Get the free 2017 COLORADO ALTERNATIVE Minimum Tax Instructions

Show details

DR 0104AMT (11/08/17)

COLORADO DEPARTMENT OF REVENUE

Denver CO 802610005

Colorado.gov/Tax×DONATED×Alternative Minimum Tax Instructions

See form on page 2Individual taxpayers are subject to a

We are not affiliated with any brand or entity on this form

Instructions and Help about 2017 Colorado alternative minimum

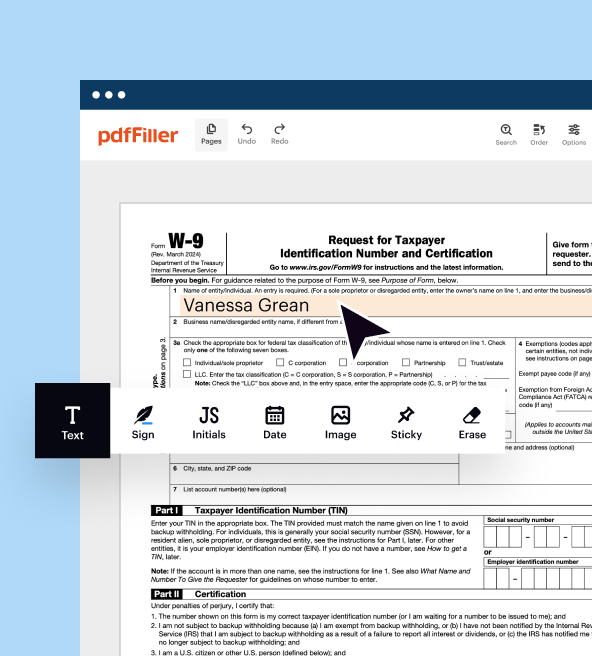

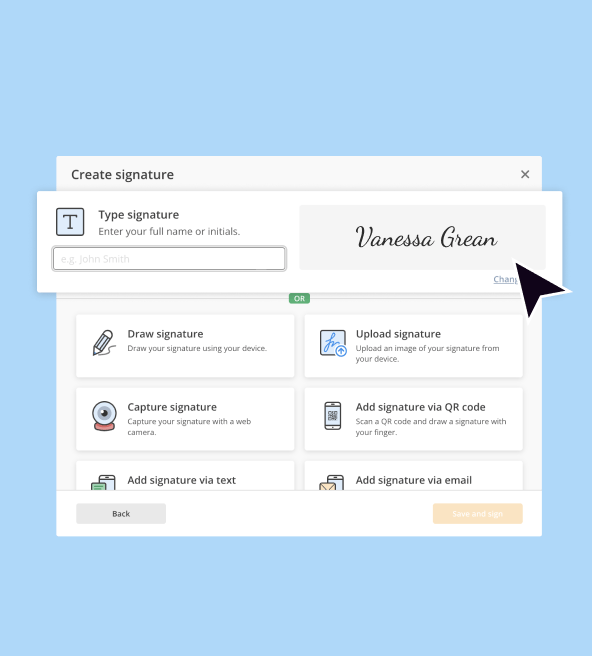

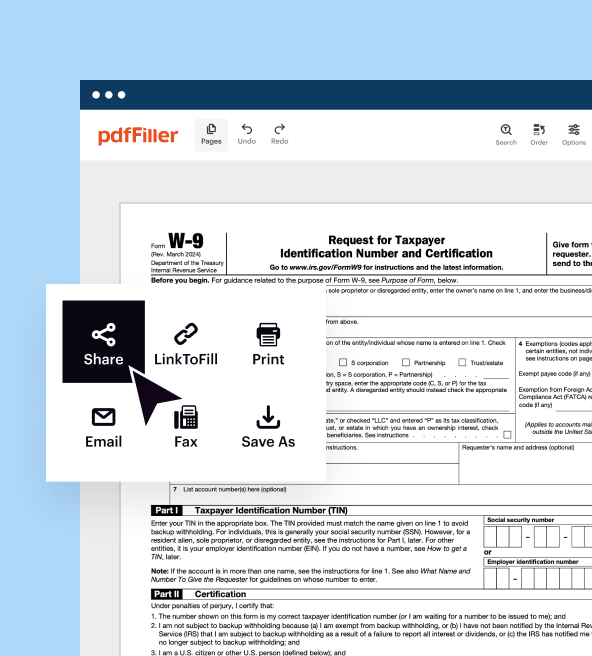

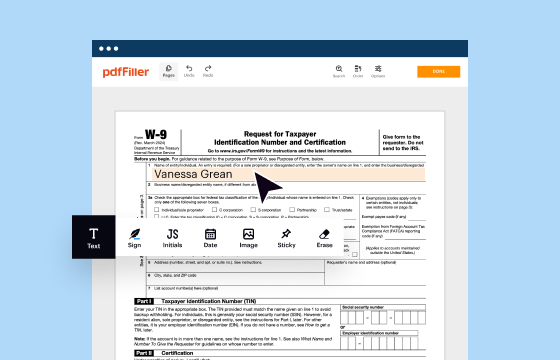

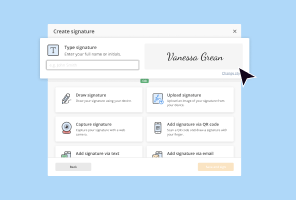

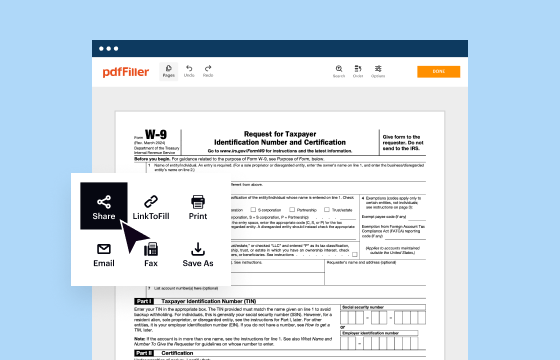

How to edit 2017 Colorado alternative minimum

How to fill out 2017 Colorado alternative minimum

Instructions and Help about 2017 Colorado alternative minimum

How to edit 2017 Colorado alternative minimum

You can edit the 2017 Colorado alternative minimum tax form using pdfFiller's online tools. Begin by uploading your document to the platform. Once uploaded, utilize the editing features to input necessary information or correct any errors. Remember to save the changes to ensure your form is up-to-date before submission.

How to fill out 2017 Colorado alternative minimum

Filling out the 2017 Colorado alternative minimum tax form requires you to gather relevant financial data. Here are the steps you should follow:

01

Obtain your federal tax return to reference income data.

02

Calculate your alternative minimum taxable income (AMTI) using federal guidelines.

03

Complete the required sections of the form, including any adjustments necessary for Colorado residents.

04

Double-check all entries for accuracy before submission.

Latest updates to 2017 Colorado alternative minimum

Latest updates to 2017 Colorado alternative minimum

There have been no significant updates specifically for the 2017 Colorado alternative minimum tax form since its release. However, it is important to always check for underlying tax law changes that may affect the form's applicability or the calculations required.

All You Need to Know About 2017 Colorado alternative minimum

What is 2017 Colorado alternative minimum?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About 2017 Colorado alternative minimum

What is 2017 Colorado alternative minimum?

