Get the free 2016 MINNESOTA INDIVIDUAL INCOME FORMS AND INSTRUCTIONS FORM M1

Show details

SAME DEPARTMENT. NEW LOOK.2016MINNESOTA

INDIVIDUAL

INCOME FORMS AND INSTRUCTIONS FORM M1MINNESOTA INCOME TAX RETURN SCHEDULE M1WMINNESOTA INCOME TAX WITHHELD SCHEDULE M1MA

MARRIAGE CREDIT SCHEDULE

We are not affiliated with any brand or entity on this form

Instructions and Help about 2016 Minnesota individual income

How to edit 2016 Minnesota individual income

How to fill out 2016 Minnesota individual income

Instructions and Help about 2016 Minnesota individual income

How to edit 2016 Minnesota individual income

Editing the 2016 Minnesota individual income tax form can be streamlined using efficient tools. For instance, pdfFiller provides easy ways to modify your form by allowing digital alterations. Simply upload your completed form to pdfFiller, and you can make necessary edits without starting from scratch.

How to fill out 2016 Minnesota individual income

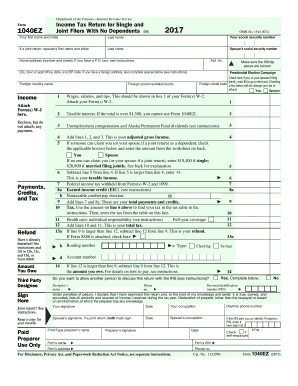

Filling out the 2016 Minnesota individual income tax form requires specific taxpayer information. Begin by entering your name, address, and Social Security number at the top of the form. Follow through the sections which outline income sources, deductions, and credits applicable to your situation. Ensure all figures are accurate, as inaccuracies can lead to delays or penalties.

Latest updates to 2016 Minnesota individual income

Latest updates to 2016 Minnesota individual income

Stay informed about any updates related to the 2016 Minnesota individual income tax form, including changes in deductions or credits applicable due to recent tax legislation. Review the Minnesota Department of Revenue's official announcements for the most current information, ensuring compliance with state tax regulations.

All You Need to Know About 2016 Minnesota individual income

What is 2016 Minnesota individual income?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About 2016 Minnesota individual income

What is 2016 Minnesota individual income?

The 2016 Minnesota individual income tax form is a document used by residents to report their annual income to the state. This form calculates tax liability based on income, deductions, and credits applicable to the taxpayer’s situation for the year 2016.

What is the purpose of this form?

The purpose of the 2016 Minnesota individual income tax form is to assess the tax due based on a taxpayer's income for that year. It allows the Minnesota Department of Revenue to collect taxes needed for state services and programs. Ensuring accurate completion is essential for proper tax compliance.

Who needs the form?

The form is necessary for all Minnesota residents who earn income above a specified threshold during the year. This includes those with wages, self-employment income, or other revenue sources that require reporting. Non-residents earning Minnesota-source income may also need to file this form.

When am I exempt from filling out this form?

Certain individuals may be exempt from filing the 2016 Minnesota individual income form, such as those whose income falls below the minimum filing threshold defined by state regulations. Additionally, residents who solely receive Social Security benefits are typically not required to file.

Components of the form

The 2016 Minnesota individual income tax form consists of several sections, including personal information, income computative lines, deductions, tax credits, and signature. Each component plays a role in calculating the total tax liability or potential refund, making it essential to fill each part accurately.

What are the penalties for not issuing the form?

Failing to file the 2016 Minnesota individual income tax form on time can result in penalties, including late fees and interest on the owed taxes. The Minnesota Department of Revenue enforces these penalties to encourage timely compliance. Repeated violations can lead to increased penalties, further complicating the taxpayer's situation.

What information do you need when you file the form?

To file the 2016 Minnesota individual income tax form, gather relevant documents including W-2 forms,1099s, and records of any other income. Additionally, you will need information regarding deductions like mortgage interest, property taxes, and educational expenses to ensure your filing reflects all applicable credits.

Is the form accompanied by other forms?

The 2016 Minnesota individual income tax form may require accompanying forms depending on your specific tax situation. Common additional forms include schedules for reporting certain types of income or deductions, such as Schedule M1 for adjustments or Schedule M1SA for specific credits. Always refer to the form instructions to ensure all necessary documentation is submitted.

Where do I send the form?

To submit the 2016 Minnesota individual income tax form, send it to the address designated by the Minnesota Department of Revenue. The mailing address varies based on whether you enclose a payment or not. Check the instructions included with the form for the correct address to ensure timely processing.

See what our users say