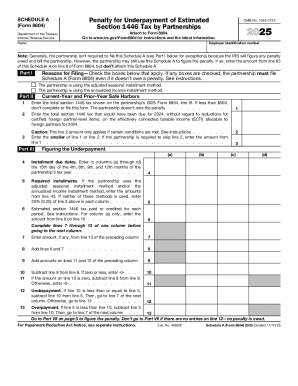

IRS 8804 - Schedule A 2018 free printable template

Instructions and Help about IRS 8804 - Schedule A

How to edit IRS 8804 - Schedule A

How to fill out IRS 8804 - Schedule A

About IRS 8804 - Schedule A 2018 previous version

What is IRS 8804 - Schedule A?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

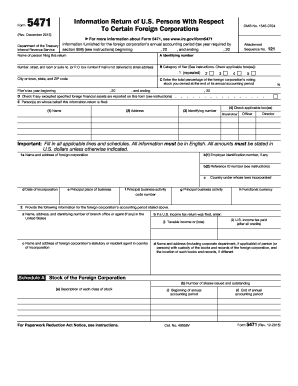

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

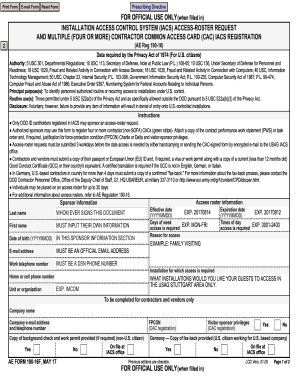

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8804 - Schedule A

What should I do if I realize there was a mistake after submitting the 8804 instructions 2019?

If you discover an error after filing your 8804 instructions 2019, you can amend your submission by using the appropriate correction process. Generally, this involves filing an amended return and including the necessary details about what was corrected. Ensure you keep records of your original and amended filings for future reference.

How can I verify if my 8804 instructions 2019 have been received and processed?

You can track the status of your 8804 instructions 2019 by checking online or contacting the relevant tax authority directly. Keeping a record of your submission confirmation can help expedite any inquiries regarding its processing status.

Are there any common errors filers should avoid when submitting 8804 instructions 2019?

Yes, common errors include mismatched taxpayer identification numbers, incorrect reporting of amounts, and failing to include all necessary information. To reduce these mistakes, double-check your entries and ensure all documentation aligns with the figures reported in your 8804 instructions 2019.

Is electronic filing of 8804 instructions 2019 secure, and what are the technical requirements?

Electronic filing of the 8804 instructions 2019 is generally secure, provided you use approved software that complies with IRS standards. Ensure your internet connection is stable and that your browser is up to date to avoid technical issues during the submission process.

What steps should I take if I receive a notice or letter regarding my 8804 instructions 2019 from the IRS?

If you receive a notice about your 8804 instructions 2019, read it carefully to understand the issue raised. Prepare any documentation requested and respond promptly to clarify any discrepancies. It’s advisable to consult a tax professional for assistance if the notice requires complex information.