those who meet certain income thresholds and tax guidelines set by the state.

What is the purpose of this form?

The purpose of the 760 ip - automatic form is to facilitate the income tax filing process for eligible Virginia residents. This form allows filers to report their income and determine their tax liabilities efficiently, often resulting in a streamlined refund process.

Who needs the form?

Individuals who meet the eligibility criteria for the automatic filing process in Virginia need to complete the 760 ip - automatic form. Generally, this form is for residents with a straightforward tax situation, including single filers or those with simple income sources.

When am I exempt from filling out this form?

You may be exempt from filing the 760 ip - automatic form if you do not meet the income requirements or if your income sources are complex and require different tax forms. Additionally, individuals who are claimed as dependents or have no income are typically not required to file.

Components of the form

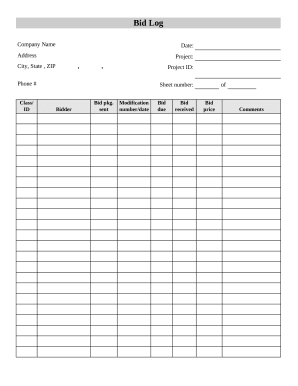

The 760 ip - automatic form includes various sections requiring personal identification information, income details, and any applicable deductions or credits. Ensure that each section is completed accurately to avoid delays in processing.

What are the penalties for not issuing the form?

Failure to issue or file the 760 ip - automatic form can result in penalties, including fines and interest on any unpaid taxes. It's critical to file on time to avoid these additional costs.

What information do you need when you file the form?

When filing the 760 ip - automatic form, you will need identification details, income statements (such as W-2s or 1099s), and any documentation supporting deductions or credits claimed. Having this information ready will help streamline the filing process.

Is the form accompanied by other forms?

Typically, the 760 ip - automatic form may not require additional forms if you meet the criteria for automatic filing. However, certain circumstances may necessitate accompanying forms, particularly if you are claiming specific credits or deductions.

Where do I send the form?

Once completed, the 760 ip - automatic form should be mailed to the address provided by the Virginia Department of Taxation. Ensure that you verify the correct mailing address to avoid processing delays.

See what our users say