Get the free Arizona Form 309 Credit for Taxes Paid to Another State or Country 2017

Show details

Arizona Form3092017Credit for Taxes Paid to Another State or CountryInclude with your return. A separate form must be filed for each state or country for which a credit is claimed.

For the calendar

We are not affiliated with any brand or entity on this form

Instructions and Help about Arizona Form 309 Credit

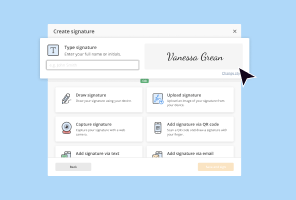

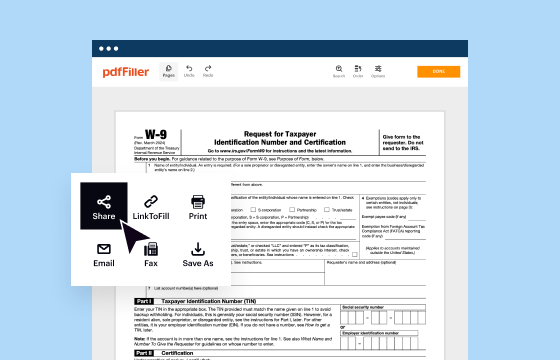

How to edit Arizona Form 309 Credit

How to fill out Arizona Form 309 Credit

Instructions and Help about Arizona Form 309 Credit

How to edit Arizona Form 309 Credit

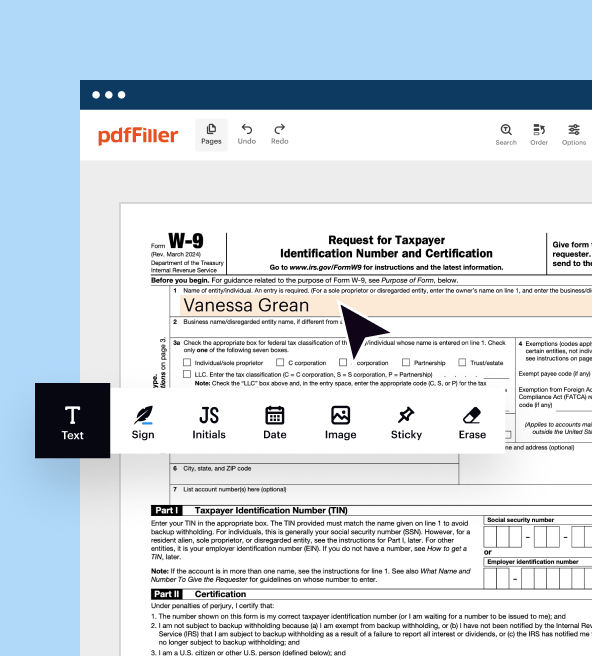

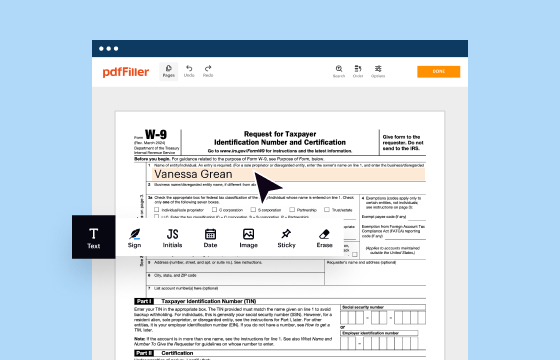

To edit Arizona Form 309 Credit, you can utilize a PDF editing tool like pdfFiller. This tool allows you to upload your existing form, make necessary adjustments, and save the updated document for filing. Ensure that any changes comply with IRS guidelines to avoid potential penalties.

How to fill out Arizona Form 309 Credit

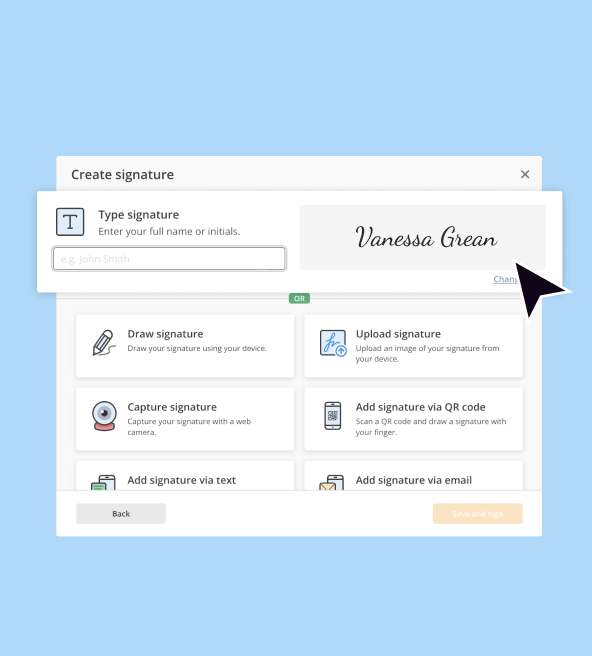

Filling out Arizona Form 309 Credit requires accurate information regarding your tax situation. Begin by entering your personal information, including your name and Social Security number. Next, provide details regarding your income and any qualifying credits. It's essential to double-check all entered data for accuracy before submitting.

