Get the free 2017 Schedule M1CR Credit for Income Tax Paid to Another State

Show details

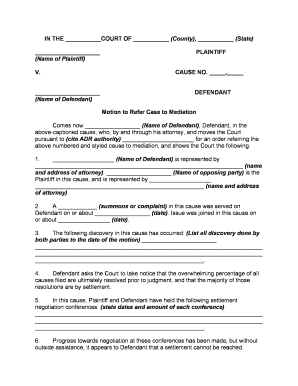

2017 Schedule M1CR, Credit for Income Tax Paid to Another State

Your First Name and Initial×171321×Last Asocial Security Understate or Canadian Province or Territory That Taxed Income Also Taxed

We are not affiliated with any brand or entity on this form

Instructions and Help about 2017 schedule m1cr credit

How to edit 2017 schedule m1cr credit

How to fill out 2017 schedule m1cr credit

Instructions and Help about 2017 schedule m1cr credit

How to edit 2017 schedule m1cr credit

To edit the 2017 schedule m1cr credit form, open it in a PDF editor such as pdfFiller. Use its tools to input accurate information, ensuring that all fields are correctly filled. After editing, save your changes before printing or submitting the form.

How to fill out 2017 schedule m1cr credit

Filling out the 2017 schedule m1cr credit form requires gathering specific financial information related to Michigan income tax credits. Begin by providing your personal and contact information, followed by detailing your qualifying expenses. Ensure accuracy to avoid complications during processing.

Latest updates to 2017 schedule m1cr credit

Latest updates to 2017 schedule m1cr credit

There have been no recent updates to the 2017 schedule m1cr credit form. However, it's important to verify any changes related to tax laws or procedures that may have occurred since 2017.

All You Need to Know About 2017 schedule m1cr credit

What is 2017 schedule m1cr credit?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About 2017 schedule m1cr credit

What is 2017 schedule m1cr credit?

The 2017 schedule m1cr credit is a form used to claim a credit for a portion of expenses incurred for certain types of purchases and payments in Michigan. It specifically assists taxpayers who qualify for these credits under Michigan tax law.

What is the purpose of this form?

The purpose of the 2017 schedule m1cr credit form is to calculate and claim available tax credits for eligible taxpayers in Michigan. This form focuses on providing a standardized method for claiming credits related to child care, dependent care, and other qualifying expenses.

Who needs the form?

Taxpayers who have incurred qualifying costs during the tax year and wish to claim the m1cr credit must complete this form. This includes individuals who have dependent care expenses or other eligible costs outlined by Michigan tax regulations.

When am I exempt from filling out this form?

You may be exempt from filling out the 2017 schedule m1cr credit if your total income falls below certain thresholds or if you do not have any qualifying expenses. Verify your circumstances against the state criteria to determine exemption eligibility.

Components of the form

The 2017 schedule m1cr credit consists of various sections requiring detailed information. Components include personal identification details, the types of credits being claimed, and the total amount of qualified expenses. Each section must be accurately filled to ensure successful processing.

What are the penalties for not issuing the form?

Failing to issue the 2017 schedule m1cr credit when required can result in penalties such as increased tax liabilities or fines. It may also delay processing of your tax return, leading to possible interest charges on unpaid taxes.

What information do you need when you file the form?

To file the 2017 schedule m1cr credit, you need to provide accurate personal identification information, details of qualifying expenses, and any related documentation that supports your claims. Gather all necessary paperwork beforehand to streamline the filing process.

Is the form accompanied by other forms?

The 2017 schedule m1cr credit may need to be submitted alongside your state income tax return. It's essential to check specific filing requirements to ensure compliance and completeness of your tax return submission.

Where do I send the form?

The completed 2017 schedule m1cr credit form should be sent to the Michigan Department of Treasury. Ensure that you send it to the correct address as specified in the filing instructions to avoid processing delays.

See what our users say