Get the free PERSONAL INDIVIDUAL TAX PREPARATION GUIDER PERSONAL INCOME TAX RETURNS PA40

Show details

PERSONAL INDIVIDUAL TAX

PREPARATION GUIDER PERSONAL INCOME TAX RETURNS

PA40

DFO02 (EX) 1216PErsOnal individual tax Preparation guide.revenue.pa.before reviewing how to assist taxpayers in the preparation

We are not affiliated with any brand or entity on this form

Instructions and Help about personal individual tax preparation

How to edit personal individual tax preparation

How to fill out personal individual tax preparation

Instructions and Help about personal individual tax preparation

How to edit personal individual tax preparation

To edit your personal individual tax preparation, first, obtain a copy of the specific tax form required for your situation, such as Form 1040. You can use tools like pdfFiller to make edits easily. Upload the form to pdfFiller, which allows for straightforward editing of text fields, checkboxes, and dates. After making the necessary changes, ensure you save and download the edited version for your records.

How to fill out personal individual tax preparation

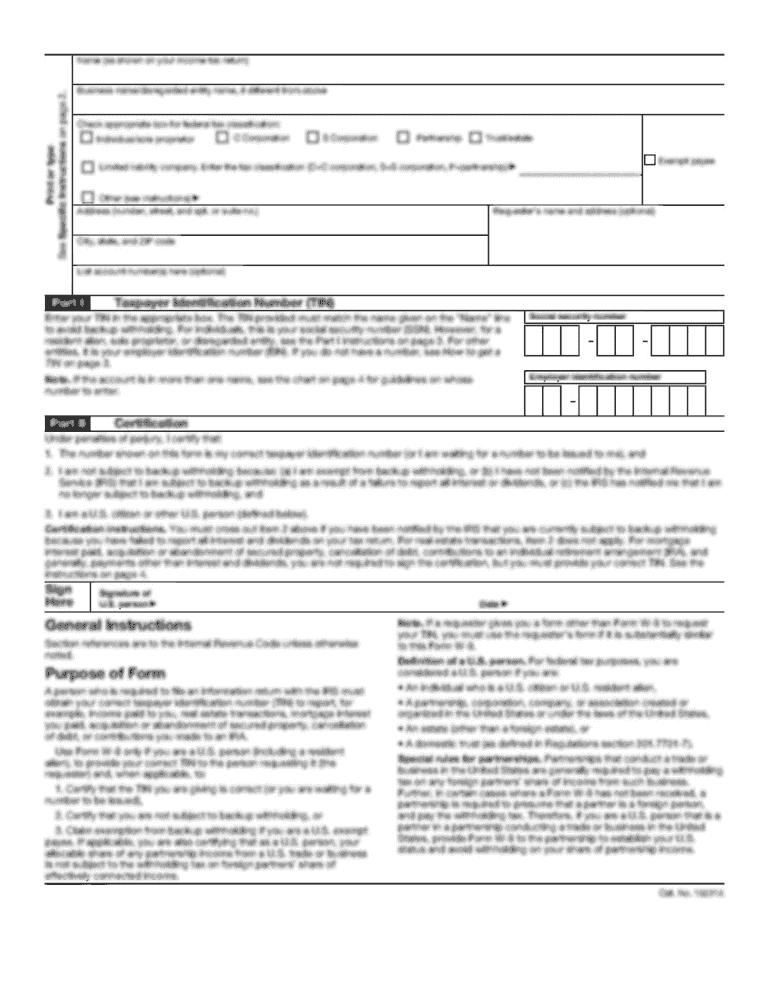

Filling out personal individual tax preparation involves a series of steps to ensure accuracy and compliance. Start by gathering all relevant financial documents, including W-2s, 1099s, and any other income statements. Use the following steps to complete your personal tax form:

01

Review the completion instructions on the form.

02

Enter your personal information, such as name, address, and Social Security number.

03

Document all sources of income comprehensively.

04

Claim applicable deductions and credits.

05

Calculate your tax liability using the provided tax tables.

06

Sign and date the form before submission.

Latest updates to personal individual tax preparation

Latest updates to personal individual tax preparation

As of 2023, there have been updates regarding deduction limits and tax credits that may affect personal individual tax preparation. It is crucial to stay informed about these changes to maximize your potential refunds and reduce your taxable income. Always refer to the IRS website or official publications for the latest guidelines and forms.

All You Need to Know About personal individual tax preparation

What is personal individual tax preparation?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About personal individual tax preparation

What is personal individual tax preparation?

Personal individual tax preparation is the process through which U.S. taxpayers organize, complete, and submit their federal and, if applicable, state income taxes. It typically involves filing the IRS Form 1040 or its variations, depending on individual financial circumstances. Accurate preparation is essential to comply with tax laws and avoid penalties.

What is the purpose of this form?

The primary purpose of the personal individual tax preparation form is to report annual income to the Internal Revenue Service (IRS) while accounting for deductions and credits. This enables the IRS to assess the taxpayer's tax liability or refund due for the tax year. Different variations of the form may address specific situations, such as self-employment or foreign income.

Who needs the form?

Any U.S. citizen or resident alien with income must use the personal individual tax preparation form to report earnings. This includes employees, independent contractors, and self-employed individuals. Additionally, you may need to file if you meet certain income thresholds set by the IRS, even if you have no tax liability.

When am I exempt from filling out this form?

You may be exempt from filling out the personal individual tax preparation form if your gross income falls below the IRS filing threshold for your age and filing status. Additionally, certain low-income workers may qualify for the Earned Income Tax Credit (EITC) or other benefits, allowing them to file a return without owing taxes. However, it's advisable to check the IRS guidelines each tax year for any exemptions.

Components of the form

The personal individual tax preparation form consists of several key components, including personal information, income reporting, deductions, tax credits, and a summary of tax calculations. Each section requires specific details, such as your filing status and any relevant supporting documentation. Familiarizing yourself with these components can help ensure accurate completion and reporting.

What are the penalties for not issuing the form?

Failing to submit the personal individual tax preparation form by the deadline can result in significant penalties. The IRS may impose a failure-to-file penalty, which is typically a percentage of the unpaid tax amount for each month the return is late. Additionally, interest accrues on any unpaid taxes from the original due date, compounding the total owed.

What information do you need when you file the form?

When filing your personal individual tax preparation form, you will need several pieces of information, including:

01

Your Social Security number or Taxpayer Identification Number (TIN).

02

W-2s and 1099s showcasing various income sources.

03

Records of other income types (rental, dividend, etc.).

04

Deductions and credits documentation, such as mortgage interest statements.

05

Bank information for direct deposit of any refund.

Is the form accompanied by other forms?

Depending on your financial situation, your personal individual tax preparation form may need to be accompanied by various schedules and forms. For instance, if you have self-employment income, you may need to attach Schedule C. Always review IRS requirements for additional forms that apply to your specific tax situation.

Where do I send the form?

The submission location for your personal individual tax preparation form depends on your state of residence and whether you are submitting electronically or via mail. For mailed forms, refer to the IRS website for addresses designated for different forms and states. If you file electronically, most tax preparation software includes direct submission options to the IRS.

See what our users say