Latest updates to Arizona Form 309 Credit

Latest updates to Arizona Form 309 Credit

Arizona Form 309 Credit may undergo revisions each tax year. Ensure you’re using the latest version of the form by checking the Arizona Department of Revenue website or consulting with a tax professional. Staying updated is crucial to compliance and maximizing your eligible credits.

All You Need to Know About Arizona Form 309 Credit

What is Arizona Form 309 Credit?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About Arizona Form 309 Credit

What is Arizona Form 309 Credit?

Arizona Form 309 Credit is a tax return form used to claim a credit available to eligible taxpayers. This form is specific to Arizona's tax regulations and offers taxpayers the opportunity to reduce their state income tax liability based on qualifying expenses.

What is the purpose of this form?

The purpose of Arizona Form 309 Credit is to allow taxpayers to apply for tax credits that can reduce the total amount of state income tax owed. The form provides a structured way for taxpayers to report their qualifying expenses that might otherwise go unclaimed.

Who needs the form?

Taxpayers who qualify for specific credits related to income, expenses, or other qualifying measures are required to file Arizona Form 309 Credit. This includes individuals who have incurred eligible expenditures in areas such as education, health, or energy conservation.

When am I exempt from filling out this form?

You may be exempt from filling out Arizona Form 309 Credit if your income is below the threshold for tax liability or if you do not have any qualifying expenses. Additionally, certain non-profit organizations may also be exempt from filing this form.

Components of the form

The components of Arizona Form 309 Credit typically include the taxpayer's identifying information, a section to detail qualifying credits, and a calculation area for the credit being claimed. Accurate completion of all sections is critical for successful processing.

Due date

The due date for submitting Arizona Form 309 Credit generally aligns with the state income tax filing deadline. This is typically April 15 of each year unless the date falls on a weekend or holiday, in which case the deadline may be adjusted.

What are the penalties for not issuing the form?

Penalties for not issuing Arizona Form 309 Credit can include late filing fees and additional interest on any unpaid taxes. Failure to comply with filing requirements may also result in disqualification from claiming the eligible credits in future tax years.

What information do you need when you file the form?

When filing Arizona Form 309 Credit, you will need personal identification details, information on qualifying expenses, income figures, and any supporting documentation that verifies your claims. Accurate and complete records help ensure your filing is processed smoothly.

Is the form accompanied by other forms?

Arizona Form 309 Credit may need to be submitted alongside additional forms or documentation, depending on the nature of the claim. This could include supporting schedules or tax documentation that substantiates the credits you are claiming.

Where do I send the form?

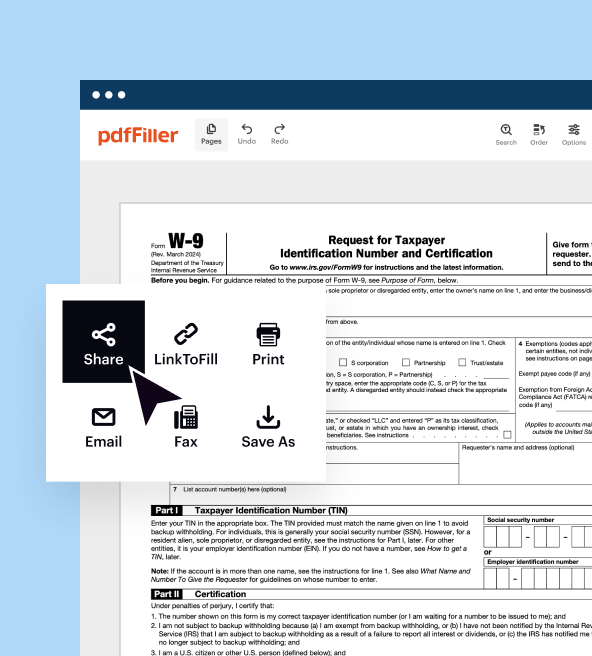

Arizona Form 309 Credit should be mailed to the address specified in the form's instructions. Typically, this will be the Arizona Department of Revenue. Always verify the current mailing address with the official website or tax resources to ensure proper submission.

See what our users say