Get the free 2015 COLORADO ALTERNATIVE Minimum Tax Computation Schedule

Instructions and Help about 2015 colorado alternative minimum

How to edit 2015 colorado alternative minimum

How to fill out 2015 colorado alternative minimum

Latest updates to 2015 colorado alternative minimum

All You Need to Know About 2015 colorado alternative minimum

What is 2015 colorado alternative minimum?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

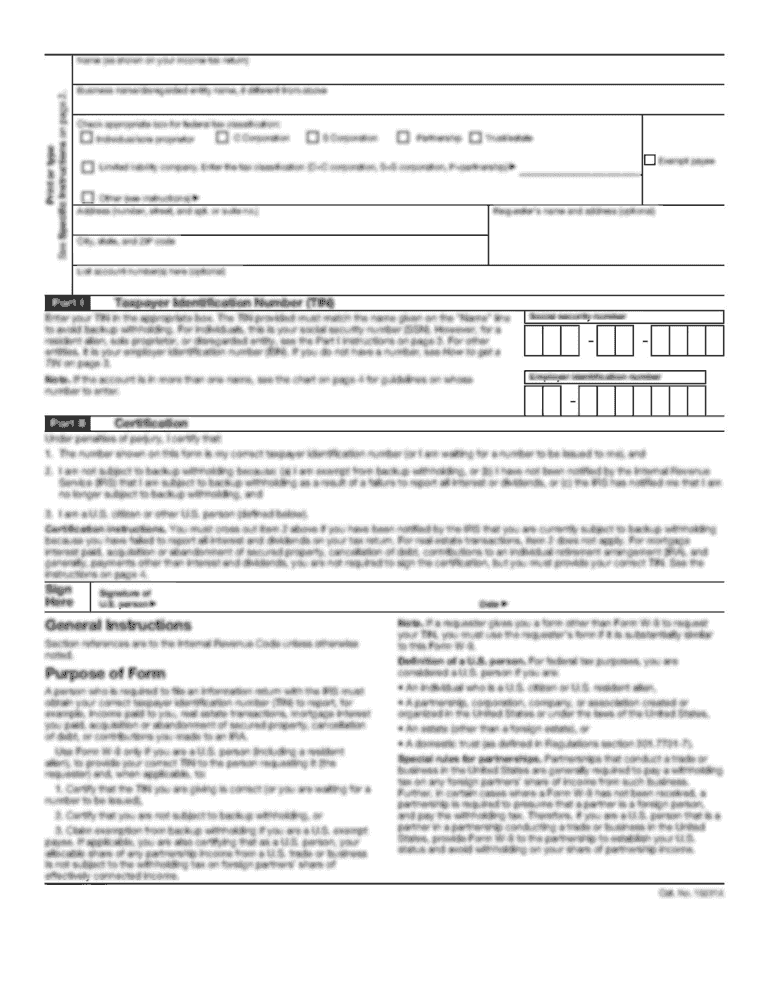

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about 2015 colorado alternative minimum

How can I correct mistakes made on my 2015 Colorado alternative minimum?

If you discover errors after submitting your 2015 Colorado alternative minimum, you can submit an amended form. This involves filling out a new alternative minimum with corrections noted and clearly marking it as an amended return. Make sure to explain the changes and provide any necessary documentation to support your amendments.

What should I do if my 2015 Colorado alternative minimum submission is rejected?

In the event that your 2015 Colorado alternative minimum is rejected, you should first review the e-file rejection codes provided. These codes often indicate the specific issue that needs to be addressed. Once you've identified the problem, correct it and resubmit your form as soon as possible to ensure compliance.

How long should I retain records related to my 2015 Colorado alternative minimum?

It is advisable to retain records related to your 2015 Colorado alternative minimum for at least three years after the filing date. This period helps ensure you have documentation available in case of audits or inquiries. Always store these records securely to protect your personal data.

Can someone e-file the 2015 Colorado alternative minimum on my behalf?

Yes, if you have authorized a representative or have a power of attorney, they can e-file the 2015 Colorado alternative minimum on your behalf. Make sure they have all necessary documentation and access to the relevant information for accurate submission.

What common errors should I watch out for when filing the 2015 Colorado alternative minimum?

Common errors when filing the 2015 Colorado alternative minimum might include incorrect Social Security numbers, missing signatures, or failing to include required income sources. Carefully reviewing your form before submission can help you avoid these pitfalls and ensure a smoother filing process.