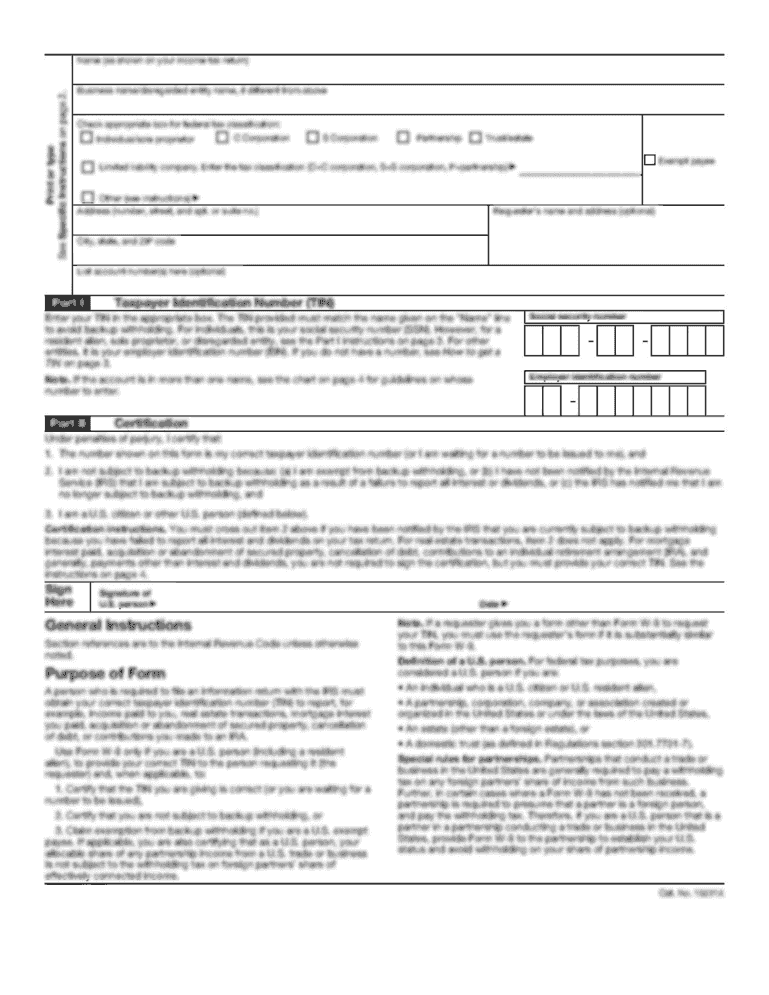

The 2017 Colorado alternative minimum tax form is a tax document used by specific taxpayers in Colorado to calculate their alternative minimum tax (AMT) obligation. This form is necessary for filers who may be subject to AMT due to higher-income levels or specific itemized deductions that may trigger this tax.

What is the purpose of this form?

The primary purpose of the 2017 Colorado alternative minimum tax form is to ensure that higher-income individuals pay a minimum amount of tax even if their deductions are substantial. The AMT calculation prevents taxpayers from significantly reducing their tax liability through certain deductions or credits.

Who needs the form?

Taxpayers with a higher income or those who claim specific deductions that could lead to a minimal tax liability may need to complete the 2017 Colorado alternative minimum tax form. Generally, individuals with an adjusted gross income exceeding certain thresholds or those with significant itemized deductions should assess their need for this form.

When am I exempt from filling out this form?

Taxpayers who do not meet the income threshold or who have no substantial itemized deductions typically do not need to file the 2017 Colorado alternative minimum tax form. Furthermore, certain individuals, such as low-income earners or those taking standard deductions, are generally exempt from this requirement.

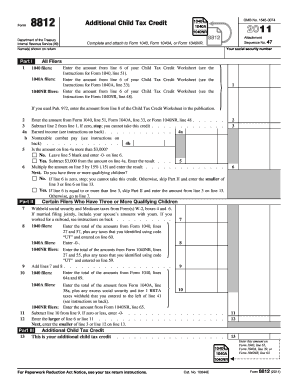

Components of the form

The 2017 Colorado alternative minimum tax form consists of several components, including income calculations, adjustments for state-specific deductions, and the computation of the alternative minimum tax. Each section requires specific financial data, and it is crucial to fill them correctly to determine the appropriate tax liability.

What are the penalties for not issuing the form?

Failing to file the 2017 Colorado alternative minimum tax form can lead to penalties and interest on any unpaid tax due. It is essential to file the form accurately and on time to avoid these financial repercussions, which may compound over time due to accrued interest.

What information do you need when you file the form?

When filing the 2017 Colorado alternative minimum tax form, you will need your total income, business income, itemized deductions, and any adjustments specific to Colorado tax regulations. It is vital to have your federal tax return and any relevant documents handy to ensure accuracy during the filing process.

Is the form accompanied by other forms?

Typically, the 2017 Colorado alternative minimum tax form is filed alongside your Colorado individual income tax return. You may need additional schedules or forms for various deductions or income types, depending on your overall tax situation.

Where do I send the form?

To submit the 2017 Colorado alternative minimum tax form, you must send it to the Colorado Department of Revenue. Ensure you check the most recent submission guidelines for addressing your form correctly, as mailing addresses may vary depending on whether you are filing electronically or via traditional mail.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.