Get the free 2016 COLORADO ALTERNATIVE Minimum Tax Instructions for Part Year and Nonresidents

Show details

*DONATED×DR 0104AMT (11/16/16)

COLORADO DEPARTMENT OF REVENUE

Denver CO 802610005

www.TaxColorado.comAlternative Minimum

Tax Instructions for Part Year and Nonresidents In the case of a nonresident,

We are not affiliated with any brand or entity on this form

Instructions and Help about 2016 Colorado alternative minimum

How to edit 2016 Colorado alternative minimum

How to fill out 2016 Colorado alternative minimum

Instructions and Help about 2016 Colorado alternative minimum

How to edit 2016 Colorado alternative minimum

Editing the 2016 Colorado alternative minimum tax form can be done easily using pdfFiller. Simply upload the PDF file to the platform. Once uploaded, you can access various editing tools that allow you to modify text fields, add signatures, or fill in required information. After making changes, ensure to save the updated document for your records.

How to fill out 2016 Colorado alternative minimum

To properly fill out the 2016 Colorado alternative minimum tax form, first gather all necessary financial documents, including prior tax returns and any relevant income statements. Follow these steps to complete the form:

01

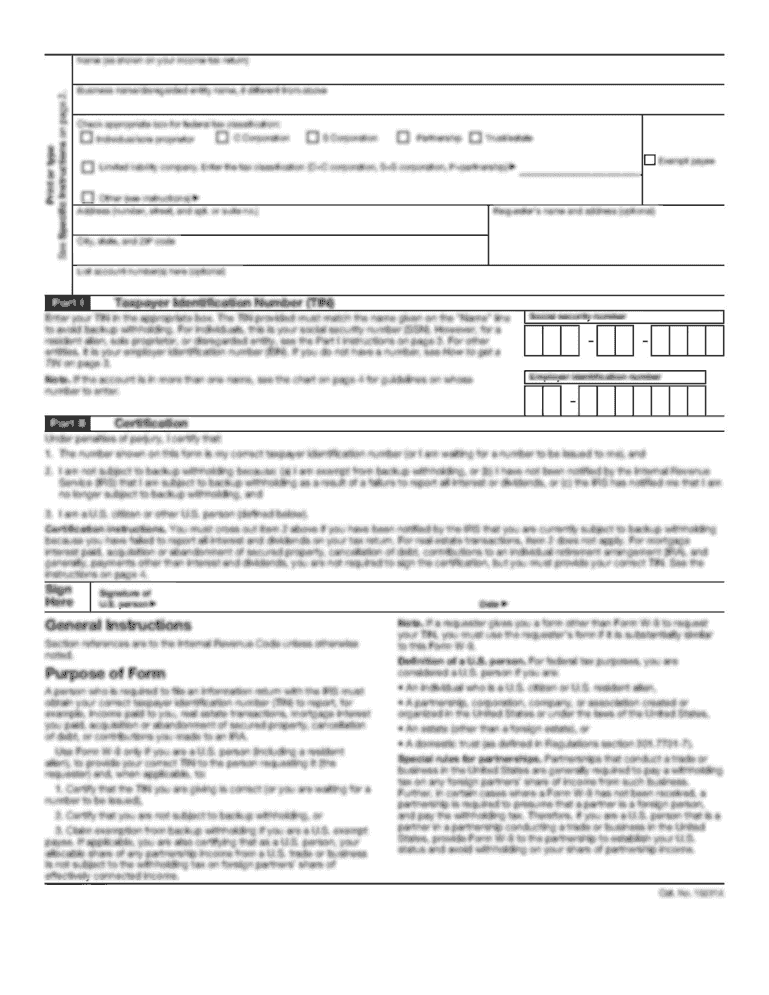

Begin with your personal information at the top of the form, including your name, address, and Social Security number.

02

Provide details about your income from various sources, including wages, dividends, and interest.

03

Calculate your alternative minimum taxable income (AMTI) by adding back certain deductions and exemptions.

04

Complete the tax calculations, applying the appropriate rates found on the form's instructions.

05

Sign and date the form before submission.

Latest updates to 2016 Colorado alternative minimum

Latest updates to 2016 Colorado alternative minimum

As of the last update in 2016, no new changes were implemented specifically for the Colorado alternative minimum tax form. It is important for filers to check for any new legislation that might affect tax calculations or filing procedures each tax season.

All You Need to Know About 2016 Colorado alternative minimum

What is 2016 Colorado alternative minimum?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About 2016 Colorado alternative minimum

What is 2016 Colorado alternative minimum?

The 2016 Colorado alternative minimum tax form is designed to ensure that individuals who benefit from certain tax advantages pay a minimum level of tax. The alternative minimum tax (AMT) applies to taxpayers with higher incomes or significant deductions that could minimize their tax liability. Completing this form is mandatory for determining if AMT applies to your situation.

What is the purpose of this form?

The purpose of the 2016 Colorado alternative minimum tax form is to assess an alternate calculation of tax liability, which may result in a higher tax owed compared to the standard calculation. The form prevents excessive use of deductions and exemptions that can significantly reduce income tax liability for higher earners. Understanding this calculation can help ensure compliance and avoid underpayment penalties.

Who needs the form?

Individuals who might need to file the 2016 Colorado alternative minimum tax form typically include those with higher earnings or those who have claimed specific tax benefits that significantly lower their tax obligations. You are likely required to complete this form if your federal adjusted gross income exceeds certain thresholds, or if you have substantial taxable income from investments or other sources.

When am I exempt from filling out this form?

You may be exempt from filing the 2016 Colorado alternative minimum tax form if your income falls below the designated threshold set by the Colorado Department of Revenue. Generally, taxpayers with lower overall income, limited deductions, or those who do not exceed the AMTI amounts are not obligated to file.

Components of the form

The main components of the 2016 Colorado alternative minimum tax form include sections for personal information, income details, adjustments, deductions, and tax calculation tables. Each section is designed to help calculate the alternative minimum tax liability accurately. Review each part carefully to ensure correct completion.

What are the penalties for not issuing the form?

Failure to submit the 2016 Colorado alternative minimum tax form when required can result in penalties imposed by the Colorado Department of Revenue. These penalties may include interest on unpaid taxes and additional late-filing charges. It is critical to understand your filing requirements to avoid potential financial penalties.

What information do you need when you file the form?

When filing the 2016 Colorado alternative minimum tax form, you will need information including:

01

Your personal identification details, such as name and Social Security number.

02

Federal and state income tax returns from the previous year for reference.

03

Details regarding income sources, including W-2s, 1099s, and other statements.

04

Documentation on any applicable deductions and credits.

Is the form accompanied by other forms?

The 2016 Colorado alternative minimum tax form may need to be submitted alongside other forms such as the standard Colorado individual income tax return (Form 104). Always check the filing instructions to determine if specific attachments or additional forms are required for your individual tax situation.

Where do I send the form?

After completing the 2016 Colorado alternative minimum tax form, you must send it to the Colorado Department of Revenue. The mailing address may vary based on whether you are including payment. Review the latest filing instructions on the Colorado Department of Revenue website or the form's guidance for the exact address to ensure timely processing.

See what our users say